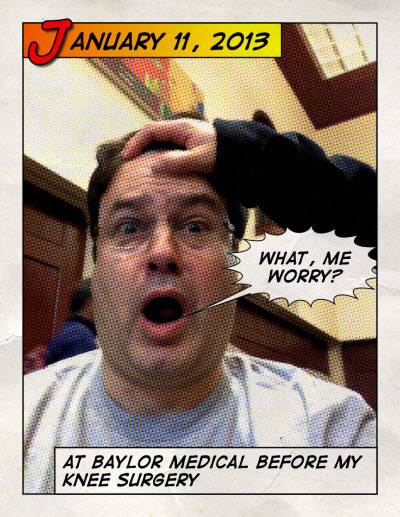

It brought back memories of my knee surgery from 12 years ago… and reminded me of what technology makes possible.

Before my knee surgery, I wasn’t enjoying the prospect of the needles, the knock-out drugs, the cutting, or the recovery process. Frankly, I was scared.

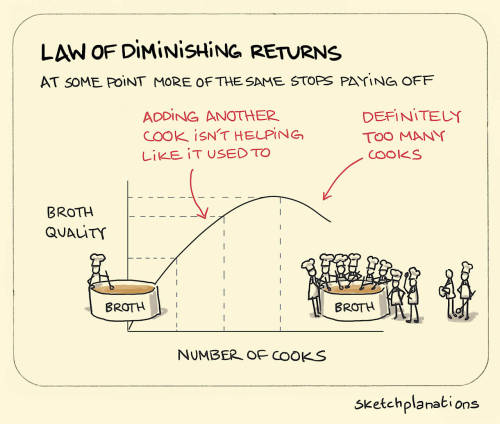

History is littered with tales of once-rare resources that have become plentiful through innovation. The reason is pretty straightforward: scarcity is often context-dependent.

Imagine a giant orange tree packed with fruit. If you pluck all the oranges from the lower branches, you are effectively out of accessible fruit. From that limited perspective, oranges are now scarce. But once someone invents a piece of technology called a ladder, the problem is solved.

Here is a picture from inside my knee (unlike years ago, they didn’t have to slice me open to gain access for the picture or the repair): less damage, less time, less drugs, less recovery.

Bottom-Line: I walked over 2,500 steps the day after the surgery.

Think how far diagnostics and surgery have come since then?

Whether it is 3D imaging, minimally invasive surgical instruments, or linking big data and elastic computing, technology is a resource-liberating mechanism. It can make the ‘once scarce’ the ‘now abundant’ (or ‘readily accessible’) … and a lot less painful.

From ‘Doctor Klingon’ to Clarity — and What That Means for You

But where are we today – and how was surgery different?

It sounds like a joke, but the future of medicine is in your pocket.

One of the biggest differences for me was having AI available to help me feel informed throughout the process. From the beginning, where I wanted to understand the issue and potential solutions, to having AI available on my phone in the recovery room. For example, while waiting for the doctor to tell me “how things went,” I downloaded the surgical notes from the hospital portal, only to find that they were written in “doctor speak” Klingon. So I opened Perplexity in incognito mode and asked it to interpret the notes, and explain everything to me as if I had minimal medical knowledge but still wanted to understand what happened and what I should expect. The result was incredibly comforting, and I was able to use that to send updates to family and friends.

Meanwhile, try to imagine the extensive technology used by doctors and medical staff throughout the process to test, analyze, interpret, monitor, and treat.

Soon, we’ll be able to utilize real-time data for diagnostics and design treatment plans and preventive care tailored to an individual’s unique biology and lifestyle. As a result, personalized, predictive healthcare will become the norm. Likewise, the idea of tailoring treatment to your unique biology will be expected, not exceptional.

It’s also easier than ever to imagine the shift from reactive to preventive medicine. Surgery will become less frequent as AI and wearables catch problems before they require intervention. Likewise,. That means better care and better outcomes – at scale!

And it is all getting better faster than before.

Pretty cool!

via

via  via

via

via

via