Pop Quiz! What line item is the largest asset on Uncle Sam’s balance sheet?

- U.S. Official Reserve Assets

- Total Mortgages

- Taxes Receivable

- Student Loans

The correct answer, as of the Flow of Funds report for Q1 2012, is … Student Loans.

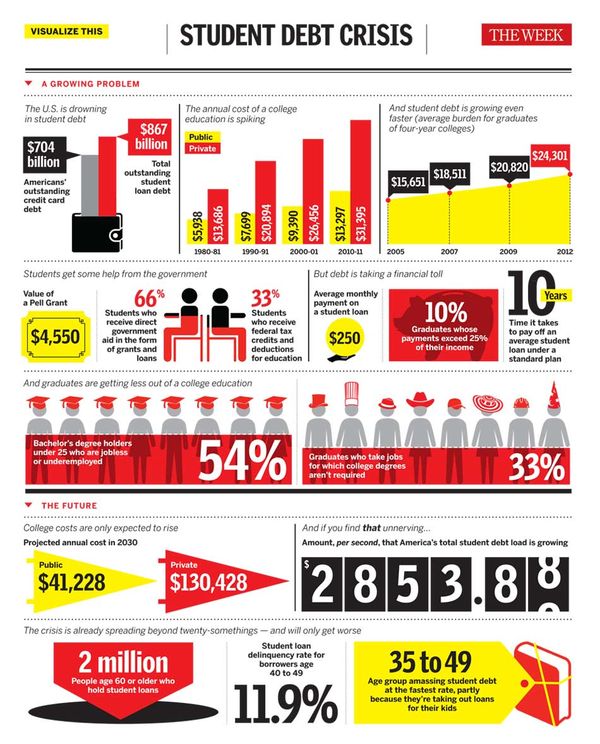

The rapid growth in student debt has been a frequent topic in the financial press. Earlier this year the Consumer Financial Protection Bureau (CFPB) posted an article with the attention-grabbing title: Too Big to Fail: Student debt hits a trillion .

Student loans may be a liability on the consumer balance sheet, but they constitute an asset for Uncle Sam. Just how big? Nearly 35% of the total federal assets, over four times the 8.6% percent for the total mortgages outstanding.

The nation's total student debt load is growing at a terrifying $2,853 per second.

Here, an infographic.

Could this be a catalyst to the next market turmoil? Seems woth watching.

Leave a Reply to QuickQuid Cancel reply