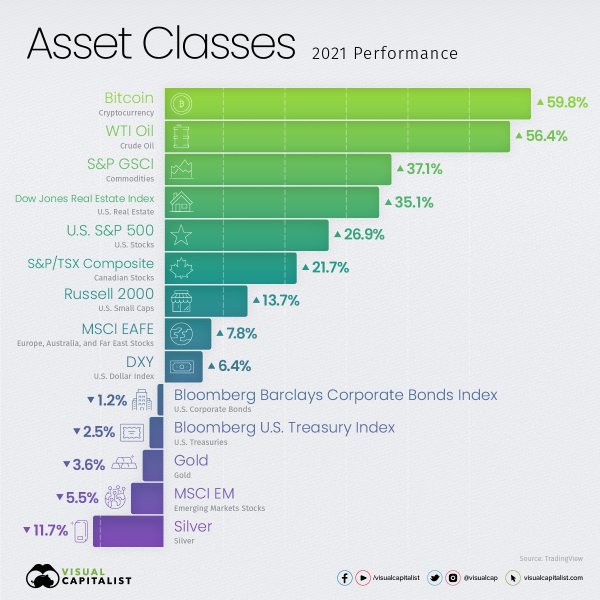

2020 was a roller coaster of volatility, and while 2021 was as well, most asset classes saw improvements as the world reopened.

But it wasn't all smooth sailing. There were significant supply chain struggles and rising inflation … not to mention the rising cases of COVID.

Regardless, markets are not the economy, and while there are numerous factors to think about, I've always found markets interesting.

via visualcapitalist

via visualcapitalist

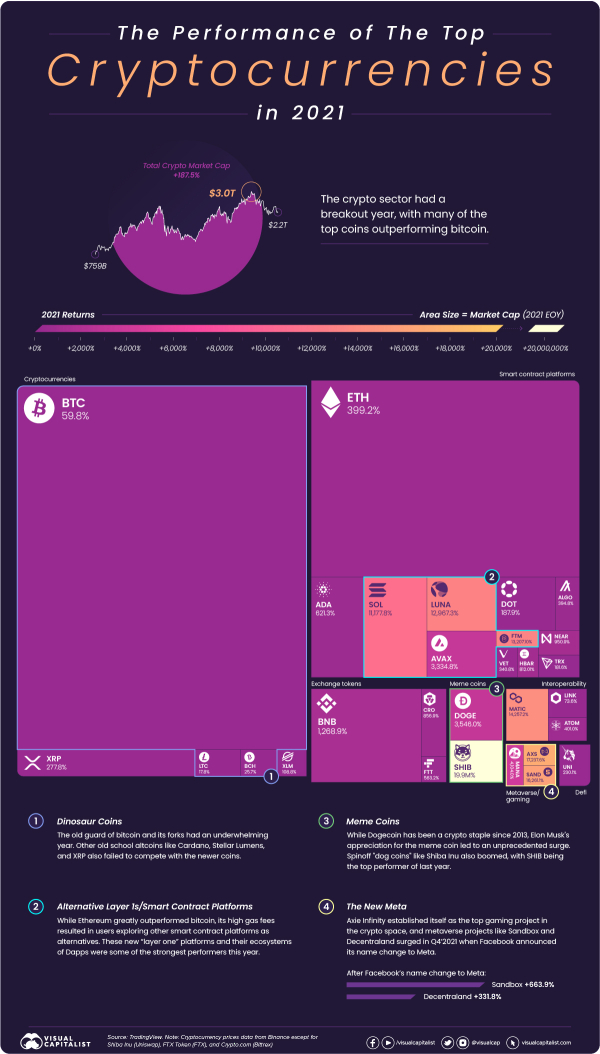

2021 was a year of rampant speculation, in part because so many systematic traders underperformed. For example, Renaissance reportedly saw ~15 billion in outflows last year (despite double-digit returns) as their clients likely moved towards more "exciting" opportunities.

Of course, some of those "exciting" opportunities were cryptocurrency-related. Moreover, chasing performance like that is often mean-reverting. Yet, I've seen a massive increase in interest among various business groups in crypto, Web 3.0, and the Blockchain.

Cryptocurrencies

While crypto generally performed well in 2021, 2022 has seen a drop that erased over $1 trillion in value.

via visualcapitalist

via visualcapitalist

The reality is that crypto markets matured a lot in 2021. The thousands of coins are mostly a distraction, but there are many interesting coins from various sectors with interesting technology behind them. There is increased infrastructure and decreased correlation between coins. Unfortunately, not enough to keep this drop from affecting the whole space.

So the question is, is this a "discount" for people to buy into the space, or a sign of future troubles?

It's no secret that I've always been a fan of Blockchain but cautious of cryptocurrencies.

I think there is a lot of money to be made speculating in cryptocurrencies, but how much of that money being made is attributed to luck vs. skill?

Crypto's are interesting, in part, because they're a digital currency decentralized over a peer-to-peer network.

The more people are willing to accept it as a medium of exchange, the more valuable it becomes (and the more it becomes a stable store of value).

Supposedly, decentralization provides it safety from censorship and government interference – meaning it has value as an international currency and as a currency for black-market transactions. But, in my opinion, that remains to be seen (and I consider it unlikely for most cryptocurrencies).

However, the worth of a Bitcoin isn't just based on sentiment (on one hand, there are desires to avoid fiat currency vagaries, government interventions, and scrutiny, while having a fair price discovery method, etc. … on the other hand, there are also the costs to mine a Bitcoin, transaction fees, etc. and crypto has recently been under fire for its huge environmental impact).

Compared to a reserve currency – whose worth is primarily influenced by trade value and other macroeconomic factors – watching crypto's volatility can be scary.

That being said, as adoption increases and more businesses enable it, it's possible that it will continue to legitimize. For the time being, I remain a long-term skeptic because there is too much working against it.

Many of my initial complaints are centered on coins as currency. I get that there are already many interesting uses of Blockchain that will also help to bring credibility to coins as a store of value.

The question for me is, even if cryptocurrency is here to stay long-term (and avoids government control), which coins will it be? Do they even exist today?

I'm positive there is money to be made related to the Blockchain, NFTs, and cryptocurrencies. But, at this point, it's a speculators game, and I think the best way to capitalize on this trend sustainably is to sell picks and shovels for the gold rush, instead of trying to stumble upon gold.

via

via  via

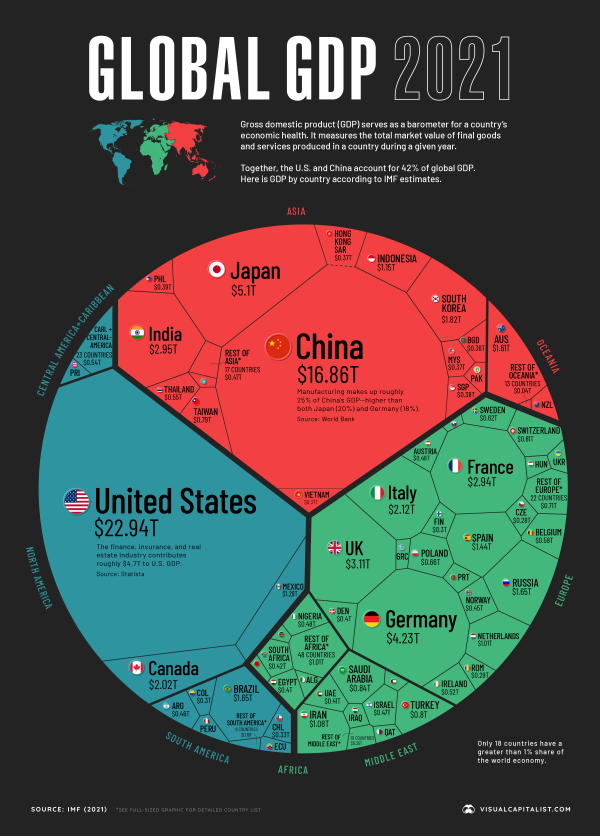

via