I'm surprised by how much of my typing is now done outside of

traditional e-mail or business software (like Microsoft Word). Instead,

my typing is done in web-based applications like my blog, Facebook, or

Twitter. That's where a program like Asutype really shines.

I have been using a very effective spell-checking and text expansion program for several years now. It works so well that I forget it's there, even though it automatically fixes most of my typing errors and makes it easy for me to enter repetitive phrases or pieces of information. The bottom-line is that it helps me type more accurately and much faster.

There are three basic ways to use the software.

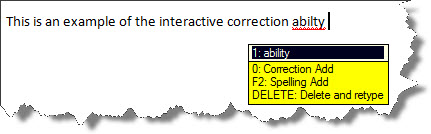

- Correct Mistakes Interactively. The first is an interactive spell checker that works as you type (hence the name "Asutype"). When you type something that isn't in its dictionaries, it pops up a correction box with several of the most likely replacement candidates. This provides a quick and easy way to fix your spelling without having to retype anything.

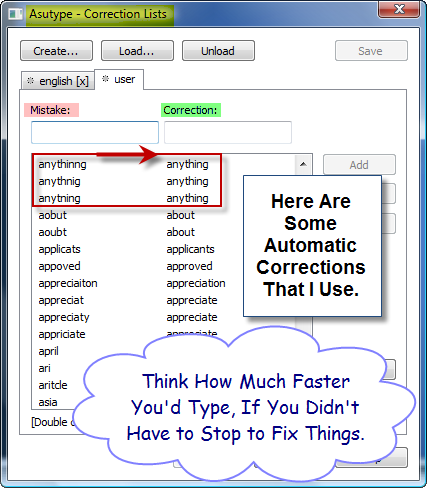

- Correct Repetitive Mistakes Automatically. The software also keeps track of the mistakes you make as well as the corrections that you apply and allows you to create a list of automatic entries. From time-to-time I'll review the list of corrections and choose to add them to my permanent list. When I do that, then next time I mistype that word or phrase, the software automatically fixes it (without even asking). This means I type much quicker because most of my typing mistakes are repetitive and that means I make them consistently). I'm actually surprised by how many different ways I could misspell certain words. It's not so much that I don't know how to spell them, it's that my fingers don't do the right thing when I'm trying to type quickly or get distracted.

- Automate Repetitive Typing. The software also has some very powerful text expansion capabilities. I think of them almost as abbreviations or shortcuts. There are certain words or phrases that I type often (examples include: Capitalogix, our web address, or phrase like "please contact me if you have questions or comments".). Another example might be to use the abbreviation "VTY", which could expand to "very truly yours" … and then your signature block.

You never have a second chance to make a first impression, so I'm glad that Asutype helps me seem like a good speller. Here are the links for you to find out more information or to download a trial copy yourself. I don't have anything to do with the company other than I'm a happy user. I've had my license for years, and I can vouch for their service, support, and the good experience that I've had with their tool. I hope you like it too.