Have you heard the commentators trying to explain Thursday's massive move down in the markets by blaming computer trading, a trader's error, or the news about what's happening in Greece?

I don't believe that any of those explanations are the "cause" of the melt-down.

There's a difference between things that happen near the same time, and things that cause other things to happen. In statistics this is the difference between a coincident and a causal indicator.

There's a difference between things that happen near the same time, and things that cause other things to happen. In statistics this is the difference between a coincident and a causal indicator.

An Unlikely Explanation.

Even if some trader accidentally tried to sell a billion shares of Procter & Gamble rather than 1 million shares … Do you really believe a broker's or exchange's risk-management protections would allow a billion share order (sure, an error … but not that error)? Or, do you really believe that a "fat-fingered" sale in America would cause Asia's market to go down 8%?

Think about how many market participants there are around the world. Free market buying and selling is supposed to take care of mispriced assets. If

something is too high, then people won't buy it. When something's too

low, speculators swoop in to grab the bargain.

A More Likely Scenario.

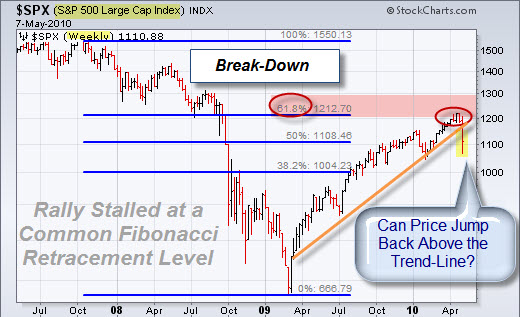

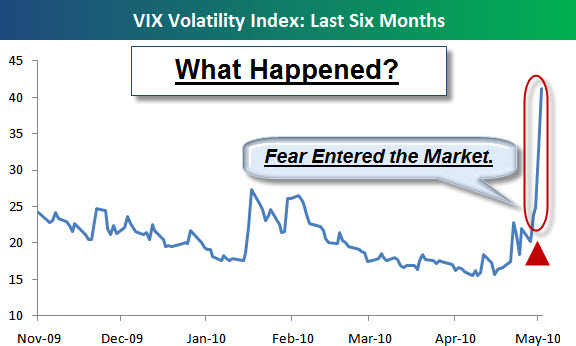

The real story is that people are scared. And unlike the recent rally, the move down was met with selling rather than buying.

There's an old trading adage that says markets climb a wall-of-worry one step at a time, then fall off the roof. In a normal up-trend, chances are you'll just hold what you own; because you have no real incentive to take action. Consequently, as recent policies and actions pushed the markets higher, many market participants simply smiled and felt good about their good fortune.

However, it doesn't work the same way when markets go down. In order to protect your profits, or avoid losses, it is important to take risk off the table. As more people start doing that, prices start to move faster, which feeds the fire … and finds even more sellers. As a result, there actually is an incentive to take massive action.

But Don't You Have to Blame Someone?

One of the interesting arguments that I've heard recently is that the crash was caused as high-frequency trading firms stopped trading in the market. In other words, the lack of liquidity caused these massive price moves.

To me, it makes sense that high-frequency trading (or other algorithmic trading systems) stopped trading during times of market turmoil. One of the primary lessons from last year's bear market is to recognize that certain systems are designed only for normal market periods.

As price and volatility move outside normal levels, we now tighten our risk and cash management parameters. Once we got past those limits, we stopped trading. Why? Because of the massive pain inflicted by not doing that the last time we saw those types of price moves and volatility.

Likewise, I suspect it's the same for many other systems traders. Each of them went through a process of figuring out what works, and what doesn't work, during different market conditions. It makes sense that they learned to trade less when they don't have an edge.

Consequently, the patterns of price movement and liquidity changed during the big move down.

Let the Investigations Begin.

Trying to figure-out what caused people to be afraid is silly. Fear

cause people to be afraid. Human nature weighs the fight or flight

instinct … and often chooses flight during dangerous situations.

And if people are trying to sell, but no one is buying, then price

will continue to fall until it's low enough that people feel they're

getting a bargain again.

On a side note, if a trader puts in a limit order to buy an asset if

gets down to a certain price (let's say $0.01 for a share of Accenture)

and there is no other buyer to fill a "market order", then crazy as it

sounds, that is what happens.

Will More Regulation Help Here?

I see both sides. On one hand, I am surprised that the Specialists weren't there to back-stop the market and take more sales at falling (yet, realistic) prices. Perhaps that merits some scrutiny?

On the other hand, in a free market environment, do you really believe that it is in our best interests for the governments and the exchanges to figure-out how to prevent markets from going down?

When the NYSE started to enforce trading curbs and slowdowns, sophisticated investors started off-loading some of their sales to other markets and exchanges around the world. The result is that prices continued to go down.

Again, I don't believe that an error caused prices to go down, though it may have been in error in judgment caused by human nature for masses of the population to feel so scared.

However, remember that fear and greed are the fuel that drives the engine of the markets. I suspect that limiting fear will have unintended consequences.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=67a164aa-e5a6-4196-b874-96eb8e8a0c06)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=5c75f536-760b-48fd-a19e-3754e4492781)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=30e63534-77d4-4e62-b9aa-c2c2a037ea4a)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=05248ddc-bd89-49cd-954a-42f96af9e1b5)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=76e1c64f-12c5-4465-a9f6-3beb5f9d9c65)

My recommendation: let go of your expectations and simply enjoy the

spectacle.

Even Freud has to agree, sometimes a cigar is just a cigar … and sometimes, a movie is just a movie.

Iron Man 2 was a fun and action-packed movie that I'm glad I watched on a big screen.

Does It Live-Up to Its Hype?

Before its release, there were a number of very negative reviews and predictions that it would be "unwatchable". Nonetheless, audiences are watching and, according to Rotten Tomatoes, enjoying the movie.

I had fun seeing it with my son this weekend. It was good enough in virtually every way.

The story held together well enough that I didn't think much about the plot (not that there was much of a plot to think about).

The graphics didn't "wow" me, the way that Avatar's did; but they were good enough that I didn't think about them (even though many of the special effects had to have been computer-generated).

Here is a Trailer so you can see it for yourself.

Here are more videos.