As we discuss the economy, I also think about my youngest son, who is looking at houses right now.

In countless ways, today's youth have it easier than we did. Access to opportunities, the internet, capital sources, etc., has gotten more accessible, yet there are a few things that have gone the other way, such as buying a house.

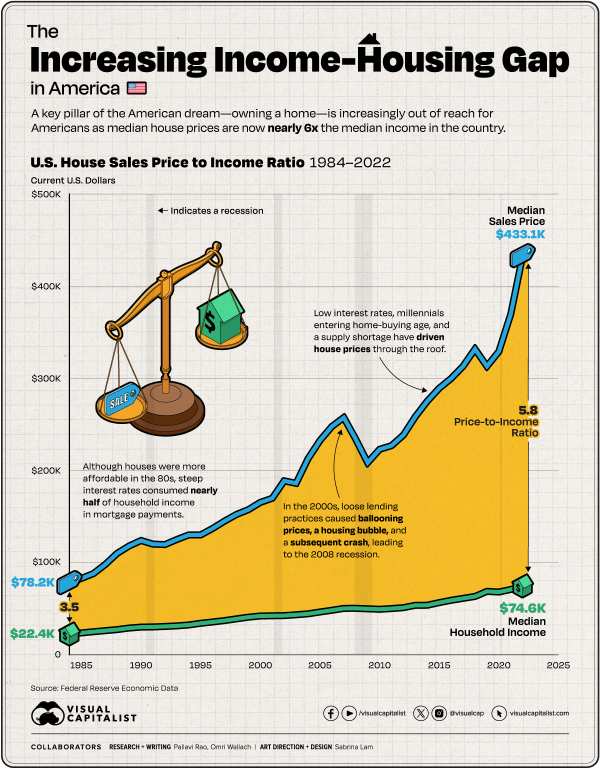

via visualcapitalist

The chart above does not show interest rates or inflation. For example, in 1984, the 30-year fixed rate was close to 14%, over double what it is now.

But, to put things in perspective … I moved to Texas in 1986. Part of my rationale was that I could buy a "nice" home for a little less than my initial starting salary as a lawyer.

Recently, policy decisions have vastly increased house prices. How much? Median house prices are nearly 6x the median household income in America. Meanwhile, the economics of renting are significantly better than buying. According to the WSJ, it's 52% more expensive to buy than rent due to mortgage prices.

When housing costs are this high, consumer spending and mobility are reduced, making individuals less likely to relocate for job opportunities.

We live in interesting times. Sometimes, I miss the good old days.

Leave a Reply