The world is poised on the cusp of an economic and cultural shift as dramatic as that of the Industrial Revolution. - Steven Levy

Artificial Intelligence is one of my favorite things to talk about … It makes so much possible!

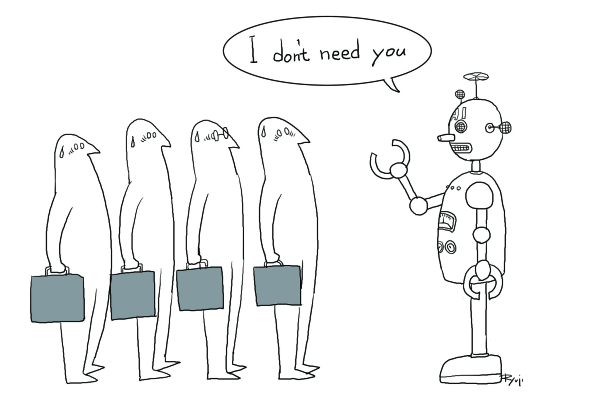

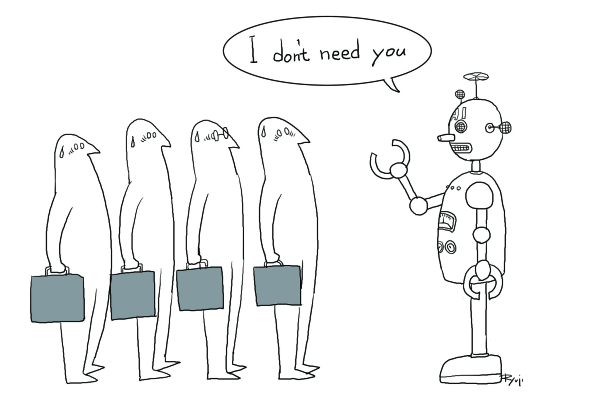

In a previous article, I mentioned that forecasts expect AI to impact or eliminate up to 50% of current jobs. Nevertheless, I think that is the start of the story. The ultimate impact will be more significant and more positive than most people expect.

Freeing humans to do more has always been a boon to society. Electricity put a lot of people out of work … but, look what it made possible.

We'd be naive to think AI isn't going to influence the job market, but that doesn't mean you can't navigate that shift.

A Look At Industrial Revolutions

The Industrial Revolution has two phases: one material, the other social; one concerning the making of things, the other concerning the making of men. - Charles A. Beard

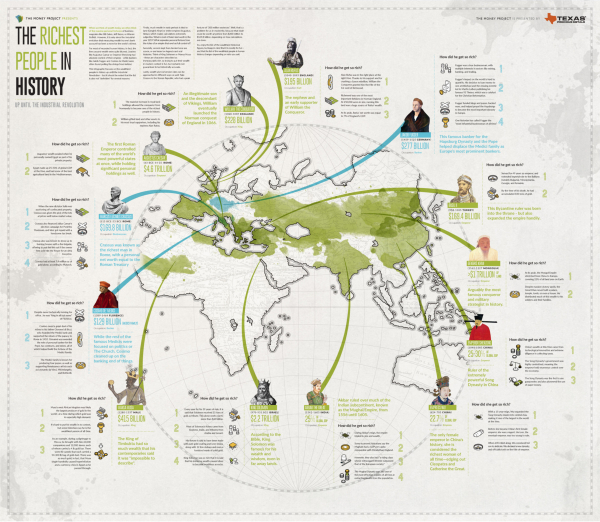

There are several turning points in our history where the world changed forever. Former paradigms and realities became relics of a bygone era.

Today, we're at another turning point.

Tomorrow's workforce will require different skills and face different challenges than we do today. You can consider this a Fourth Industrial Revolution. Compare today's changes to our previous industrial revolutions.

Each revolution shared multiple similarities. They were disruptive. They were centered on technological innovation. They created concatenating socio-cultural impact.

The fourth shares all the same hallmarks.

We're harnessing new technologies like AI, the IoT, renewable energy, and the blockchain. Automation will reach new levels in this revolution. But there also will be an explosion of new fields, new markets, and new necessary skillsets – it's going to impact the world as holistically as electricity did.

How will humans create value in an increasingly automated world?

I believe that, if managed well, the Fourth Industrial Revolution can bring a new cultural renaissance, which will make us feel part of something much larger than ourselves: a true global civilization. I believe the changes that will sweep through society can provide a more inclusive, sustainable and harmonious society. But it will not come easily. - Klaus Schwab

One of the distinctions I've recently made about the industrial revolutions is that for a long time, technology helped humans act like robots. Think about a plow and a farmer, or a seamstress and a sewing machine. After that, it helped robots try to act like humans, which you've seen more recently.

I believe we're at another inflection point, where new capabilities will free up humans to be more human and to pursue more of what they really want.

Robots can do many things, but they've yet to match the creativity and emotional insight of humanity. As automation spreads to more jobs, the need for management, creativity, and decision-making won't go anywhere … they may be bolstered by data analytics, but they won't disappear.

Our uniqueness and flexibility rightly protect our usefulness. AI and automation free us up to be our best selves and to explore new possibilities.

These are exciting times!

via visualcapitalist

via visualcapitalist

via

via  via

via