Here is Apple's launch video. They do know how to innovate and market, don't they?

Yes, it is stuff that does the stuff their other stuff does. Yet, somehow it is generating great Buzz.

Are you planning to buy one? I'm planning to resist … for now.

Thoughts about the markets, automated trading algorithms, artificial intelligence, and lots of other stuff

Here is Apple's launch video. They do know how to innovate and market, don't they?

Yes, it is stuff that does the stuff their other stuff does. Yet, somehow it is generating great Buzz.

Are you planning to buy one? I'm planning to resist … for now.

This video provides a peek into the science of human motivation.

There is a mismatch between what science knows and what business

does.

And what's alarming here is that our business operating system —

think of the set of assumptions and protocols beneath our businesses,

how we motivate people, how we apply our human resources — it's built

entirely around these extrinsic motivators, around carrots and sticks.

That's actually fine for many kinds of 20th century tasks. But for 21st

century tasks, that mechanistic, reward-and-punishment approach doesn't

work, often doesn't work, and often does harm.

Here is the direct link to the video on Ted's site.

Here is an excerpt from the talk.

Too many organizations are making their decisions, their policies about talent and people, based on assumptions that are outdated, unexamined, and rooted more in folklore than in science. And if we really want to get out of this economic mess, and if we really want high performance on those definitional tasks of the 21st century, the solution is not to do more of the wrong things. To entice people with a sweeter carrot, or threaten them with a sharper stick. We need a whole new approach.

And the good news about all of this is that the scientists who've been studying motivation have given us this new approach. It's an approach built much more around intrinsic motivation. Around the desire to do things because they matter, because we like it, because they're interesting, because they are part of something important. And to my mind, that new operating system for our businesses revolves around three elements: autonomy, mastery and purpose.

These are the building blocks of an entirely new operating system for our businesses.

This video provides a peek into the science of human motivation.

There is a mismatch between what science knows and what business

does.

And what's alarming here is that our business operating system —

think of the set of assumptions and protocols beneath our businesses,

how we motivate people, how we apply our human resources — it's built

entirely around these extrinsic motivators, around carrots and sticks.

That's actually fine for many kinds of 20th century tasks. But for 21st

century tasks, that mechanistic, reward-and-punishment approach doesn't

work, often doesn't work, and often does harm.

Here is the direct link to the video on Ted's site.

Here is an excerpt from the talk.

Too many organizations are making their decisions, their policies about talent and people, based on assumptions that are outdated, unexamined, and rooted more in folklore than in science. And if we really want to get out of this economic mess, and if we really want high performance on those definitional tasks of the 21st century, the solution is not to do more of the wrong things. To entice people with a sweeter carrot, or threaten them with a sharper stick. We need a whole new approach.

And the good news about all of this is that the scientists who've been studying motivation have given us this new approach. It's an approach built much more around intrinsic motivation. Around the desire to do things because they matter, because we like it, because they're interesting, because they are part of something important. And to my mind, that new operating system for our businesses revolves around three elements: autonomy, mastery and purpose.

These are the building blocks of an entirely new operating system for our businesses.

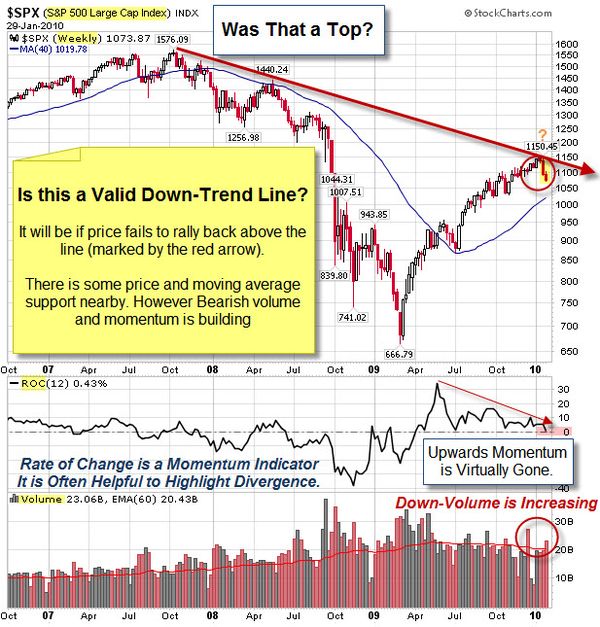

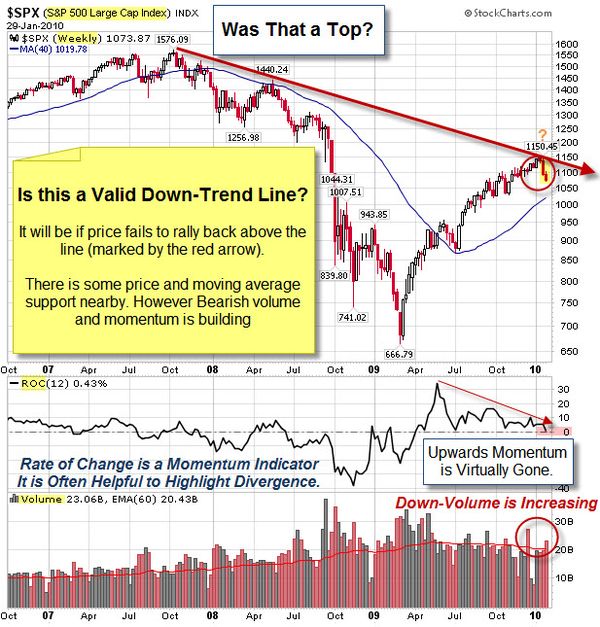

We Do Live In Interesting Times.

The markets pulled-back a little last week. To be fair, the correction was small in comparison to the size of the rally since last March. In many cases where the recent trend has been bullish for so long, people use this type of weakness to add to positions. So, an oversold-rally would make sense here.

However, some traders have doubts about the health of the market.

There is a fear that things may not be what they seem. For example, the GDP number came in higher than expected, but still resulted in selling. OK, GDP didn't tell us useful things (this time) because the better than expected number was the result of accounting and statistics, rather than real economic growth. Traders saw through that, and also see that there are still troubling data points coming in … like that Durable Goods Orders and Weekly Unemployment Claims were both weaker than

expected; and Consumer Spending continues to decline. Still, the Markets sold "good news" again last week. And even

though the moves weren't violent or extended, I take that as a bearish

indicator.

Is It Possible That the Market is Still in a Down-Trend?

Right now, the issue is whether price can get back above the down-trend line (marked by the red arrow) that started in October of 2007.

Is that down-trend line really valid? It will be if price fails to rally here.

As you examine the markets, it is easy to become near-sighted. By that I mean that it is easy to look at the ups and the downs, and to assign a cause based on what's happening in America (for example, the crisis of faith in Bernanke, Geithner, or even a jobless recovery). However, it is harder to believe that any of those issues is the real cause after you look at the next chart (or collection of charts).

How Can The Economies Of This

Many Countries React the Same?

A quick glance around the globe shows remarkably similar performance in many markets.

It brings up two questions:

To get a closer look for yourself, here is a link to the charts. That brings up a third question: What's really causing the markets to behave so similarly?

HBR Shows that Countries Did Deal With the Crisis Differently.

The economic crisis will influence business long into recovery. This Harvard Business Review visualization puts various bailout and stimulus programs in perspective. Calculating these interventions as percentages of GDP helps identify which economies will be stressed and which will have the resources to bounce back.

Is This Time Different?

Lots of people are reading Reinhart & Rogoff's book, This Time is Different. It examines the trend towards public debt that balloons in

response to financial crises. Here is an excerpt from PIMCO's summary of the book:

These examples tend to confirm that banking crises are

followed by a de-leveraging of the private sector accompanied by a substitution

and escalation of government debt, which in turn slows economic growth and

(perhaps) lowers returns on investment and financial assets.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

We Do Live In Interesting Times.

The markets pulled-back a little last week. To be fair, the correction was small in comparison to the size of the rally since last March. In many cases where the recent trend has been bullish for so long, people use this type of weakness to add to positions. So, an oversold-rally would make sense here.

However, some traders have doubts about the health of the market.

There is a fear that things may not be what they seem. For example, the GDP number came in higher than expected, but still resulted in selling. OK, GDP didn't tell us useful things (this time) because the better than expected number was the result of accounting and statistics, rather than real economic growth. Traders saw through that, and also see that there are still troubling data points coming in … like that Durable Goods Orders and Weekly Unemployment Claims were both weaker than

expected; and Consumer Spending continues to decline. Still, the Markets sold "good news" again last week. And even

though the moves weren't violent or extended, I take that as a bearish

indicator.

Is It Possible That the Market is Still in a Down-Trend?

Right now, the issue is whether price can get back above the down-trend line (marked by the red arrow) that started in October of 2007.

Is that down-trend line really valid? It will be if price fails to rally here.

As you examine the markets, it is easy to become near-sighted. By that I mean that it is easy to look at the ups and the downs, and to assign a cause based on what's happening in America (for example, the crisis of faith in Bernanke, Geithner, or even a jobless recovery). However, it is harder to believe that any of those issues is the real cause after you look at the next chart (or collection of charts).

How Can The Economies Of This

Many Countries React the Same?

A quick glance around the globe shows remarkably similar performance in many markets.

It brings up two questions:

To get a closer look for yourself, here is a link to the charts. That brings up a third question: What's really causing the markets to behave so similarly?

HBR Shows that Countries Did Deal With the Crisis Differently.

The economic crisis will influence business long into recovery. This Harvard Business Review visualization puts various bailout and stimulus programs in perspective. Calculating these interventions as percentages of GDP helps identify which economies will be stressed and which will have the resources to bounce back.

Is This Time Different?

Lots of people are reading Reinhart & Rogoff's book, This Time is Different. It examines the trend towards public debt that balloons in

response to financial crises. Here is an excerpt from PIMCO's summary of the book:

These examples tend to confirm that banking crises are

followed by a de-leveraging of the private sector accompanied by a substitution

and escalation of government debt, which in turn slows economic growth and

(perhaps) lowers returns on investment and financial assets.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

Some technology is innovative and impressive, but doesn't serve a business need. For example, you keep hearing about Cloud Computing. Yet, how likely is it that you're going to

allow your business to put a bunch of your proprietary data out on the net

anytime soon?

I'm not saying bad things about clouds, I'm just saying that there are a number of other recent advances that are interesting and perhaps more relevant. Some of these advances promise to save time and money while

making the computer environment safer and more robust. An example is the class of solutions that take advantage of shared resources (like database clustering and virtualizing

servers and desktops).

For us, one of the biggest changes in information technology, recently, has been the increasing use of virtualization.

For us, one of the biggest changes in information technology, recently, has been the increasing use of virtualization.

What is Virtualization?

Several years ago, I needed to purchase a big and powerful computer to run certain in-depth tests. Yet, only a small percent of the tests we run require a machine that big. Some of our other testing took a long time, but didn't require many of the computer's resources. In both cases, we were dramatically under-using the machine a majority of the time.

With virtualization, you can take a big powerful machine and divide it into smaller less powerful machines when you need to.

That means you can use all of the machine's capacity for one purpose some of the time. While other times, you can load a configuration optimized for a different type of test, which lets you create more virtual machines.

So, if you are running a test that might take one computer 24 hours to run (but didn't use much of the computer's processing power), you could use virtualization to split the computer into four virtual computers. The result is that it might only take you six or seven hours to complete the same task.

That is a simple example, but hopefully it gives you an idea of what is possible.

There are two main players in this space, Microsoft and VMware.

Virtual PCs Move to the Desktop.

That same technology has moved to the desktop.

For example, Windows 7 comes with Microsoft's Virtual PC. This makes it easy for you to create a clone of the computer (running inside your computer) but that doesn't affect the primary operating system.

You can use a different operating system in the Virtual PC. So, even

though you might use Windows 7, you could setup the Virtual PC to run

with Windows XP or even Linux (for compatibility or testing reasons).

Another use of a Virtual PC is as a "sandbox" that lets you install and try software that you wouldn't otherwise try on your main computer.

For example, Microsoft just came-out with a beta version of its Office 2010 product. I asked some of our IT staff if I should install it on my PC to try. When they stopped laughing at me, the answer was "absolutely not", because it might hang, damage something or create the need to re-install the computer. A Virtual PC, however, is a great place to try something like that without risking your primary work environment.

Give it a try.

Resources:

Some technology is innovative and impressive, but doesn't serve a business need. For example, you keep hearing about Cloud Computing. Yet, how likely is it that you're going to

allow your business to put a bunch of your proprietary data out on the net

anytime soon?

I'm not saying bad things about clouds, I'm just saying that there are a number of other recent advances that are interesting and perhaps more relevant. Some of these advances promise to save time and money while

making the computer environment safer and more robust. An example is the class of solutions that take advantage of shared resources (like database clustering and virtualizing

servers and desktops).

For us, one of the biggest changes in information technology, recently, has been the increasing use of virtualization.

For us, one of the biggest changes in information technology, recently, has been the increasing use of virtualization.

What is Virtualization?

Several years ago, I needed to purchase a big and powerful computer to run certain in-depth tests. Yet, only a small percent of the tests we run require a machine that big. Some of our other testing took a long time, but didn't require many of the computer's resources. In both cases, we were dramatically under-using the machine a majority of the time.

With virtualization, you can take a big powerful machine and divide it into smaller less powerful machines when you need to.

That means you can use all of the machine's capacity for one purpose some of the time. While other times, you can load a configuration optimized for a different type of test, which lets you create more virtual machines.

So, if you are running a test that might take one computer 24 hours to run (but didn't use much of the computer's processing power), you could use virtualization to split the computer into four virtual computers. The result is that it might only take you six or seven hours to complete the same task.

That is a simple example, but hopefully it gives you an idea of what is possible.

There are two main players in this space, Microsoft and VMware.

Virtual PCs Move to the Desktop.

That same technology has moved to the desktop.

For example, Windows 7 comes with Microsoft's Virtual PC. This makes it easy for you to create a clone of the computer (running inside your computer) but that doesn't affect the primary operating system.

You can use a different operating system in the Virtual PC. So, even

though you might use Windows 7, you could setup the Virtual PC to run

with Windows XP or even Linux (for compatibility or testing reasons).

Another use of a Virtual PC is as a "sandbox" that lets you install and try software that you wouldn't otherwise try on your main computer.

For example, Microsoft just came-out with a beta version of its Office 2010 product. I asked some of our IT staff if I should install it on my PC to try. When they stopped laughing at me, the answer was "absolutely not", because it might hang, damage something or create the need to re-install the computer. A Virtual PC, however, is a great place to try something like that without risking your primary work environment.

Give it a try.

Resources:

Last week several news items caught my eye as potential "sign-of-the-times" indicators. With markets still near recovery highs, the amount of fear and loathing is surprising. Here are some examples.

Let's Look at the Market.

For

a number of weeks, the rally was holding-up even though there were a

number of signs indicating underlying weakness. That means buyers

bought the dip.

Well, last week price finally broke beneath the trend-line from the

March lows. It is a bearish sign, unless price can get back above the

trend-line quickly.

Currently,

price is still above the support level marked by the orange

dashed-line. A move beneath this level would be another bearish sign.

The next question is whether the move will find the selling power that has been so noticeably absent during the rally?

Perhaps A Little Bit of Fear Will Be a Good Thing for Trading Volume.

The CBOE Volatility Index (VIX), often thought of as the market's fear gauge, capped its biggest three-day run-up since February 2007. Recently (until last week) it was more of a complacency gauge. Here is a chart showing the steady decline, and then the surge.

So, short-term, we'll see if that shakes-out some Bulls who are questioning their conviction.

Rembember, however, that market rallies often happen after a fear spike subsides. So if we don't get selling volume, the next question is whether Bulls will buy the dip?

At this point I am watching the VIX, because while the spike of fear was big … it came when the VIX was at an extended low. Fear and Greed (or Bears and Bulls) collide, here, as a result of the conflict between the short and longer term views of the market. Which side wins will likely have big consequences, because a move higher in the VIX will likely coincide with a bigger move down in the markets.

The U.S. Dollar might also provide some clues to market direction. The Dollar and equity markets often move opposite each other. Currency speculators increased bets against the Dollar in the latest week, according to Commodity Futures Trading Commission data released on Friday. The value of net short positions in the dollar rose to $3.12 billion in the week ending Jan. 19, from a net short position of $2.7 billion the previous week, according to Reuters calculations.

The Markets Are Oversold in the Short-Term.

This chart shows the percent of stocks in the S&P 500 Index that are trading above their 10-day moving average (in other words, what percent are in an up-trend on a short-term basis?). Right now, less than 10% are.

As you can see, we don't get extreme readings like this often … and when we do, the market tends to bounce. To see an interactive version of this chart with an overlay of the S&P 500 Index (so you can see how often the overbought and oversold readings work) click here.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

Last week several news items caught my eye as potential "sign-of-the-times" indicators. With markets still near recovery highs, the amount of fear and loathing is surprising. Here are some examples.

Let's Look at the Market.

For

a number of weeks, the rally was holding-up even though there were a

number of signs indicating underlying weakness. That means buyers

bought the dip.

Well, last week price finally broke beneath the trend-line from the

March lows. It is a bearish sign, unless price can get back above the

trend-line quickly.

Currently,

price is still above the support level marked by the orange

dashed-line. A move beneath this level would be another bearish sign.

The next question is whether the move will find the selling power that has been so noticeably absent during the rally?

Perhaps A Little Bit of Fear Will Be a Good Thing for Trading Volume.

The CBOE Volatility Index (VIX), often thought of as the market's fear gauge, capped its biggest three-day run-up since February 2007. Recently (until last week) it was more of a complacency gauge. Here is a chart showing the steady decline, and then the surge.

So, short-term, we'll see if that shakes-out some Bulls who are questioning their conviction.

Rembember, however, that market rallies often happen after a fear spike subsides. So if we don't get selling volume, the next question is whether Bulls will buy the dip?

At this point I am watching the VIX, because while the spike of fear was big … it came when the VIX was at an extended low. Fear and Greed (or Bears and Bulls) collide, here, as a result of the conflict between the short and longer term views of the market. Which side wins will likely have big consequences, because a move higher in the VIX will likely coincide with a bigger move down in the markets.

The U.S. Dollar might also provide some clues to market direction. The Dollar and equity markets often move opposite each other. Currency speculators increased bets against the Dollar in the latest week, according to Commodity Futures Trading Commission data released on Friday. The value of net short positions in the dollar rose to $3.12 billion in the week ending Jan. 19, from a net short position of $2.7 billion the previous week, according to Reuters calculations.

The Markets Are Oversold in the Short-Term.

This chart shows the percent of stocks in the S&P 500 Index that are trading above their 10-day moving average (in other words, what percent are in an up-trend on a short-term basis?). Right now, less than 10% are.

As you can see, we don't get extreme readings like this often … and when we do, the market tends to bounce. To see an interactive version of this chart with an overlay of the S&P 500 Index (so you can see how often the overbought and oversold readings work) click here.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week

On the surface, the markets still look pretty good. However, last week something happened that I consider a bearish warning sign. The Market sold-off on good news. Although Intel announced strong results, it looks like the market priced-in the good news already.

In addition, the tech-heavy Nasdaq Composite Index has lagged the S&P 500 recently. Clearly, it is still in an up-trend. However, price has pulled back to test the trend-line. If the trend is to continue, this is where buyers should step-in.

There is key support at the 2,200 level. No alarms, yet … Just a reminder to stay vigilant.

Is the Rally Losing Momentum?

The rally has lasted longer than I expected. And each time we've been at a tipping point, recently, market corrections haven't succeeded in triggering sellers.

However, the rally has lost some of its momentum. There are many signs (like poor volume or increasing negative divergences) that point to underlying weakness.

Is there an Unseen Hand?

Some believe the rally is orchestrated by the government, and supported by various plunge-protection initiatives. I find that hard to fathom. It's a free market, and there are simply more buyers than sellers. It doesn't matter if there are only a few buyers … price will continue to go up as long as buying pressure is stronger than selling pressure.

Nonetheless, recent trading has stayed in a relatively narrow range. From my standpoint, this is probably a result of a fundamental disagreement between the Bulls and the Bears. Let's look at some of the major areas of contention.

Here are some of the reasons Bulls think the Market is still cheap enough for valuations to be attractive.

In contrast, Bears are warning that we may be at an important longer-term top. Here are things they are watching.

Time will tell, and so will the charts.

The New Bailout.

Finally, I thought this was funny.

Business Posts Moving the Markets that I Found Interesting This Week:

Lighter Ideas and Fun Links that I Found Interesting This Week