On the surface, the markets still look pretty good. However, last week something happened that I consider a bearish warning sign. The Market sold-off on good news. Although Intel announced strong results, it looks like the market priced-in the good news already.

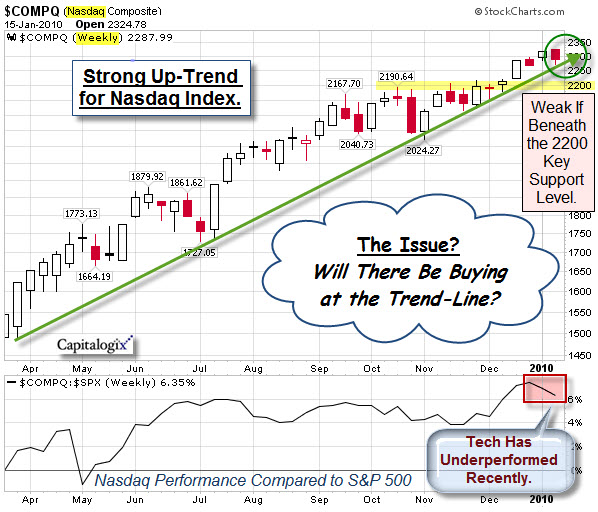

In addition, the tech-heavy Nasdaq Composite Index has lagged the S&P 500 recently. Clearly, it is still in an up-trend. However, price has pulled back to test the trend-line. If the trend is to continue, this is where buyers should step-in.

There is key support at the 2,200 level. No alarms, yet … Just a reminder to stay vigilant.

Is the Rally Losing Momentum?

The rally has lasted longer than I expected. And each time we've been at a tipping point, recently, market corrections haven't succeeded in triggering sellers.

However, the rally has lost some of its momentum. There are many signs (like poor volume or increasing negative divergences) that point to underlying weakness.

Is there an Unseen Hand?

Some believe the rally is orchestrated by the government, and supported by various plunge-protection initiatives. I find that hard to fathom. It's a free market, and there are simply more buyers than sellers. It doesn't matter if there are only a few buyers … price will continue to go up as long as buying pressure is stronger than selling pressure.

Nonetheless, recent trading has stayed in a relatively narrow range. From my standpoint, this is probably a result of a fundamental disagreement between the Bulls and the Bears. Let's look at some of the major areas of contention.

Here are some of the reasons Bulls think the Market is still cheap enough for valuations to be attractive.

- The green-shoots of growth may be a sign that the economy is getting stronger.

- Corporations are starting to invest, and M&A activity is picking-up.

- Perhaps most important, though, is that government stimulus continues, while the Fed remains accommodative.

In contrast, Bears are warning that we may be at an important longer-term top. Here are things they are watching.

- Whether there is growth, other than from government stimulus?

- Whether spending starts to loosen-up and grow?

- Whether the credit crisis gets worse?

- Whether real-estate has another leg down?

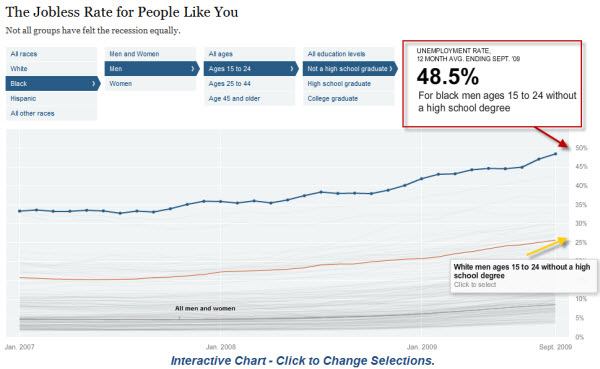

- Whether employment numbers start to improve?

Time will tell, and so will the charts.

The New Bailout.

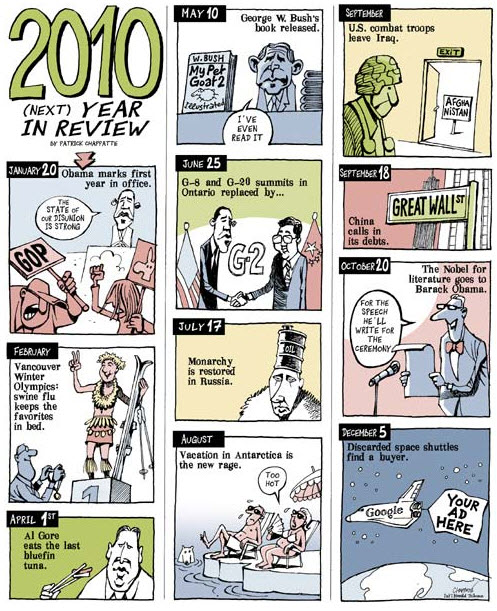

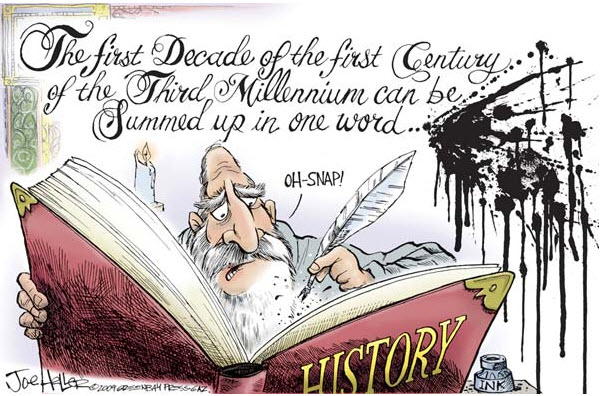

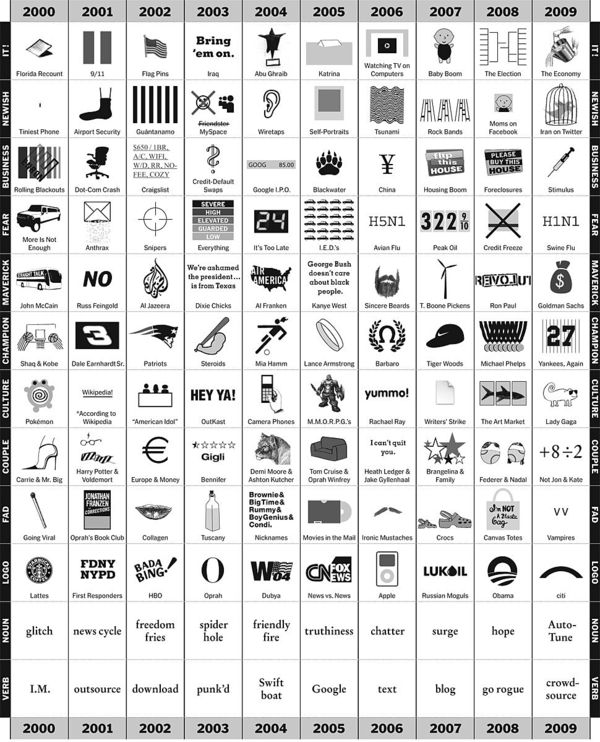

Finally, I thought this was funny.

Business Posts Moving the Markets that I Found Interesting This Week:

- Bubble Warning – Markets Too Dependent on Government Stimulus. (Economist)

- JP Morgan Analyst Optimistic about 2010. (Business Insider)

- Divergent Views on Signs of Life in the Economy (NYTimes)

- Tech's Winners & Losers for 2010 from John Dvorak (MarketWatch)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Sony Pins Future on a 3-D Coming to Your Living Room. (WSJ)

- A New High-Tech Battle – Which 3-D Glasses Are Best? (NYTimes)

- Data Pack Rats: Why Storage is Becoming a Bigger Issue. (Forbes)

- 24 Job Interview Questions You Don't Want To Be Asked. (Business Insider)

- More Posts with Lighter Ideas and Fun Links.