This was a quiet week in the market. Until Friday, each day was a narrow range day with very little volume. For the first time in a while there seemed to be very little external influence on the market. Governments weren’t overtly buying or selling to push an agenda. Giant funds weren’t trying desperately to hedge positions or cover margin calls. Instead, it was just the normal fear and greed of market participants. It was the dance of the undecided.

There were attempts to move the market down, only to have the market close relatively unchanged. There also were moves to push the markets higher, only to come back down and close, again, relatively unchanged. To me, though, that was good news. All-in-all I thought it was a constructive week of base-building that will serve the market well in the weeks ahead.

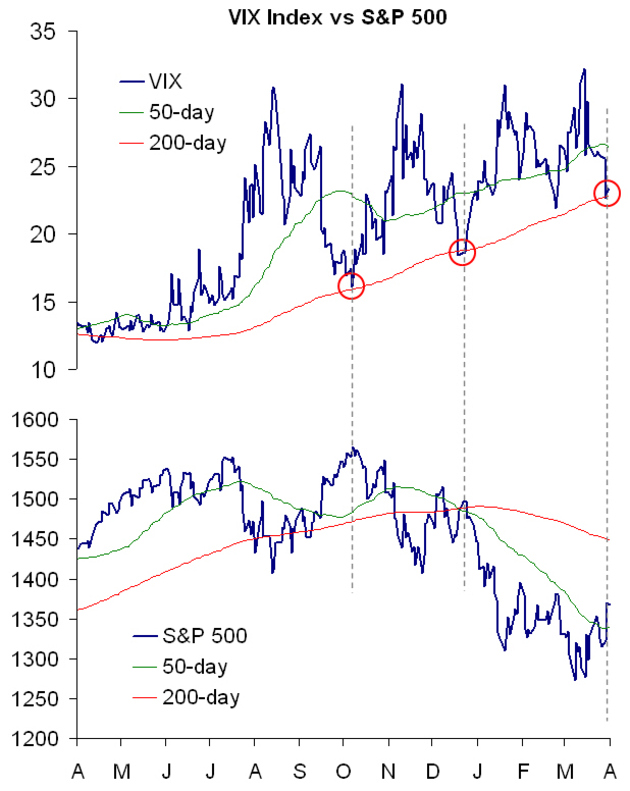

On Thursday, I told one our portfolio managers that it would be very easy to see some selling so close to important overhead and down-trend resistance. Also I expected a re-test of the 50-day moving average. From a chartist’s standpoint, these are common-sense "Technical Analysis 101" comments and expectations.

Friday was interesting. It is earnings season and GE announced results that fell far short of expectations. The markets sold off pretty hard. And now investors are twitchy again. Everywhere I turned pundits blamed the sell-off on GE and were predicting the next bear leg down.

This is why they say that "markets climb a wall of worry." Experienced traders know that it is not the news that matters, it is the reaction to the news. In my opinion, GE simply stirred-up emotions that were already there. A little selling and over-reaction were expected, even if GE’s announcement wasn’t.