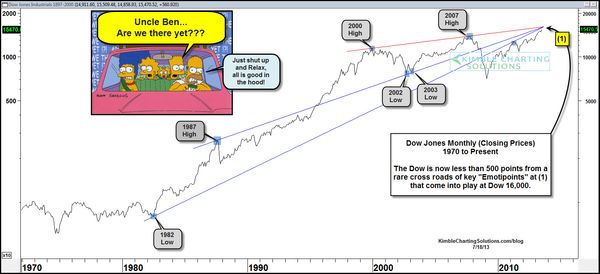

Some people are reacting like Bernanke said "On the count of three … run."

Here are some of the posts that caught my eye. Hope you find something interesting.

- Audible

Inspiration: Work Smarter by Listening to These 7 Great TED Talks.

(Mindjet) - The

World’s Top 100 Most Innovative Organizations. (Thomson Reuters) - What

Could the NSA Do With a Quantum Computer? (NewStatesman) - Mmm

Mmm Good? First taste of test-tube burger declared 'close to meat'.

(Reuters) - The

Vitamin Myth: Why We Think We Need Supplements. (The Atlantic)

- Could

Geithner End Up the Next Fed Chairman? (Bloomberg) - Wall

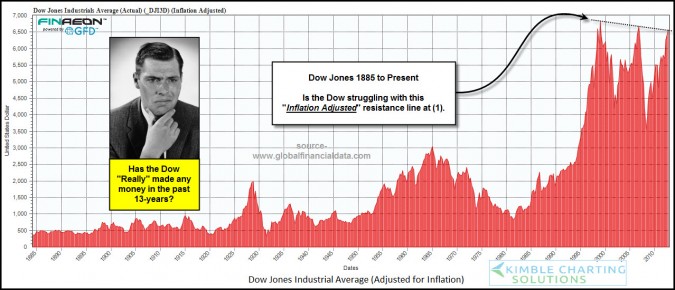

Street Pros Believe a Fall Taper is Already Priced Into Markets. (CNBC) - 80

Percent of U.S. Adults Face Near-Poverty, Unemployment: Survey. (HuffingtonPost) - The

Undisputed Champion? Guess who won the post-crisis recovery? Banks.

(ReformedBroker) - Goldman

Sachs: Creative Destruction. The 8 Extraordinary Technologies Forcing

Businesses To Adapt Or Die (BusinessInsider)