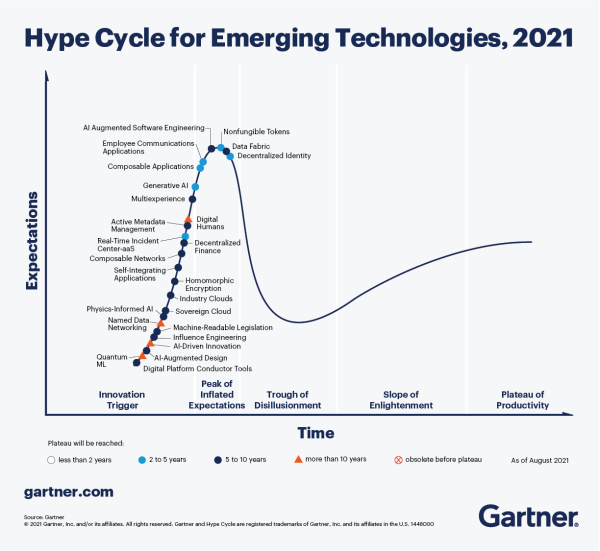

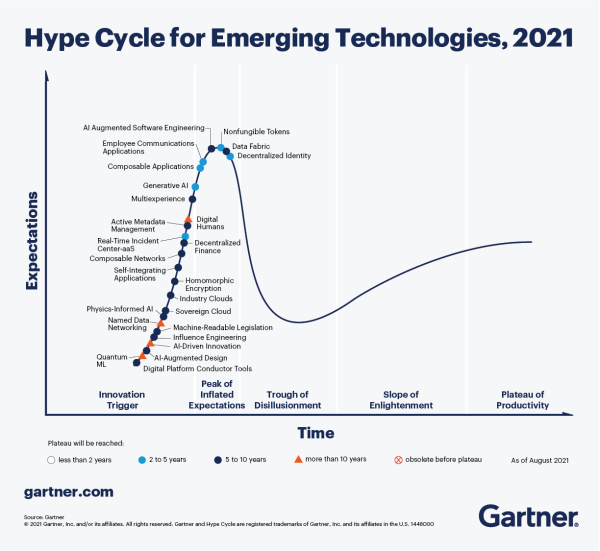

Each year, I share an article about Gartner's Hype Cycle for Emerging Technologies. Here’s last year’s.

It's one of the few reports that I make sure to track every year. It does a good job of explaining what technologies are reaching maturity, and which technologies are being supported by the cultural zeitgeist.

Technology has become cultural. It influences almost every aspect of everyday life.

Identifying which technologies are making real waves (and will impact the world) can be a monumental task. Gartner's report is a great benchmark to compare reality against.

2021’s trends aren’t all that different from 2020 – but you can now find NFTs, digital humans, and physics-informed AI on the list. While there have been a lot of innovations, the industry movers have stayed the same – advanced AI and analytics, post-classical computing and communication, and the increasing ubiquity of technology (sensors, augmentation, IoT, etc.).

What's a "Hype Cycle"?

As technology advances, it is human nature to get excited about the possibilities and to get disappointed when those expectations aren't met.

At its core, the Hype Cycle tells us where in the product's timeline we are, and how long it will take the technology to hit maturity. It attempts to tell us which technologies will survive the hype and have the potential to become a part of our daily life.

Gartner's Hype Cycle Report is a considered analysis of market excitement, maturity, and the benefit of various technologies. It aggregates data and distills more than 2,000 technologies into a succinct and contextually understandable snapshot of where various emerging technologies sit in their hype cycle.

Here are the five regions of Gartner's Hype Cycle framework:

- Innovation Trigger (potential technology breakthrough kicks off),

- Peak of Inflated Expectations (Success stories through early publicity),

- Trough of Disillusionment (waning interest),

- Slope of Enlightenment (2nd & 3rd generation products appear), and

- Plateau of Productivity (Mainstream adoption starts).

Understanding this hype cycle framework enables you to ask important questions like "How will these technologies impact my business?" and "Which technologies can I trust to stay relevant in 5 years?"

That being said – it's worth acknowledging that the hype cycle can't predict which technologies will survive the trough of disillusionment and which ones will fade into obscurity.

What's exciting this year?

Before I focus on this year, it's important to remember that in 2019 Gartner shifted towards introducing new technologies at the expense of technologies that would normally persist through multiple iterations of the cycle. This change is indicative of more innovation and more technologies being introduced than in the genesis of this report. Many of the technologies from the past couple of years (like Augmented Intelligence, 5G, biochips, the decentralized web, etc.) are represented within newer modalities or distinctions.

It's also worth noting the impact of the pandemic on the prevalent technologies.

For comparison, here's my article from 2019, and here's my article from 2015. Click on the chart below to see a larger version of this year's Hype Cycle.

via Gartner

Last year, the key technologies were bucketed into 5 major trends – but this year Gartner focused on 3 major themes.

- Engineering Trust represents technologies that create the infrastructure of trusted businesses. The emphasis is on security, reliability, and repeatability of practices. Change is hard, and so is the integration of new technologies into existing businesses. That’s why it’s important to do it right the first time to prevent technologies from being cost centers. Sample technologies from this year’s hype cycle include real-time incident command centers, data fabric, and sovereign cloud. If I could include a technology not on the list – I’d heavily support the blockchain as an instrumental asset in this domain.

- Accelerating Growth is the second theme, and it builds on top of “Engineering Trust”. Once you have a good business core you can focus on driving organizational and industrial growth. Last year, "composite architectures" was a trend that emphasized the shift to agile/responsive architectures and decentralization. This year, many of the technologies gaining attention are AI-driven tools that can be applied to improve and accelerate human-facing support. Think HR training, customer service, and onboarding. As a culture, we’ve become more comfortable with the ubiquity of AI and technology, and while there are still ethical and societal roadblocks, you can expect many new use-cases to show up sooner rather than later. Sample technologies from this year’s hype cycle include digital humans, industry cloud, and quantum machine learning. To see more of my thoughts on Accelerating Growth check out my article on “Turning Thoughts Into Things”.

- Sculpting Change is the third theme and closes off what I believe is a very strong thematic year from Gartner. The nexus of this theme is that change is disruptive and that many of the technologies we will gravitate toward will be attempting to create order from the chaos. This is especially important in the context of rapid innovation, societal changes, and Covid-19. The emphasis of these technologies is on generalized and reliable technologies that are less brittle and specific than our current uses. AI is already a massively exciting space, but many of the use cases are too specific to be useful. Sample technologies include physics-informed AI, composable applications, and influence engineering.

If we compare this year’s list to last year, I think we’ve seen a massive increase in the maturity of “Digital Me”, the integration of technology with people in both reality and virtual reality. But, we’ve seen less progress on “Beyond Silicon” despite the massive chip shortage. It’s a space I’m hoping to see more improvement in, fast, to meet increasing demand.

Of course, I’m always most interested in the intersection of AI and other spaces. Last year, many of the emerging trends were AI-centric, and this year it feels as if AI has become the underpinning of broader trends. In my opinion, this points towards the increasing maturity and adoption of AI. Models are becoming more generalized, and able to attack more problems. They're becoming integrated with human behavior and even with humans.

As we reach new echelons of AI, it's likely that you'll see over-hype and short-term failures. As you reach for new heights, you often miss a rung on the ladder… but it doesn't mean you stop climbing. More importantly, it doesn't mean failure or even a lack of progress. Challenges and practical realities act as force functions that forge better, stronger, more resilient, and adaptable solutions that do what you wanted (or something better). It just takes longer than you initially wanted or hoped.

To paraphrase a quote I have up on the wall in my office from Rudiger Dornbusch … Things often take longer to happen than you think they will, and then they happen faster than you thought they could.

Many of these technologies have been hyped for years – but the hype cycle is different than the adoption cycle. We often overestimate a year and underestimate 10.

Which technologies do you think will survive the hype?

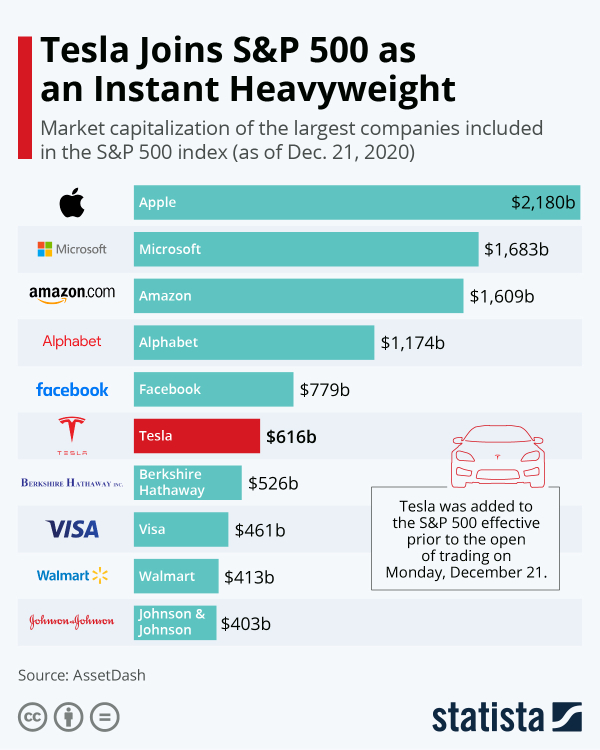

via Statista

via Statista  via PuzzledHippo3

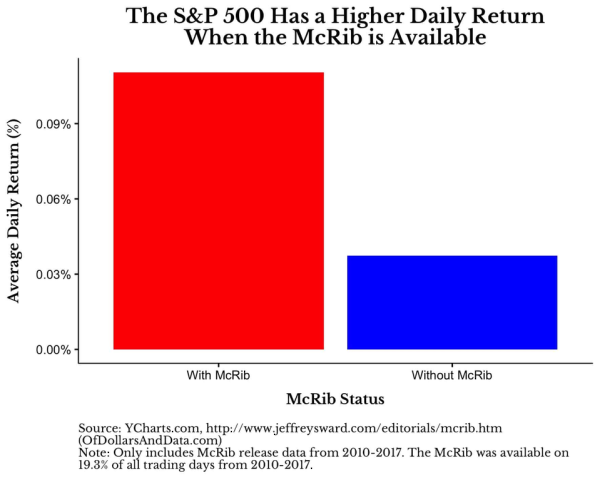

via PuzzledHippo3

via

via

via

via