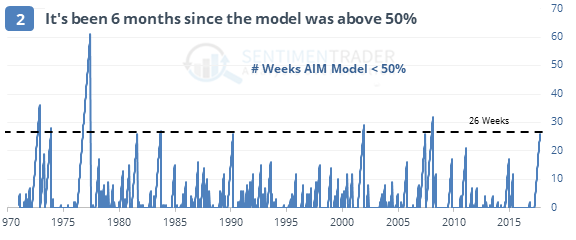

Maybe bulls are just superstitiousEven though investors are buying, they won’t say they’re bullish in sentiment surveys. The Advisor & Investor Model (AIM) is a model that averages the momentum of the four major sentiment surveys. It has been below 50% for 6 months, one of the longest streaks since 1970.via SentimenTraderNobody wants to shortAmong active investment managers, even the most bearish one is betting on a rally, which is a break from other surveys which mostly show apathetic sentiment. Unlike other surveys, this one has less of a contrarian bent, however.Call buyers returnOn the ISE exchange, recently, there were more than 200 call options bought for every 100 puts. That’s typically interpreted as a sign of excessive optimism from options traders.So, how are you feeling about the markets. Let me know.

Trading

-

Bulls Say They’re Hesitant While Active Managers Jump In

I saw this article on SentimenTrader. Thought it was worth sharing. -

Here Are Some Links For Your Weekly Reading – August 19th, 2018

Turns out, Google is tracking your location history – even when you turn off location tracking in Google Maps.

It's increasingly apparent that privacy in today's digital age is a farce.

If you want to actually stop Google from tracking location (short of selling all of your material possessions and living off the grid) turn off your device information, location history and web activity here. This will depersonalize your searches as well – so your ads will (hopefully) not know your deepest darkest secrets anymore.

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- 3 Key Factors that Led to Apple Becoming the World's First Trillion-Dollar Company. (Entrepreneur)

- 7 Job Skills of the Future (That AIs and Robots Can't Do Better Than Humans). (Forbes)

- This Will Help You Grasp the Sizes of Things in the Universe.(Nautilus)

- A Fascinating List of Autonomic Functions that Occur within Human Bodies Every 60 Seconds. (LaughingSquid)

- Hear Freddie Mercury & Queen's Isolated Vocals on Their Enduring Classic Song, We are the Champions. (OpenCulture)

- Here's How Fortnite Hooked 125 Million Players.(TheNextWeb)

- Six Media Giants Control 90 Percent of the Content We Consume. (PR Daily)

- Contradiction: Fund Managers Love Tech but Worry about the Trade War. (ValueWalk)

- Report: Just 12% of 2017'S $43 Billion in Music Industry Revenue Went to Artists. (CNW)

- Bill Gates Noticed a Global Economy Trend that No One is Paying Enough Attention To. (Observer)

-

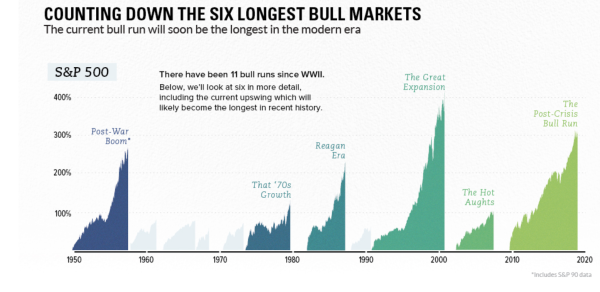

Will This Be The Longest Bull Run In The Modern Era?

When August 2018 ends, should the trend continue, the current bull market will become the longest bull market (post-World War II,) taking over for the S&P 500 surge from November 1990 to March 2000.

Today's bull market run started after the financial crisis caused by the US housing bubble collapse.

Full Infographic via Visual Capitalist

Full Infographic via Visual CapitalistWhat ended the previous runs?

Who knows why a bull market really ends? After-the-fact, it’s easy to proclaim that previous bull runs ended for a “reason”. Looking back, there was the dot-com bubble, Russia launching Sputnik, the energy crisis (and double-digit inflation), Black Monday, the housing bubble, etc.

There is an undertone of fear as interest rates rise, stimulus tightens, and debt rises.

Nonetheless:

- U.S. stock markets are at all-time highs

- U.S. housing prices are at all-time highs

- World bond markets are in a bubble

- The Fed is raising interest rates

Should we be worried?

Ultimately, the Market is not the Economy. And, traders have not been skittish recently.

In addition, markets aren’t governed by the laws of physics … so, what goes up doesn’t really have to go down (at least not all the way).

However, there are signs of underlying weakness. And while markets are impossible to predict, and history doesn’t really repeat itself (though it often rhymes) … a number of indicators are flashing that have previously signaled a recession.

A trader knows that a trend continues until it breaks. This one hasn’t broken.

Nothing works forever, but there is always something working.

Pay attention, and respond accordingly.

Let me know what you think.

Onwards!

-

Economists and Markets

I recently got a text from Megan Greene, who is a friend and the global chief economist at Manulife Asset Management.She told me that she wrote an article in FT about a conversation we had. Her take was that Here are some excerpts:I was recently informed by the owner of an artificial intelligence fund that markets do not listen to economists anymore. Rather than immediately dust off my CV and see what transferable skills I might have, I dug around for evidence of his claim and found there was something to it.

Here are some excerpts:I was recently informed by the owner of an artificial intelligence fund that markets do not listen to economists anymore. Rather than immediately dust off my CV and see what transferable skills I might have, I dug around for evidence of his claim and found there was something to it.A fundamental shift in market structure towards rules-based, passive investing over the past decade means a lot of trading is no longer based on fundamentals. But just because some markets do not pay attention to economists, it does not mean economists should not pay attention to these markets. On the contrary — this shift in market structure could well be a trigger for the next global downturn. The US Federal Reserve is concerned enough that “Changing Market Structure and Implications for Monetary Policy” is the topic for this year’s economic symposium in Jackson Hole.

JPMorgan notes that only about 10 percent of US equity investment is now done by traditional, discretionary traders. AI quant funds use powerful supercomputers to crunch huge amounts of data, unearth patterns and survey trading strategies across different markets in real time. They do not care why markets move, only that they do.

These funds are not waiting on tenterhooks for my analysis of every non-farm payrolls report, Fed press conference, Donald Trump tweet, or earnings report. Instead, they look for trading strategies that are succeeding and adopt those strategies until a better one comes along, regardless of the underlying fundamentals. But what happens when the strategy suddenly becomes to sell everything? Will the computers find the buyers they need?

Passive investments, such as exchange traded funds (ETFs) and index funds, similarly ignore fundamentals. Often set up to mimic an index, ETFs have to buy more of equities rising in price, sending those stock prices even higher.

…

Passive investors and quant funds could also threaten the economy by making markets vastly more complex, noisy and opaque. They send mixed signals to active investors about what the fair value of a stock is. That could cause a significant misallocation of capital.

The danger is exacerbated by the speed at which trading is now done. The average holding period for a security on the New York Stock Exchange has fallen from two months in 2008 to just under 20 seconds today, according to analysis from Cumberland Advisors. Market regulators have put circuit breakers in place, but the flash crashes we have seen suggest they may not work in a crisis.

Systemic failures, misallocation of capital and dried up liquidity could cause a bear market, dragging on growth when the economic backdrop is already lackluster. Do not be fooled by the 4.1 percent growth in gross domestic product in the second quarter of 2018. The underlying fundamentals of the US economy leave a lot to be desired. A market crash — worsened by systemic effects — would probably send the economy into a tailspin.

So even though passive investors ignore economists, economists should pay attention to risks posed by the shift in market structure they represent. One would be hard pressed to find a customer willing to hand their money to an investor who genuinely does not care about fundamentals or price. Yet this is the strategy pursued by passive and quant funds.

This is not to say these funds are necessarily bad. But the real test will come when there is a sudden crisis followed by a sustained bear market. If markets stay liquid, my AI friend might be right. If not, I will be waiting by the phone to discuss the fundamentals that might lead to recovery.

Interesting take … Let me know what you think.

-

Here Are Some Links For Your Weekly Reading – August 5th, 2018

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- The 5 Levels of Leadership. (Quartz)

- Your Obsession with Cognitive Biases is Probably Making You Dumber. (Inc)

- Apple Watch Keeps Spotting Cardiac Issues and Saving Lives, this Time in Australia. (AppleInsider)

- What is Intermittent Fasting and is It Actually Good for You? (Time)

- New Radio Telescope Picks up Mysterious Signal from Space. (CNet)

Trading Links- Jeff Bezos' Parents Invested $245,573 in Amazon in 1995 Now They Could Be Worth $30 Billion. (Insider)

- The Biggest Thing to Happen in Blockchain since Bitcoin. (Forbes)

- Russia Dumped 84% of Its American Debt. What that Means. (Money)

- Big Pharma Would like Your DNA. (The Atlantic)

- AAPL Gets Even Closer to $1Tn Market Cap, Hits New All-time High in After-hours Trading. (9to5Mac)

-

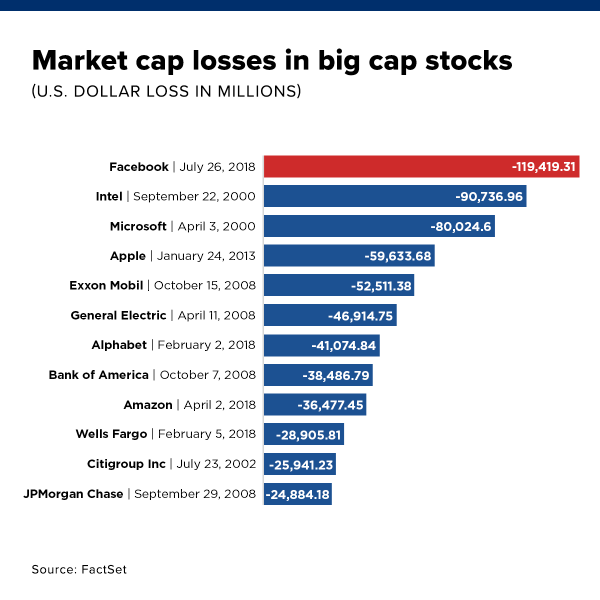

Largest Single-Day Market Cap Loss in History

Facebook has been under fire for a while now – misuse of data, privacy issues and more.

This Thursday, following a horrible quarterly report with lower-than-expected revenue and low daily active users, Facebook posted the largest single-day loss in market value by any company in U.S. history. They had peaked at about $630 billion.

Mark Zuckerberg himself lost approximately 17 billion.

via CNBC

via CNBCLooking at the list of the largest "losers" there are plenty of winning companies in their ranks, but, Facebook expects their revenue growth rate to continue to slow.

Do you think Facebook will still be a major player in the next 5 years?

-

Is Biohacking the New Key to Trading?

Last week, I was in Alaska at Steamboat Bay for a CEO retreat.

One of the other attendees was Dave Asprey – CEO of Bulletproof, author of Headstrong, and a biohacking thought-leader.

Very few people understand what we do at Capitalogix; even fewer understand it well enough to paint a vivid picture … yet, that's exactly what Dave did … almost instantly.

I asked him to retell it on video – to try and capture his take. To set your expectations, his take is different than you might imagine … It's got ancient bacteria, futuristic algorithms, and a little genius.

Kind of cool … Check it out.

"It takes a lot of computer power, and it takes a lot of algorithms, and it takes a lot of environmental sensors … that's why we can walk around, breathe, and think."

~ Dave AspreyMarkets are an environment just like the environment we live in. Our algorithms can learn and evolve based on markets in a similar way to how humans evolved and adapted to their environments.

To summarize: In the beginning, there was an algorithm … and it was good.

And, it's just the beginning.

Onwards!

-

Here Are Some Links For Your Weekly Reading – July 22nd, 2018

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- The Boston Dynamics Robots Can Now Hunt You in the Woods. (DailyDot)

- What Cyber-War Will Look Like. (Scholars-Stage)

- The Mistakes You Make in a Meeting's First Milliseconds. (Wall Street Journal)

- Does Intermittent Fasting Work? Here's What It Can (And Can't) Do for You. (Cheatsheet)

- 'Never Underestimate Human Stupidity,' Says Historian Whose Fans Include Bill Gates and Barack Obama. (CNBC)

- Coinbase Says It Has Green Light to List Coins Deemed Securities. (Bloomberg)

- CRISPR Stocks Plummet over Study Pointing to Potential Adverse Effects. (FastCompany)

- Warren Buffett Donates $3.4-Billion to Gates Foundation and His Family's Charities. (Globe&Mail)

- The 24 Rules for Success Left behind by a Legendary Wall Street Banker. (Time)

- Scientists Discovered a Quadrillion Diamonds Hidden Deep within the Earth. (Inverse)

-

Here Are Some Links For Your Weekly Reading – July 8th, 2018

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- Yes, Your Phone is Spying on You and these Researchers Proved It. (BGR)

- Talking to Your Team about Cyber Threats. (Myventurepad)

- A Mesmerizing 4K Timelapse of Kilauea's Famous Lava Flow. (TwistedSifter)

- The 2018 National Geographic Travel Photographer of the Year Winners. (TwistedSifter)

- Harvard University is Fighting to Keep Its Secretive Admissions Process under Wraps. (MarketWatch)

Trading Links- JPMorgan's Ultimate Guide to Markets and the Economy. (BusinessInsider)

- Yes, America Still is an Export Superpower. (BigThink)

- The Top 10 Biggest Airline Money Making Routes in the World (One Generates a Billion Dollars). (VFTW)

- First Commercial DNA Data Storage Service Set to Launch in 2019. (NewScientist)

- Why Quantum Computers Will Be Super Awesome, Someday. (Bloomberg)

-

A Look at Online Trading

Trading used to be reserved to those in the pit at exchanges … but the advent of electronic trading made this enterprise available to a host of other people.

Trading used to be reserved to those in the pit at exchanges … but the advent of electronic trading made this enterprise available to a host of other people.Millions of online traders have opened accounts in the past few years.

Apps like Robinhood and Coinbase make it easy for retail customers to start trading.

Who are they? This chart breaks it down.

via brokernotes

via brokernotesTo start, 37% don't have a degree, and 58% are millennials. The average income of a trader is less than 35,000. You can check brokernotes full report here.

Interesting.

What does it mean? How will it affect the popularity of new markets (like Crypto)?

Curious to hear your opinion.