Happiness is a complex concept comprised of positive emotions, lack of negative emotions, comfort, freedom, wealth, and more.

Regardless of how hard it is to quantify … humans strive for it.

Likewise, it is hard to imagine a well-balanced and objective "Happiness Report" because so much of the data required to compile it seems subjective and requires self-reporting.

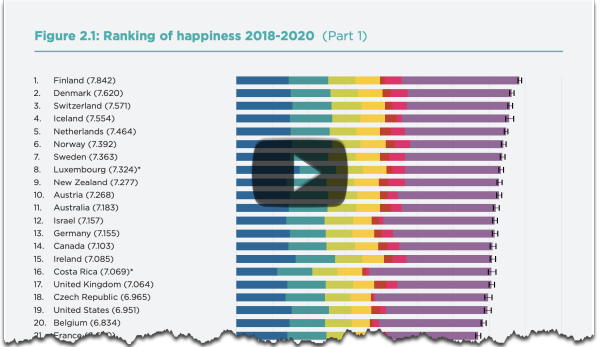

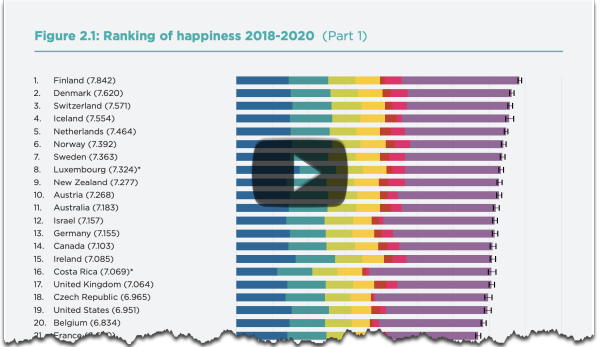

Nonetheless, the World Happiness Report does a good job with its annual look at quantifiable factors (like health, wealth, GDP, and life expectancy) and more intangible factors (like social support, generosity, emotions, and perceptions of local government and businesses). Click the image below to view the Report.

via World Health Report

via World Health Report

In their 2021 report, there was a significant focus on the effect of COVID-19 on happiness levels and mental health.

As you might expect, the pandemic caused a significant increase in negative emotions reported. Specifically, there was a significant increase in reports of worry and sadness across the ninety-five countries surveyed. Moreover, the decline in mental health was higher in groups that already had mental health problems – women, young people, and poorer people.

What's interesting about this is the resilience and bounce-back seen within the data. Considering the amount of disruption to households this past year, it's remarkable how stable the averages for countries have been.

Ultimately, globally, humans persevered in the face of economic insecurity, anxiety, and challenges to mental and physical health.

Despite the changes in emotions in 2020, overall life satisfaction rebounded quickly after March of 2020.

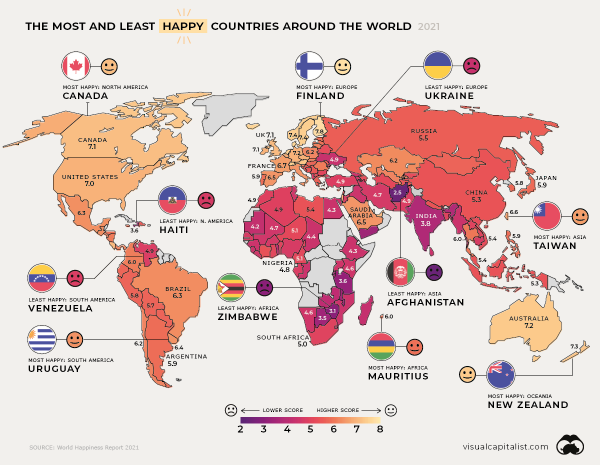

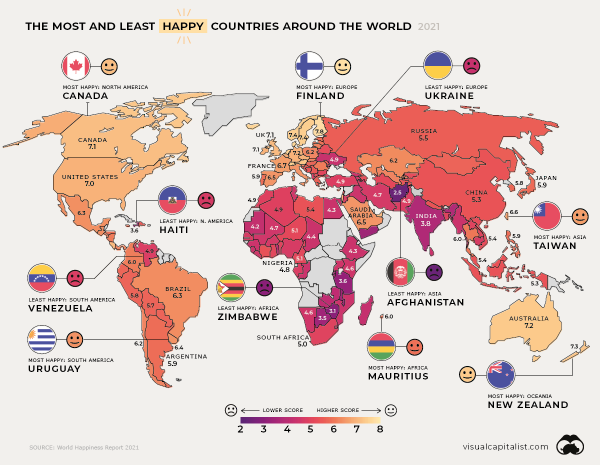

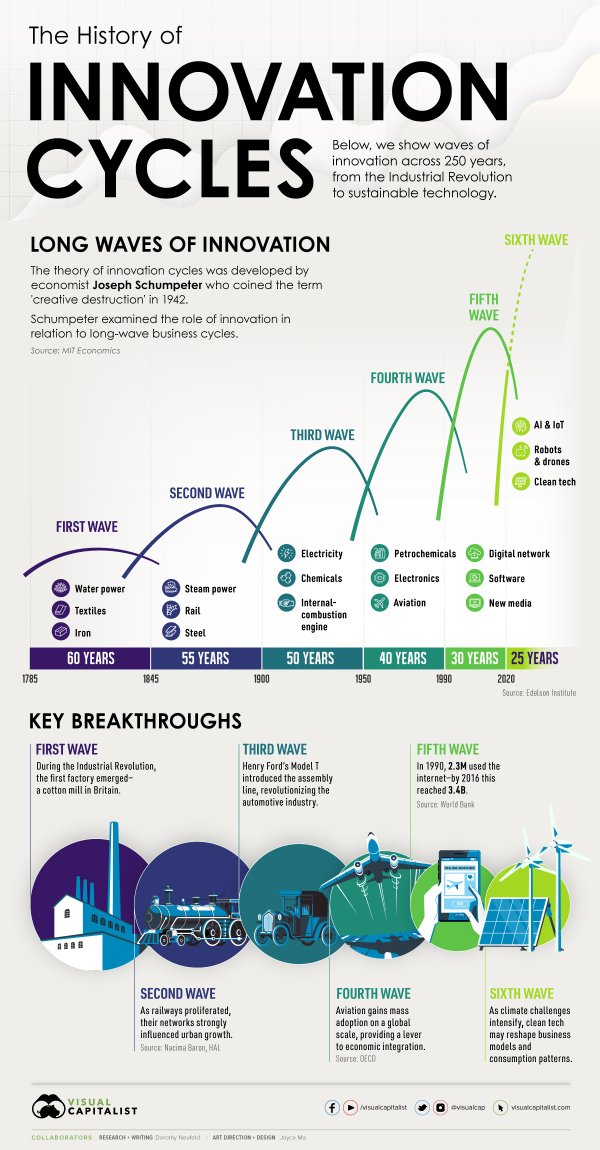

via Visual Capitalist

via Visual Capitalist

While there was a decrease in overall happiness, the relative balance in the face of such adversity may point towards the existence of a hedonic treadmill – or set point of happiness. I'm always impressed by what people can get used to, and how you can find pockets of joy in even the hardest times … or how people with everything they could ever ask for can still feel profound unhappiness.

It's oddly beautiful and a great reminder that happiness comes from within. Obviously, our environment and circumstances play a part. It's easier to be content with a roof over your head and a stable job. But, after a certain point, it's on us to create our realities.

Onwards!

via

via

via

via