The rally continues.

Individual Investors Enter the New Year with Confidence.

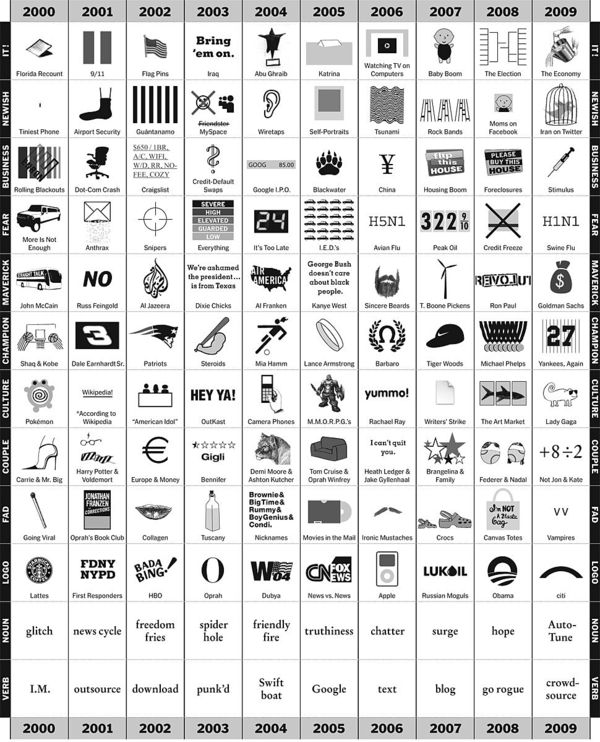

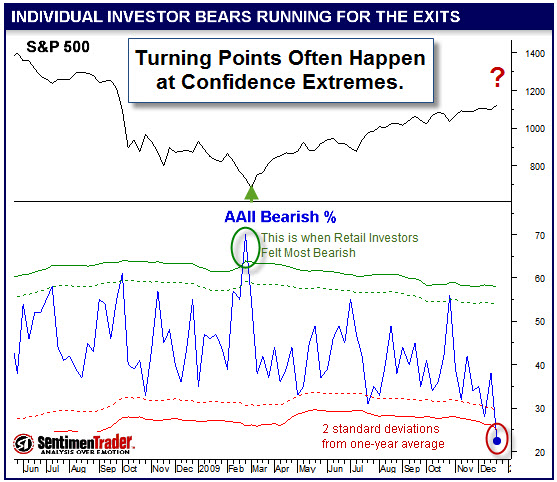

The weekly sentiment survey done by the American Association of Individual Investors (AAII) measures the percentage of individual investors (who take the survey) that are bullish, neutral and bearish.

The chart below shows that retail investors are getting quite confident and that the percent of bearish investors is unusually low. While that sounds positive, typically, this is a contrary indicator. Said a different way, turning points often happen at confidence extremes. Consequently, traders watch for bearish moves to happen at this level of bullish sentiment.

Consensus in the marketplace is rare. If everyone truly believed the same thing, no one would take the other side of your trade. However, when investors behave as a herd, it is usually because they are emotional about something. And, as we know, greed and fear are the most prevalent emotions in the market.

- Major market tops are typically accompanied by extreme levels of bullish euphoria. The crowd grows frenzied with greed — its enthusiastic lust makes stocks attractive at any price.

- Major market bottoms are characterized by widespread pessimism and despair. Here, a fear-induced panic makes most issues less attractive — regardless of price or value.

Contrarian analysis, of course, is based on the simple notion that the majority is rarely right about the stock market's direction, especially at market turning points.

Do Headlines Signal the End of Trends?

Likewise, conventional wisdom holds that magazine cover stories are contrary indicators – by the time a success or failure reaches the cover page of a major publication, the story is so well known as to be completely reflected in the market. While simplistic, the magazine cover indicator now has the support of recent academic research. This research found that cover story headlines on Business Week, Fortune and Forbes tended to indicate that the mood (bullish or bearish) of the story was about to change in the market. Moreover, when an economic issue makes the cover of a general market publication (like Time), it's guaranteed to be already very late in the game.

Consequently, I hear a lot of traders joke that Time Magazine's selection of Ben Bernanke as their "Person of the Year" will be the straw that breaks the bull-market's back.

An Old Pro Summarizes the Year for Traders.

Here is a brief interview with Art Cashin, the director of floor operations for UBS, and a frequent CNBC commentator. He is an old pro who does a nice job explaining what happened this past year and providing some perspective.

For more video from Art, click here.

Business Posts Moving the Markets that I Found Interesting This Week:

- Economic Statistic of the Decade Award. (Innovation & Growth)

- What will the Next Leg Down In Housing Look Like. (BusinessInsider)

- Will Commercial Real Estate Trigger a Double-Dip Recession? (OfTwoMinds)

- 91% of Magazines Show Decreased Ad Revenue this Year. (BusinessInsider)

- The Mystery of Money – Both Sides of the Coin. (Economist)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Innovation: Why Failing is Practically Required Success. (MaddockDouglas)

- Readability – a Browser Tool that De-Clutters & Transforms Web Pages. (Arc90)

- Coffee May Reduce Risk of Deadly Prostate Cancer. (Bloomberg)

- A McDonald's Burger is Safer Than Your Kid's School Lunch. (Slatest)

- U.S. Virtual Goods Revenue Ready to Explode. (BusinessInsider)

- More Posts with Lighter Ideas and Fun Links.