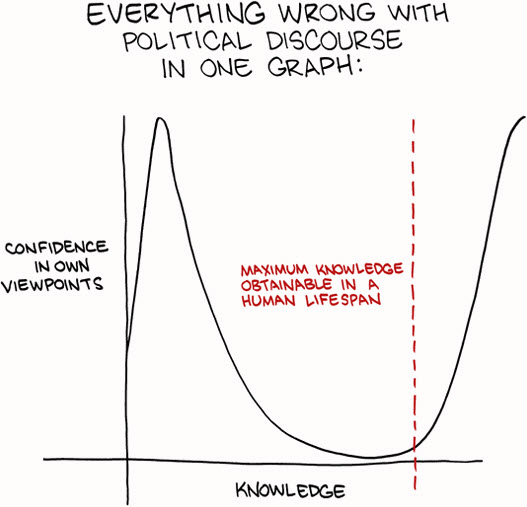

This graphic highlights some of what is wrong with political discourse.

So, the government avoided a shut-down. Is that a good or bad thing?

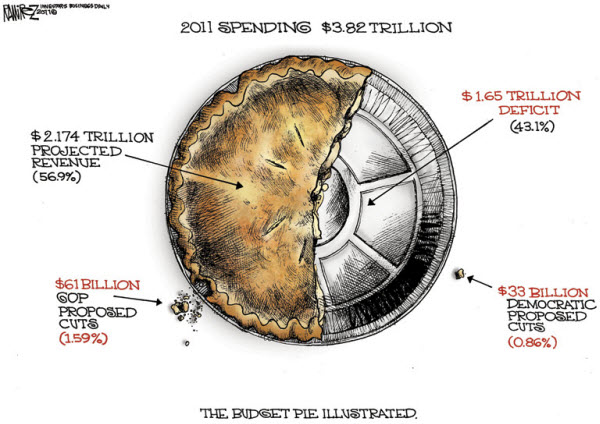

Understanding the Scope of the Budget Deficit.

What were they really fighting about?

Philip Greenspun puts the the budget deficit into easier-to-grasp context: just divide everything by 100,000,000.

- We have a family that is spending $38,200 per year.

- The family’s income is $21,700 per year.

- The family adds $16,500 in credit card debt every year in order to pay its bills.

- After a long and difficult debate among family members, keeping in mind that it was not going to be possible to borrow $16,500 every year forever, the parents and children agreed that a $380/year premium cable subscription could be terminated.

- So now the family will have to borrow only $16,120 per year.

If you are a visual thinker, here is different way to look at it.

Government Shutdown Averted – Fiscal Crisis Assured!

I saw this video and thought it made some interesting points .

For a different perpective, you can watch the introduction video released by a new political movement called the Win+Win Revolution.

Some weekend reading.

Some weekend reading.