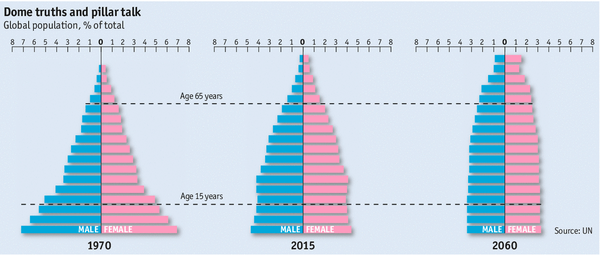

The shape of the world's demography is changing.

The traditional way of visualizing and explaining the age structure of a society has been a pyramid.

If you draw a chart with each age group represented by a bar, and each bar ranged one above the other—youngest at the bottom, oldest at the top—a pyramid is the shape you would get.

This was true because, with shorter lifespans and higher mortality rates, there were always more young people than old people.

Now the shape of the global population is changing.

Between 1970 and 2015 the dominating influence on the global population was the fertility rate (the number of children a woman would typically bear during her lifetime). It fell dramatically over the period, meaning that the world shifted from having larger to smaller families.

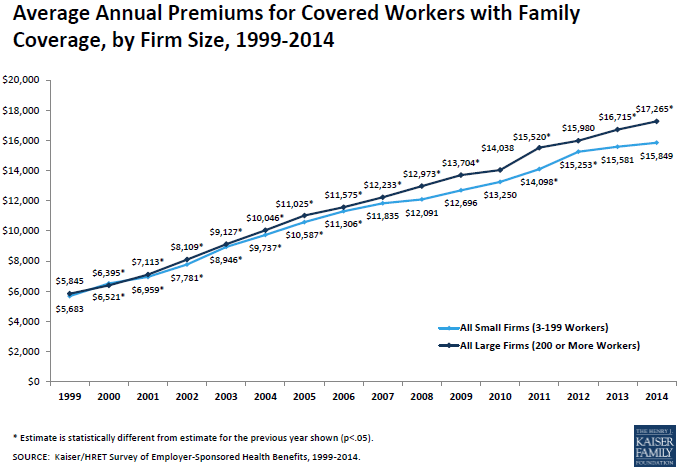

Between 2015 and 2060 the biggest influence upon the population will be aging. Fertility rates are slowing, and now almost everyone is living longer than their parents—dramatically so in developing countries.

The result will be a larger, and growing, older population. This will drive massive infrastructure projects and business opportunities.

via The Economist.

Read the full article from The World In 2015.