Business

-

How to Be a Life Coach – Ultra Spiritual Life comedy episode [video]

Have you watched the Netflix documentary, Tony Robbins: I Am Not Your Guru, yet? The reviews are very good.On the other end of the spectrum, this video 'teaches' you everything you need to know about becoming a life coach.The message: Getting rich teaching other people how to get rich has never been easier!Funny.via YouTube.Watch more Ultra Spiritual comedy episodes here. -

Here Are Some Links for Your Weekend Reading

I just got back from Asia; seemed like everyone wanted to know what the presidential candidates were saying.

Here are some of the posts that caught my eye. Hope you find something interesting.

- 8 Ways to Use the New Kauffman Index of Growth Entrepreneurship. (Kauffman)

- Facebook is Predicting the End of the Written Word. (Quartz)

- How Did Consciousness Evolve? (The Atlantic)

- This is the Only TED Talk You'll Ever Need to Watch. (Inc)

- ‘Hamilton’ Inc.: the Path to a Billion-Dollar Broadway Show. (New York Times)

- Prime Day Shows Amazon is So Powerful It Can Make up Its Own Holiday. (Wired)

- Commodities Having a Strong 2016. (Bespoke)

- Blockchain is to Banks TCP/IP is to Telcos. (Medium)

- How the Wealthiest Americans Got Rich May Surprise You. (MarketWatch)

- Apple is Making So Much Clean Energy, It Formed a New Company to Sell It. (TheVerge)

-

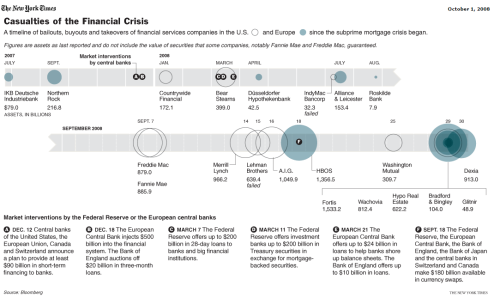

Is the 2008 Financial Crisis Still Effecting the US Economy?

Brexit had a pretty harsh effect on the short-term health of the UK … but it's yet to be seen how long that will last, and how they'll recover.

On the other hand, The 2008 Financial Crisis is still having an impact on the US Economy.

via New York Times

Since the 2008 financial crisis, private equity firms have gone from managing $1 trillion to managing $4.3 trillion of debt – private firms also have moved into ambulances, fire departments, urgent care, etc.

According to the New York Times, privatizing these services often makes them more accessible – but less responsive and more expensive … Do you agree?

-

Here Are Some Links For Your Weekend Reading

Saw this and laughed. The too true story of life as an entrepreneur.

via Gaping Void.

Here are some posts I saved this week.

- 17 Handy Tools for Entrepreneurs, Startups, and Marketers. (MarketingProfs)

- Brexit Will Not Affect 'Game of Thrones' Production. (Mashable)

- Frequent-flyer Programs are Too Complicated to Understand, the US Government Has Concluded. (Quartz)

- Why Bose’s New Wireless Headphones should Always Be in Your Hand Luggage. (TNW)

- Hillary: the New Mother Teresa? (DailyReckoning)

- Goldman Sachs’ Favorite Books List – General Books on Investing. (ValueWalk)

- Warren Would Give a Middle Finger to Wall Street as Clinton's Vice-president. (TheGuardian)

- Indonesia Considers Onshore Financial Center after Tax Amnesty. (Reuters)

- The Short- and Long-Term Economic and Market Impact of a Brexit. (InstitutionalInvestor)

- Getting Serious About Trumponomics. (Apple)

-

Are You Going to Joe Polish’s Genius Network Event?

There’s a quote surrounding success that you might be familiar with.

“If you’re the smartest person in the room … You’re in the wrong room.”

I think Jim Rohn says it better …

“You are the average of the five people you spend the most time with.”

For decades I have believed that you can predict a lot about your future, based on the quality of the people you spend the present with.

That is why I think participation in quality peer groups is critical.

Peer groups help us set higher standards for our behavior …

They help us aim higher in our aspirations …

And they help us stay better focused and committed to big-picture goals.

I belong to several executive and business leader peer groups—groups that double as advisory boards, counselor’s offices, and idea factories. They allow me to see, hear, and discuss things I don't normally think about, talk about, or even notice. Peer groups bring blind spots to my attention and keep me fully connected to trends that are transforming industry on a global scale.

One of the best groups I've joined is the Genius Network.

It brings together the brilliant minds of industry transformers in a forum focused on innovation, creative disruption, and possibilities. It’s a place for entrepreneurs to grow, connect, and collaborate to create bigger and better futures.

To give you an idea of the caliber of this particular peer group, members and guests include, Verne Harnish, Dan Sullivan, Peter Diamandis, Tony Robbins, Daymond John, Richard Branson, Steve Forbes, Arianna Huffington, and Tim Ferris.

This year's Genius Network Annual Event will be held in on October 3rd and 4th. I would highly recommend you consider attending.

Here’s a brief interview I did with Genius Network founder, Joe Polish, where he explains what to expect.

Hope to see you there!

-

The Aftermath of the UK Leaving the EU

Last week, the United Kingdom voted to leave the European Union.

Immediately, the British Pound tanked, and David Cameron resigned.

The drop was so bad that France overtook Britain as the 5th Largest economy.

Here is a chart from the morning after the vote.

via TradingEconomics.

In the aftermath, the S&P downgraded U.K. … It will be interesting to see the long-term effects.

Will the pound bounce back? Will the British economy recover?

What are your thoughts?

-

Here Are Some Links for Your Weekend Reading

I look forward to "Orange is the new Black" … But Trump getting elected isn't what I mean.

Here are some of the posts that caught my eye. Hope you find something interesting.

- Why Julian Assange Doesn’t Want Hillary Clinton to Be President. (Observer)

- Mark Zuckerberg: 'Entrepreneurship is about Creating Change, Not Just Creating Companies'. (Entrepreneur)

- Statistics is Dead – Long Live Data Science…. (DataScienceCentral)

- Elon Musk Tells You His Plan for Mars. (FoxBusiness)

- How ISIS Became the World’s Deadliest Tech Start-Up. (VanityFair)

- Google Searches Suggest Many in UK Don't Understand Brexit. (Gizmodo)

- This Fascinating Map Shows How OPEC's Oil Flows around the World. (BizInsider)

- How Much More Does the Top 1% Make, by US County. (ValueWalk)

- Ag Traders Time to Shine? (Managed Futures)

- Why Uber Keeps Raising Billions. (New York Times)

-

Finding Dory

On Father's Day, my son took me to Finding Dory.

Let's not dissect the story … I appreciated spending time with my son (but also the art and the technology used to make it).

The current state of animation is mind-blowing (not just 3D … the textures, shading, and sense of natural movement.

The rendering math is cool. Yes, I know that makes me a nerd.

But, they are using GPU servers to do massive computation (just like a Quant Fund).

Watch the video, below, to see how they did it.

CNet via YouTube.

-

Here Are Some Links for Your Weekend Reading

While conspiracy theorists argue whether the NBA rigged the finals to get to get to game 7, I find this more disturbing … it's a photo combining Hillary and Trump into a Clump.

Here are some of the posts that caught my eye. Hope you find something interesting.

- 12 Neglected Questions Successful Leaders Keep Asking. (LeadershipFreak)

- The 5 Books Bill Gates Wants You to Read this Summer. (Inc)

- Netflix Launches Fast.com, a Dead Simple Way to Test Your Internet Speed. (Mashable)

- Your Life in Weeks. (WaitButWhy)

- The 8 Most Elite Special Forces in the World. (BusinessInsider)

- Buffett Becomes Apple’s 56th Largest Shareholder with $1 Billion Investment. (BuzzFeed)

- Apple's Latest Billion-dollar Business: Venture Capital? (Mashable)

- 22 U.S. Companies that Just Keep Getting More Profitable. (MarketWatch)

- What Current Trends Tell Us about the Future of the Hedge Fund Industry. (QuantNews)

- JPMorgan Has New Theory about What Really Caused the Flash Rally. (Bloomberg)

-

The Future of FinTech

FinTech is hot … and FinTech startups are disrupting the value chain, and the industry itself, by grabbing market share, increasing customer churn, and putting pressure on margins.

I recently was at the Future of Finance conference, where I talked with the CEO of CB Insights about the changing landscape of trading and asset management.

via YouTube.

At the conference, one of the sessions was about how banks are "suffering death by a thousand cuts" and being relegated to utilities as they fail to adapt to new tech trends. Here is a graphic showing the competitive pressures FinTechs are putting on banks.

via CBInsights.

via CBInsights.Likewise, according to a report by PwC released last week, 9-out-of-10 insurers fear losing meaningful business to stand-alone FinTechs.

The game is changing, and so is what you have to do in order to win.