Have you noticed that it's easier for most people to identify and solve someone else's problem than it is to do the same for themselves?

Humans are emotional creatures. As a result, our decision-making often suffers from fear, greed, and discretionary mistakes.

As an entrepreneur, I strive to be objective about the decisions I make. Towards that goal, using key performance indicators, getting different perspectives from trusted advisors, and relying on tried-and-true decision frameworks all help.

Combining all three creates a form of "mindfulness" that comes from dispassionately observing from a perspective of all perspectives.

That almost indifferent and objective approach is also where exponential technologies like AI excel. They amplify intelligence by helping make better decisions, take smarter actions, and continually improve performance.

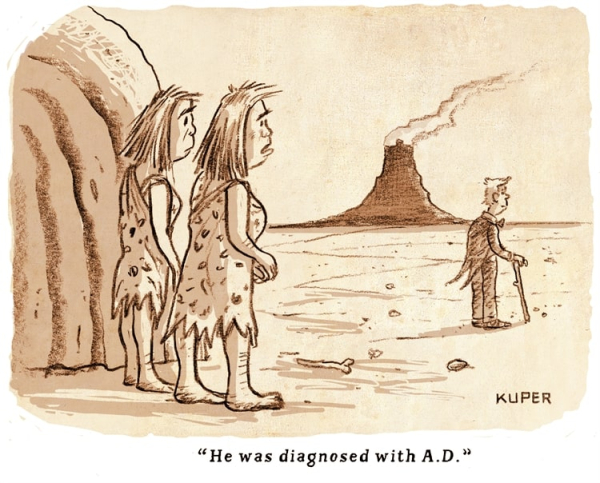

I shot a video about mindfulness and the future of A.I.

Artificial intelligence is cool. The truth, however, is that AI is still relatively limited. Individual techniques (or algorithms) are good at "something". The challenge is that they only focus on what they need to come up with their answer, without considering a different perspective. While it is good at what it is good at, it isn't necessarily good at empathetically understanding that a different technique, which comes up with a different answer, might be "right" as well.

The future of AI likely will be based on swarm intelligence, where many specialist components communicate, coordinate, and collaborate to view a situation more objectively, better evaluate the possibilities, and determine the best outcome in a dynamic and adaptable way that adds a layer of objectivity and nuance to decision making.

One of the lessons I teach to our younger employees is that an answer is not THE answer. It's intellectually lazy to think you're done simply because you come up with a solution. There are often many different ways to solve a problem, and the goal is to figure out the one that comes up with the best results.

Even if you find THE answer, it is likely only THE answer temporarily. So, it is really just a step in the right direction that buys you time to learn, improve and re-evaluate.

Hope that helps.

via

via  via

via  via

via