Last Friday was the stock market’s worst day since COVID.

The media says weak job reports and recessionary fears fueled it. Geopolitics might have played a part, too.

Over 2.9 Trillion Dollars got wiped out.

To visualize what happened, here is a market heatmap of the S&P 500 index stocks categorized by sectors and industries. Size represents market cap. There was very little green in a sea of red.

via FinViz

Last year, I asked if we would see a recession in 2024? Here is an excerpt from that post:

I want to remind people that the U.S. is resilient, and it seems like public sentiment is moving in a positive direction.

That said, 84% of CEOs and 69% of consumers think we're headed toward a recession. Meanwhile, the Fed is positive we won't … and banks are almost positive we won't.

It seems like they know something we don't … or maybe vice versa.

To lend some credence to the bullish sentiment, consumer spending is still high despite inflation and interest rates. In addition, Retailers are still posting solid earnings.

Unfortunately, we're increasingly seeing consumers resort to borrowing (including short-term lending options) to pay for goods. Household debt has hit a record high of $17 trillion in March.

— Are We Going To See A Recession In 2024?, October 2023

Yes, last week was potentially alarming. Even the ordinarily resilient tech giants took a hit.

With the unemployment rate reaching 4.3% in July, the three-month moving average is at least 0.5 percentage points above the minimum of the previous 12 months’ averages. This triggers the Sahm rule, which supposedly signals a recession. According to the rule, reaching the 0.5% threshold indicates a recession. When the jobless rate rises quickly, it suggests the economy is slumping.

But, even the inventor of the rule, Claudia Sahm, says the doomsday narrative may be overblown.

I’m not here to tell you that everything is sunshine and roses, but I am here to remind you that no indicator exists in a vacuum. While the negative performance is real, household income is still growing, and consumer spending and business investment remain resilient.

Not to mention that with graduation, there’s a massive increase in the workforce, which also impacts the numbers.

Recessions can build slowly – but come quickly – but as they build, there is time to react … and even better – there is time to not ‘react’ but ‘respond’.

AI will likely impact the workforce, business, and eventually … the economy.

I’ve learned that the market often feels random because you can’t predict events like global pandemics, threats, assassinations, or cybersecurity outages.

Over time, I’ve focussed less on guessing what will happen and more on responding faster and better to what happens.

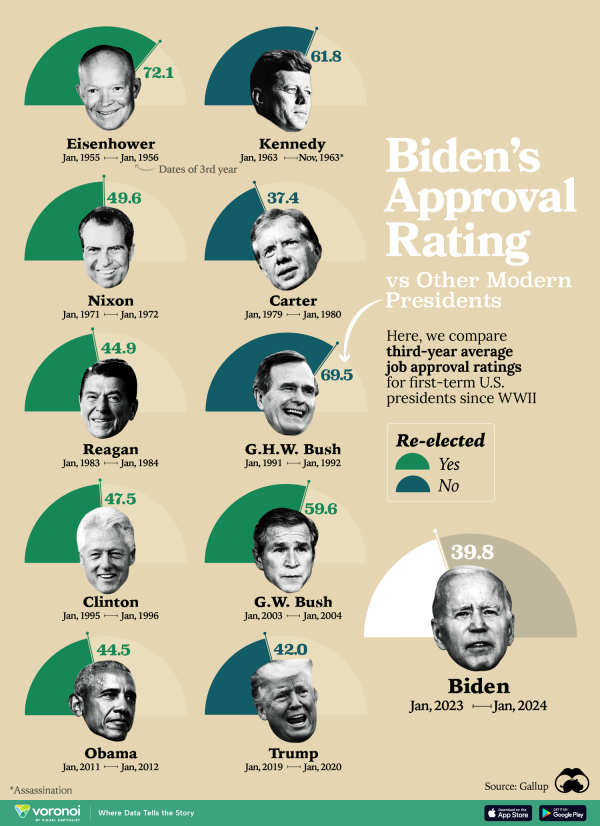

With that said, I do have an opinion here. It’s an election year, and I suspect the government will push every button and pull every lever to boost the market leading into November. Even though markets and the economy are not the same thing, many voters believe they are. So, I would say this correction is perfectly timed … and I anticipate a steady ramp-up so that people feel as good as possible about the economy when they vote.

What do you think is going to happen?

via

via

via

via