Here are some of the posts that caught my eye. Hope you find something interesting.

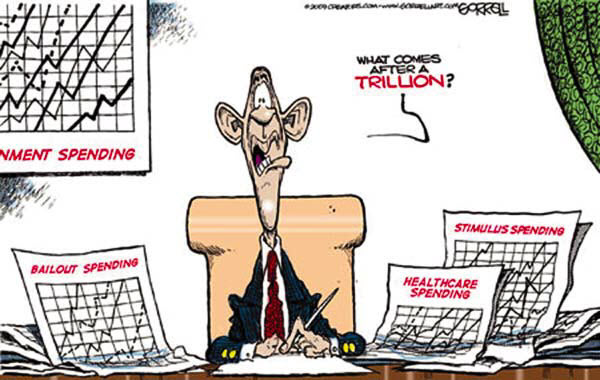

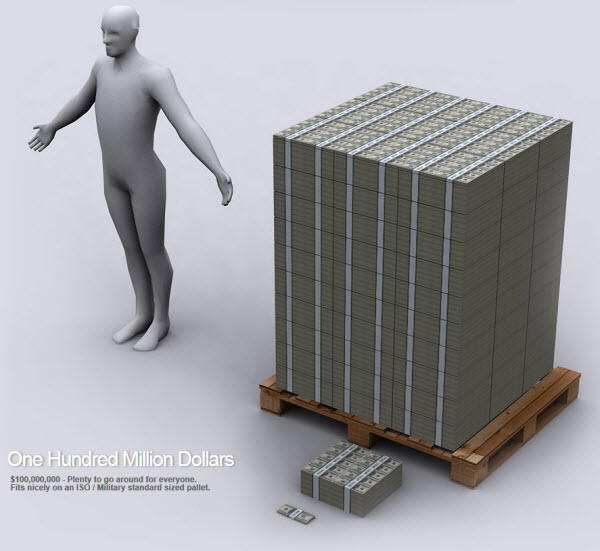

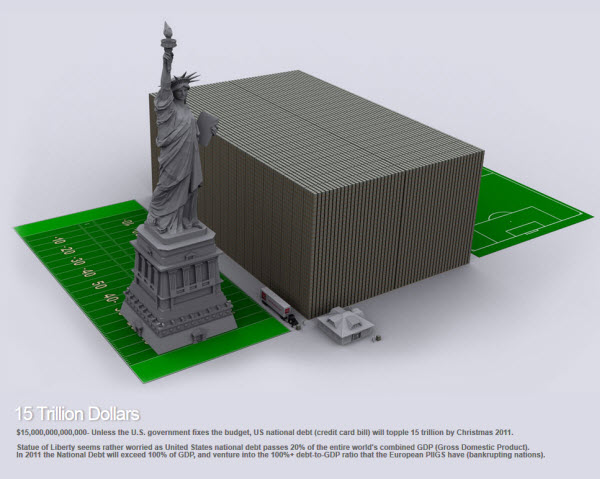

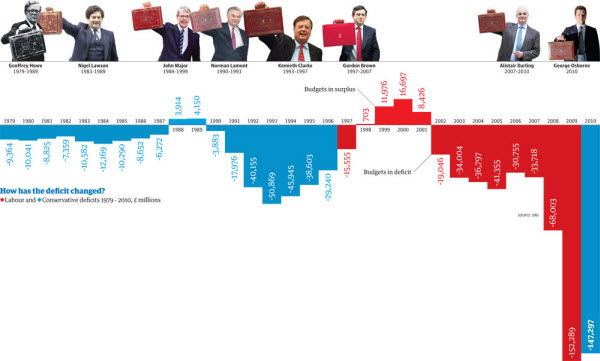

The size of the spending cuts needed is staggering. It must be difficult to negotiate something hard to comprehend.

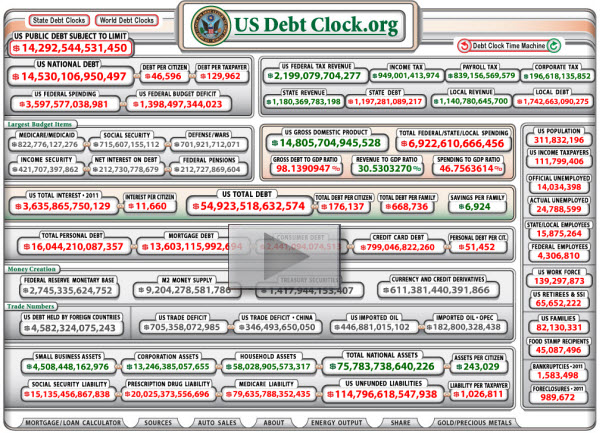

- Fed Gave $16 Trillion In Emergency Loans Over 2-1/2 Years. (RawStory)

For context, US GDP was $14.5T last year. - The Worry Lists of Central Bankers. (FTAlphaville)

Two tables that list & rank each major central bank’s current challenges. - An Important Shift? Microsoft Posts Mixed Results in 4th Quarter. (NYTimes)

30% Increase in Profit, but Sales of Windows Are Weak. - Funds of Funds May Actually Increase Risk, Study Finds. (Dealbook)

Excess diversification leads to diminishing returns. - Reforming Capitalism: A Look at Some Hidden Motives. (PsychToday)

- Predicting the Future: Looking at 2020 via Tech’s Time Machine. (GigaOm)

- Preparing for the Next Wave of Cyber-Attacks. (TechReview)

- America's Fattest States — Care to Guess? (TheWeek)

- 10 Fun-to-Follow Fake Twitter Celebs. (Mashable)

- Fun Site: What Happened In My Birth Year? (Click)