Small distinctions separate wise men from fools. Perhaps one of them has to do with what the wise man deems important.

Socrates' Triple Filter

In ancient Greece, Socrates was reputed to hold knowledge in high esteem. One day an acquaintance met the great philosopher and said, "Do you know what I just heard about your friend?"

"Hold on a minute," Socrates replied. "Before telling me anything, I'd like you to pass a little test. It's called the Triple Filter Test."

"Triple filter?"

"That's right," Socrates continued. "Before you talk to me about my friend, it might be a good idea to take a moment and filter what you're going to say. That's why I call it the triple filter test.

The first filter is Truth. Have you made absolutely sure that what you are about to tell me is true?"

"No," the man said, "Actually I just heard about it and…"

"All right," said Socrates. "So you don't really know if it's true or not. Now let's try the second filter, the filter of Goodness. Is what you are about to tell me about my friend something good?"

"No, on the contrary…"

"So," Socrates continued, "You want to tell me something bad about him, but you're not certain it's true. You may still pass the test though, because there's one filter left. The third filter is Usefulness. Is what you want to tell me about my friend going to be useful to me?"

"No, not really."

"Well," concluded Socrates, "If what you want to tell me is neither true, nor good, nor even useful … then why tell it to me at all?"

With all the divisiveness in both media and in our everyday conversations with friends, family, and strangers … this is a good filter for what you say, what you post, and even how you view markets.

How Does That Apply to Me or Trading?

The concept of Socrates' Triple Filter applies to markets as well.

When I was a technical trader, rather than looking at fundamental data and scouring the news daily, I focused on developing dynamic and adaptive systems and processes to look at the universe of trading algorithms to identify which were in-phase and likely to perform well in the current market environment.

As we've transitioned to using advanced mathematics and AI to understand markets it becomes even more true.

Filter Out What Isn't Good For You.

In contrast, there are too many ways that the media (meaning the techniques, graphics, music, etc.), the people reporting it, and even the news itself, appeals to the fear and greed of human nature.

Likewise, I don't watch TV news anymore either. It seems like story after story is about terrible things. For example, during a recent visit with my mother, I listened to her watch the news. There was a constant stream of "oh no," or "oh my," and "that's terrible". You don't even have to watch the news to know what it says.

It's also true with what you feed your algorithms. Garbage in, garbage out. Just because you can plug in more data, doesn't mean that data is adding value. Deciding what not to do, and what not to listen to is equally as important as deciding what to do.

Artificial intelligence is exciting, but artificial stupidity is terrifying.

What's The Purpose of News for You?

My purpose changes what I'm looking for and the amount of attention I pay to different types of information. Am I reading or watching the news for entertainment, to learn something new, or to find something relevant and actionable?

One of my favorite activities every week is looking for new insights and interesting articles to share with you and my team. If you aren't getting my weekly reading list on Fridays – you're missing out. You can sign up here.

Getting back to Socrates' three filters and the business of trading, I often ask myself: is it important, does it affect our edge, or can I use it as a catalyst for innovation?

There's a lot of noise out there competing for your attention. Stay focused.

Onwards!

via

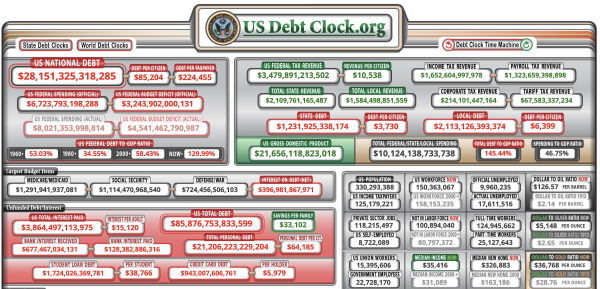

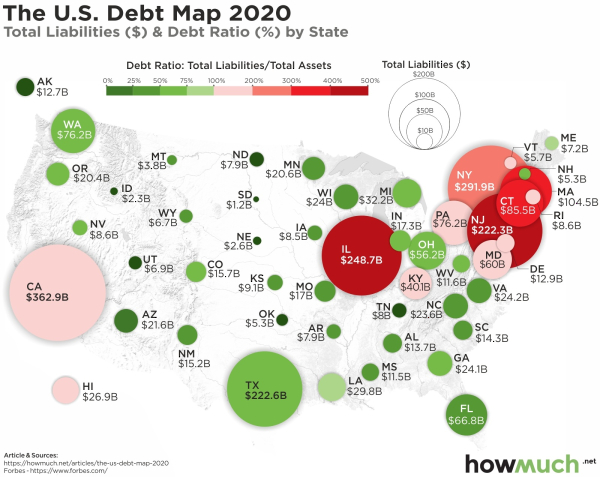

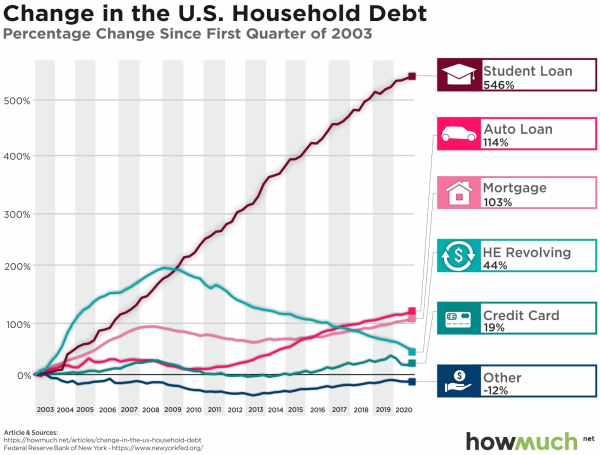

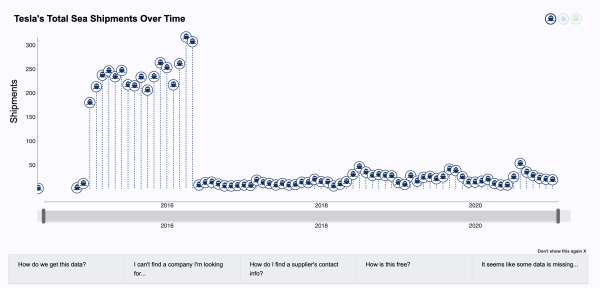

via  via

via

via

via  via

via  via

via