Feeding the Madness

"Not only is there more to life than basketball, there's a lot more to basketball than basketball." – Phil Jackson

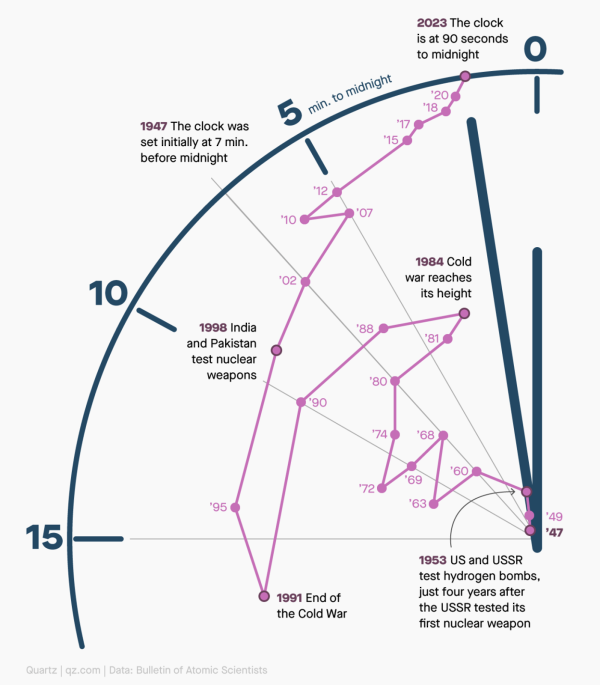

In 2017, I highlighted three people who were (semi) successful at predicting March Madness: a 13-year-old who used a mix of guesswork and preferences, a 47-year-old English woman who used algorithms and data science (despite not knowing the game), and a 70-year-old bookie who had his finger on the pulse of the betting world. None of them had the same success even a year later.

Finding an edge is hard – Maintaining an edge is even harder.

That's not to say there aren't edges to be found.

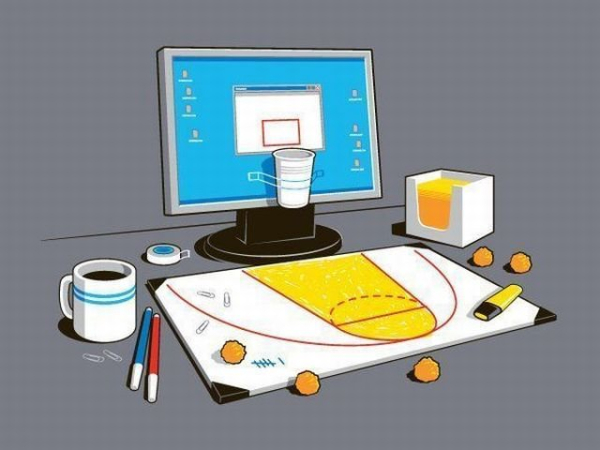

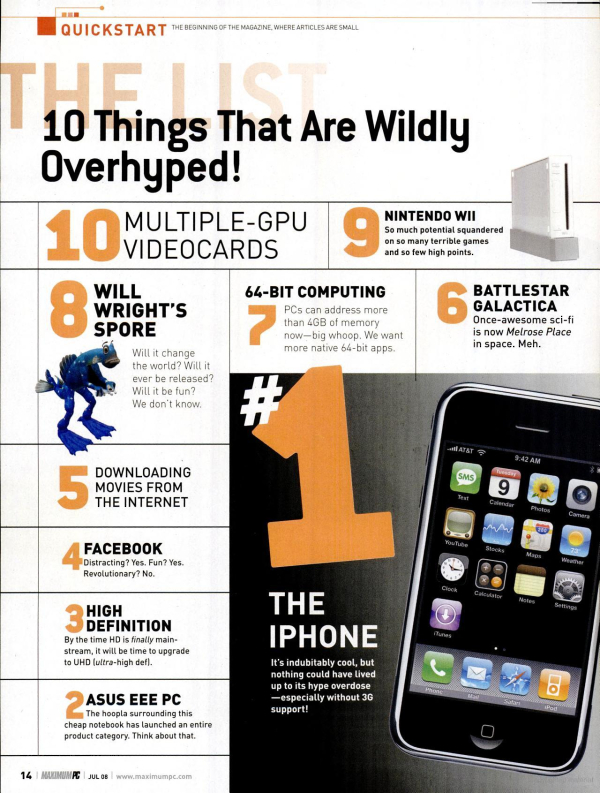

Bracket-choosing mimics the way investors pick trades or allocate assets. Some people use gut feelings, some base their decisions on current and historical performance, and some use predictive models. You've got different inputs, weights, and miscellaneous factors influencing your decision. That makes you feel powerful. But knowing the history, their ranks, etc., can help make an educated guess, and they can also lead you astray.

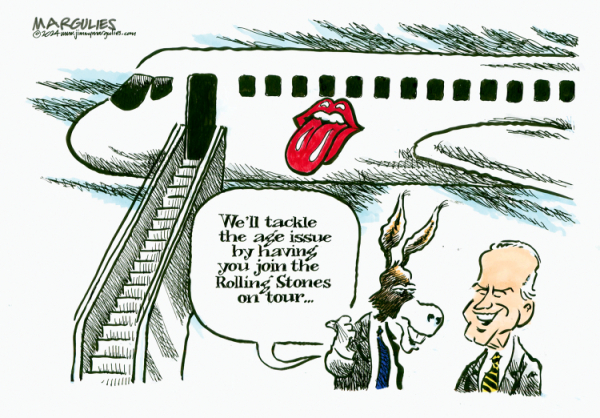

The allure of March Madness is the same as gambling or trading. As sports fans, it's easy to believe we know something the layman doesn't. We want the bragging rights of that sleeper pick, of our alma mater winning, of the big upset.

You'd think an NCAA analyst might have a better shot at a perfect bracket than your grandma or musical-loving co-worker.

In reality, several of the highest-ranked brackets every year are guesses.

The commonality in all decisions is that we are biased. Bias is inherent to the process because there isn't a clear-cut answer. We don't know who will win or what makes a perfect prediction.

Think about it from a market efficiency standpoint. People make decisions based on many factors — sometimes irrational ones — which can create inefficiencies and complexities. It can be hard to find those inefficiencies and capitalize on them, but they're there to be found.

In trading, AI and advanced math help remove biases and identify inefficiencies humans miss.

Can machine learning also help in March Madness?

“The greater the uncertainty, the bigger the gap between what you can measure and what matters, the more you should watch out for overfitting – that is, the more you should prefer simplicity” – Tom Griffiths

The data is there. Over 100,000 NCAA regular-season games were played over the last 25+ years, and we generally have plenty of statistics about the teams for each season. There are plenty of questions to be asked about that data that may add an extra edge.

That being said, people have tried before with mediocre success. It's hard to overcome the intangibles of sports – hustle, the crowd, momentum - and it's hard to overcome 1 in 9.2 quintillion odds.

Two lessons can be learned from this:

- People aren't as good at prediction as they predict they are.

- Machine Learning isn't a one-size-fits-all answer to all your problems.

Something to think about.

via

via