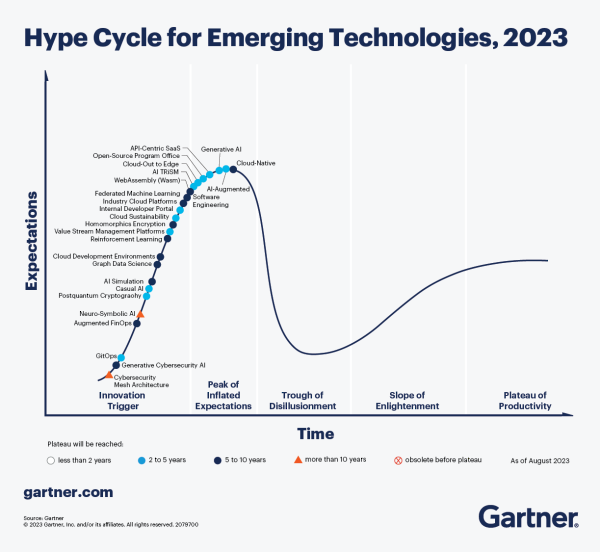

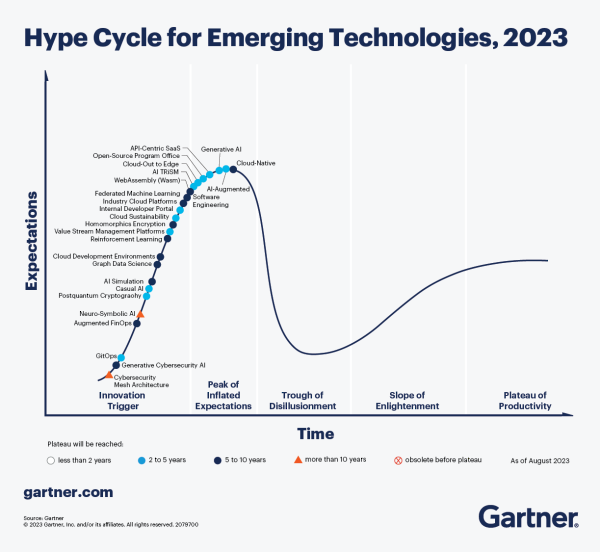

I share an article about Gartner’s Hype Cycle for Emerging Technologies each year. It does a great job of documenting what technologies are reaching maturity and which technologies’ ascents are being enhanced by the cultural zeitgeist (hype, momentum, great timing, etc.).

Creating a report like this requires a unique mixture of technological analysis and insight, an acute understanding of human nature, and a lot of common sense.

Identifying which technologies are making real waves (and thus will impact the world more) is a monumental task. Gartner’s report is a great benchmark to compare with your perception of reality.

A quick look back at past reports shows that 2021 saw the inclusion of NFTs and advancements in AI. It also focused on the increasing ubiquity of technology. 2022 built on those trends, recognizing that we were moving towards immersive experiences, faster digital transformations, and the adoption of exponential AI capabilities. For reference, click here to see what Gartner predicted last year.

Meanwhile, let’s look at the 2023 version of Gartner’s Hype Cycle for Emerging Technologies report. 2023 has some meaningful changes – and is best understood by where things are placed on Gartner’s framework called the “Hype Cycle.”

What’s a “Hype Cycle”?

As technology advances, it is human nature to get excited about the possibilities … and to get disappointed when those expectations aren’t met.

At its core, the Hype Cycle tells us where in the product’s timeline we are – and how long it likely will take the technology to hit maturity. It attempts to tell us which technologies will survive the hype and have the potential to become a part of our daily lives.

Gartner’s Hype Cycle Report is a considered analysis of market excitement, maturity, and the benefit of various technologies. It aggregates data and distills more than 2,000 technologies into a concise and contextually understandable snapshot of where various emerging technologies sit in their hype cycle.

Here are the five regions of Gartner’s Hype Cycle framework:

- Innovation Trigger (potential technology breakthrough kicks off),

- Peak of Inflated Expectations (Success stories through early publicity),

- Trough of Disillusionment (waning interest),

- Slope of Enlightenment (2nd & 3rd generation products appear), and

- Plateau of Productivity (Mainstream adoption starts).

Understanding this hype cycle framework enables you to ask important questions like “How will these technologies impact my business?” and “Which technologies can I trust to stay relevant in 5 years?”

That said – it’s worth acknowledging that the hype cycle can’t predict which technologies will survive the trough of disillusionment and which ones will fade into obscurity.

What’s exciting this year?

Before focusing on this year, it’s important to remember that, in 2019, Gartner shifted towards spotlighting new technologies at the expense of technologies that would normally persist through multiple iterations of the cycle. This change helps account for the increasing number of innovations and technology introductions we are exposed to compared to the norm when they first started producing this report. As a result, many of the technologies highlighted over the past couple of years (like Augmented Intelligence, 5G, biochips, the decentralized web, etc.) are now represented within newer modalities or distinctions.

It’s also worth noting the impact of the pandemic on the prevalent technologies.

For comparison, here’s my article from 2019, and here’s my article from 2015. Click on the chart below to see a larger version of this year’s Hype Cycle.

via Gartner

Last year’s themes were:

- Evolving/Expanding Immersive Experiences,

- Accelerated Artificial Intelligence Automation, and

- Optimized Technology Delivery (digital businesses)

This year, the key technologies were bucketed into four major themes.

- Emergent AI represents the technologies that increase workforce productivity and differentiation from competitors. The hallmark technology of this theme is Generative AI, but another exciting one is AI Simulation – where environments and people can be replicated virtually to run simulations and ask questions. Imagine being able to create a digital replica of yourself (or a specialist in different disciplines) to bounce ideas off of … or to create a virtual advisory board to help process tough issues or test the response to various situations, opportunities, or challenges.

- Developer Experience (DevX) is precisely what it sounds like. Enhancing the developer suite of technologies not only enhances your engineering team but also helps attract and retain high-level employees. Value Stream Management Platforms (VSMP) is a good example of this. VSMP is intended to optimize product delivery from end to end.

- Pervasive Cloud focuses on how cloud computing is evolving. This theme is also focused on creating an end-to-end use case. In an ideal world, this enables easy and automated operational scaling, lots of cloud-native tools, and stability improvements. A sample technology under this umbrella would be WebAssembly, a lightweight virtual machine and binary code format that would enable secure, high-performance applications on your web pages.

- Last but not least, we have Human-Centric Security and Privacy. In response to growing security concerns, this theme recognizes the pressure companies face to create cultures and systems that value and protect security. AI Trust, risk, and security management (AI TRiSM) is the culmination of this effort and represents a holistic approach to governance, reliability, efficacy, and more. This will be an important frontier to develop as we innovate faster.

Last year, the main focus was on the spread of emerging technologies. Last year’s themes focused on the ubiquity of AI in all facets of life – and the increasing immersiveness of these technologies.

This year, the focus seems to be on responding to that increasing ubiquity. It’s about building systems that help adopt these new technologies efficiently … while also protecting yourself from making mistakes at lightspeed.

Of course, I’m always most interested in the intersection of AI and other spaces. Last year, AI became a lighthouse for businesses to work toward. It’s continued to shine a light this year. In my opinion, this points towards the increasing maturity and adoption of AI. The opportunity cost of adopting AI into your business is continuing to decrease.

Meanwhile, these systems are also becoming more autonomic, self-managing, and self-learning. I’m excited to see Gartner emphasizing what this does for humans – not what it takes away from them. Remember, the heart of artificial intelligence is human – and it continues to free us up to be more human.

As we reach new echelons of AI, you’ll likely see increasing examples of over-hype and short-term failures. You often miss a rung on the ladder as you reach for new heights, but it doesn’t mean you should stop climbing. More importantly, it doesn’t mean failure or even a lack of progress. Challenges and practical realities act as force functions that forge better, more robust, resilient, and adaptable solutions that do what you want (or something better). It just takes longer than you initially wanted or hoped.

To paraphrase a quote I have up on the wall in my office from Rudiger Dornbusch … Things often take longer to happen than you think they will, and then they happen faster than you thought they could.

Many of these technologies have been hyped for years – but the hype cycle differs from the adoption cycle. We often overestimate what we can do in a year and underestimate what we can do in ten years.

I say it often … we live in interesting times!

Which technologies do you think will survive the hype?

Let me know what you think.

Onwards!