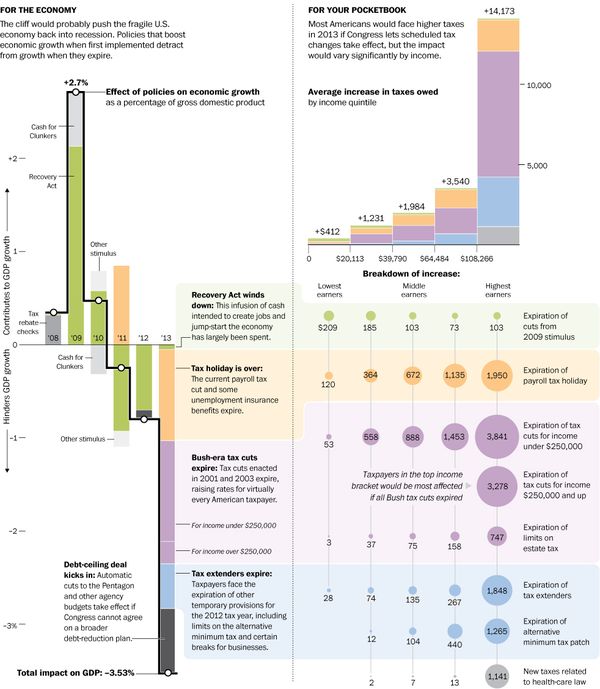

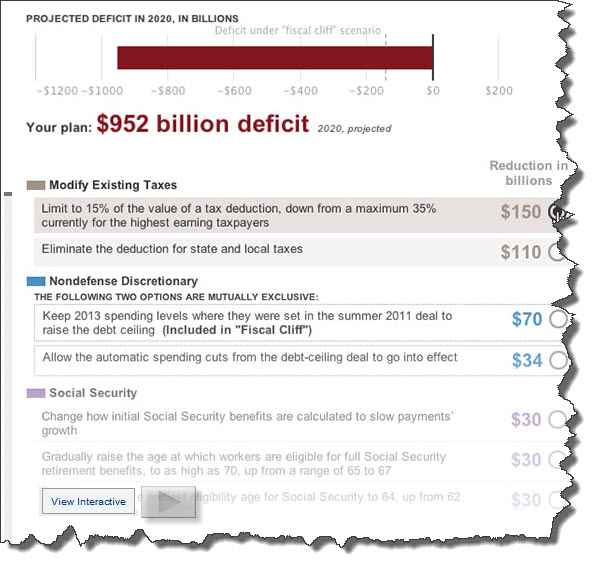

So proud of our 'solution' to the debt ceiling issue …

Here are some of the posts that caught my eye. Hope you find something interesting.

- What

a Big-Data Business Model Looks Like. (Harvard Business Review) - Everything

You’ll Ever Need To Know About Gamification. (TechCrunch) - Google

Gives $5M To Build Drones That Hunt Poachers – Forbes. (Forbes) - The

10 Greatest National Anthem Performances in Super Bowl history. (The Week) - Compare Cities Instantly

With VERSUS IO. Actually, this tool compares many things (Mashable)

- Online

Banking Attacks Were Work of Iran, U.S. Officials Say. (NYTimes) - PIMCO's

El-Erian. Game Theory Predicts More Can-Kicking in Washington (AdvisorOne) - Kleiner

Partners' View of the Future of Tech. (Wall Street Journal) - Own

the Robots, Bro, Trust Me. (ReformedBroker) - Is

Quantitative Easing Still Necessary? Direct Benefit versus Gain from the

Signal Sent. (Forbes)