As conversations about AI and rapid technological change dominate headlines, it’s easy to forget something fundamental:

To have a business, you actually have to build a business.

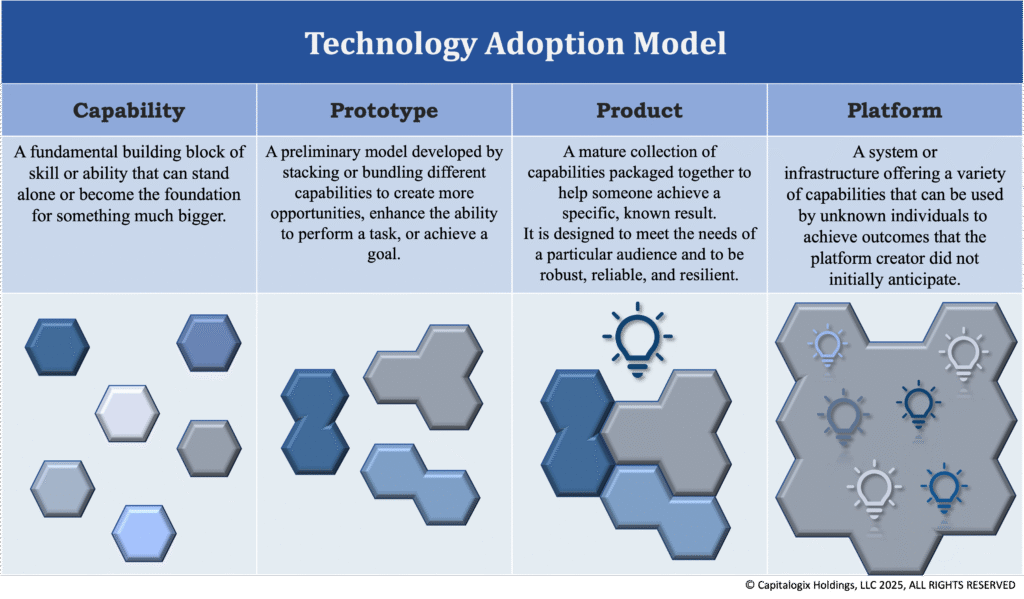

Too often, entrepreneurs string together a series of short-lived promotions — chasing trends and pivoting from one idea to the next. They launch quickly, make a modest profit, and just as quickly move on. In their haste to stay “current”, they bypass critical business building steps like product management, developing infrastructure, and consistent execution.

That approach works — until it doesn’t. Businesses built on trends are fragile. They rarely weather the shocks of a market crash, a platform crackdown, or a pandemic-sized disruption.

Like most good lessons, this one’s fractal — you’ll see it everywhere once you start looking.

Selling Picks and Shovels

Most of us have heard the old adage about selling picks and shovels during the gold rush.

During the gold rush, many people rushed to the goldfields in the hope of striking it rich by finding valuable gold nuggets. However, many participants in the gold rush did not find enough gold to become rich.

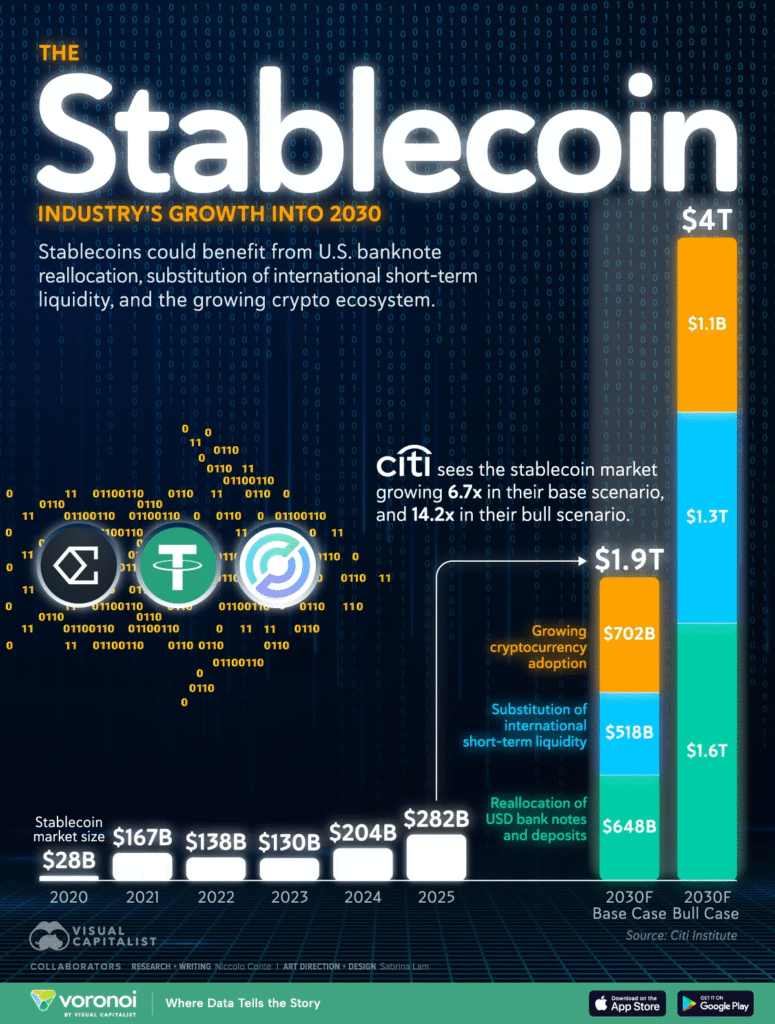

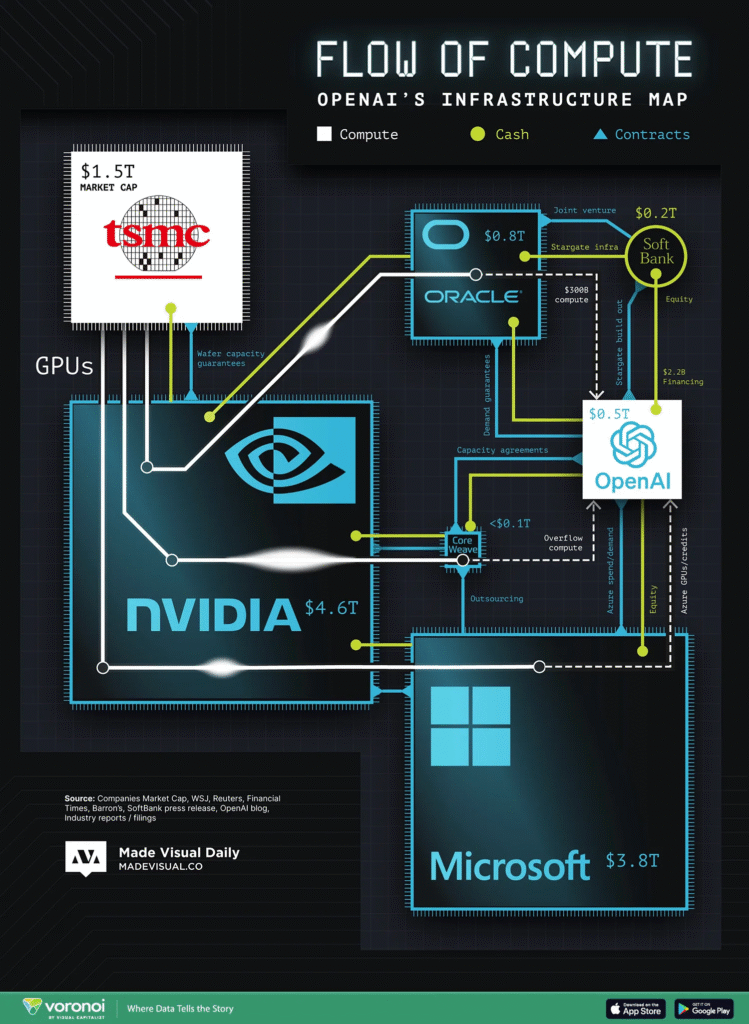

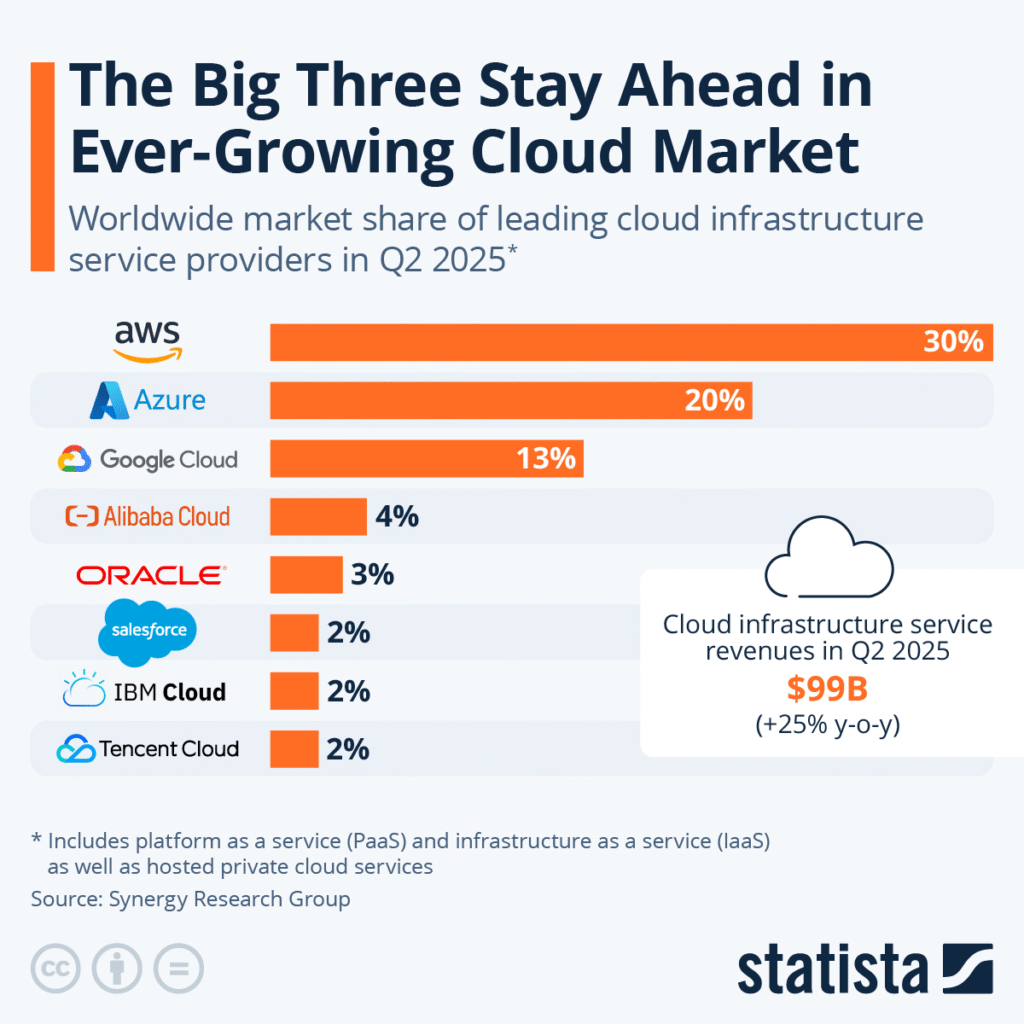

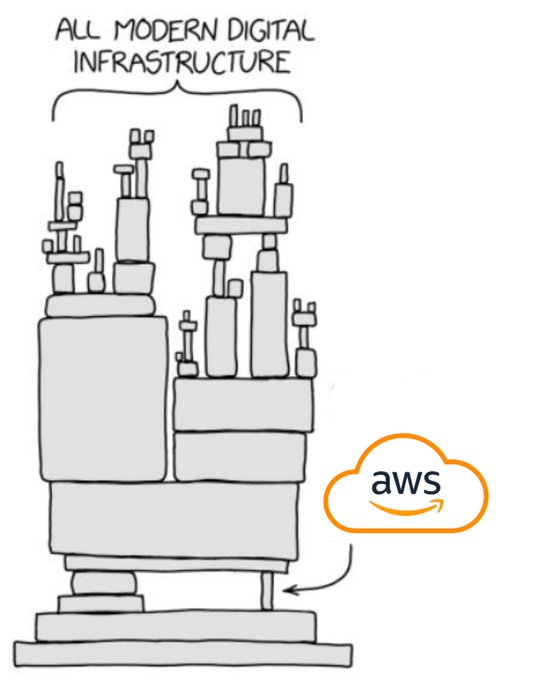

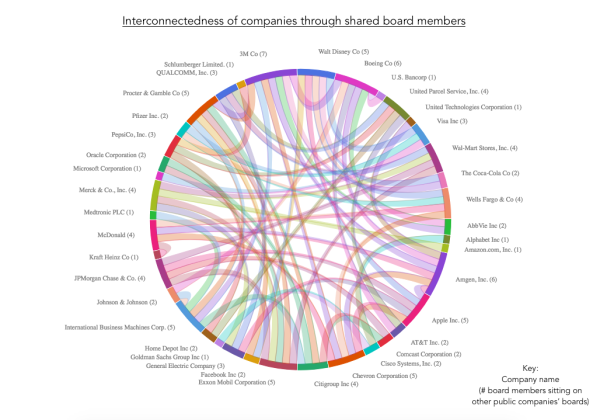

Often, the people who make the most money are the ones selling picks and shovels (goods and services) to the speculators. Said differently, profits often flow to people who provide the systems and infrastructure that enable others to dream of a bigger and better future. It’s why it’s easier to count on the blockchain being successful, rather than any specific cryptocurrency.

It’s not sexy, but it’s reduced risk, consistent demand, and a long-term perspective. When the mine dries up, you move on to the next mine and patiently stack your gold nuggets.

And, there are plenty of opportunities that don’t involve selling picks and shovels. You can build temporary lodgings, open a bar, and, of course, you can’t forget the world’s oldest profession … trading.

Okay, But What About AI

The AI boom feels a lot like the gold rush — a wave of excitement, hype, and promise. Both attract ambitious early movers chasing big wins. And both are marked by uncertainty: the fear of missing out, the fear of being left behind, and the fear of not knowing which way is up.

That fear drives people to adopt every new app or feature that flashes across their feed — anything to stay afloat. But AI is the tool, not the goal.

Chasing every shiny object is like panning for flakes of gold while ignoring the deeper veins underground. The real value lies in building something enduring: a business or system that leverages technology with purpose and focus. It’s about extending the edge you already have or finding a new one that supplements or complements your current business.

And here’s the key difference: while the gold rush came and went, AI is reshaping industries, economies, and society itself. The winners won’t be those who chase tools … but those who build with them.

In My Own Business

As an entrepreneur, it’s easy to fall in love with technology and let the perfect get in the way of the good.

In addition, it’s easy to get distracted chasing shiny new things. Jeff Bezos tells a story about how everybody asks him about “What’s new?”… but a better line of inquiry would seek to identify “What remains constant?” In a sense, there will always be a new market or a new technique that’s exciting and promising. However, your real business is the part that remains the same.

Continuity and recurring revenue create the bandwidth for innovation and ideation.

Over the years, we’ve built fault-tolerant systems that have survived fires, floods, internet outages, bad data, and global chaos — from market crashes to “Snowpocalypse.” Every challenge strengthened the foundation we stand on.

Yes, we’ve evolved. But our why hasn’t changed. New technologies, partnerships, and ventures are part of the journey — not distractions from it.

When you’re exploring the Wild West, whether it’s in a gold rush, an AI boom, or in the world of e-commerce, your chances of success rise rapidly with a goal, a why, and a plan.

The goal is to be timeless … not timely.

The next gold rush is always just around the corner. Real success isn’t measured by how many trends you chase, but by how resilient and anti-fragile your business becomes in the face of change. The foundation you build today determines the heights you’ll reach tomorrow.

Hope that helps.

via

via