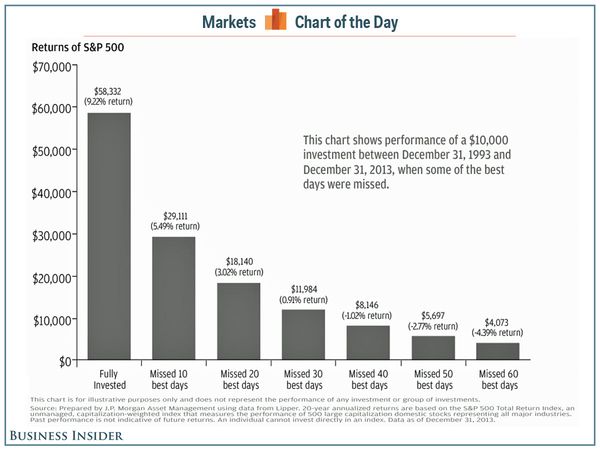

via BusinessInsider.

In this trading methodology, missing 'big win' days does so much damage because those missed gains aren't able to compound during the rest of the investment holding period.

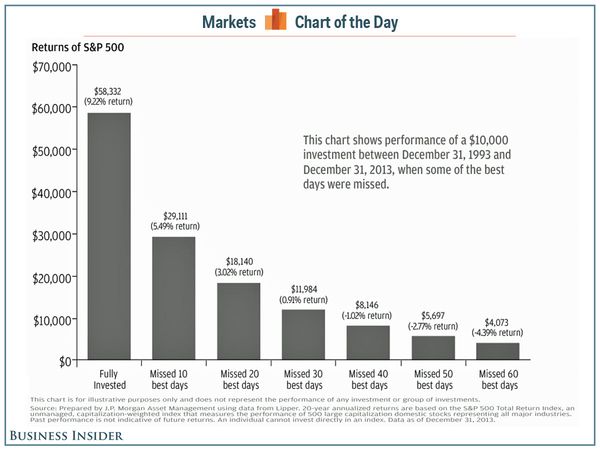

via BusinessInsider.

In this trading methodology, missing 'big win' days does so much damage because those missed gains aren't able to compound during the rest of the investment holding period.

Here are some of the posts that caught my eye. Hope you find something interesting.

Image by Simon Miller via Flickr

Image by Simon Miller via Flickr

The Economist's Big Mac index seeks to make exchange-rate theory more digestible. They say, tongue-in-cheek, that it is arguably the world's most accurate financial indicator to be based on a fast-food item.

The Big Mac index is based on the theory of purchasing-power parity (PPP), according to which exchange rates should adjust to equalize the price of a basket of goods and services around the world. For them, the basket is a burger … a McDonald’s Big Mac.

According to this measure, the most undervalued currency is India's Rupee at about 67% below its PPP rate. In India, a McDonald’s Big Mac costs just 95 Rupees on average, the equivalent of $1.54 at market exchange rates. In America, the same burger averages $4.62.

The interactive graphic, below, shows by how much, in Big Mac PPP terms, selected currencies were over- or undervalued.

The index is supposed to give a guide to the direction in which currencies should, in theory, head in the long run. It is only a rough guide, because its price reflects non-tradable elements such as rent and labor. For that reason, it is probably least rough when comparing countries at roughly the same stage of development. The Economist has added an adjustment option to account for this in the interactive version of the data.

Tech can be sexy … but this headline surprised me. "Tokyo Robots Drawing Crowds at Cabaret." Would you pay to watch "female" robots at a club?

No, not those kind of robots … there is a video.

Here are some of the posts that caught my eye. Hope you find something interesting.

It might seem difficult to define what makes a smart company, but you probably know one when you see it.

When such a company commercializes a truly innovative technology, things happen … leadership in a market is bolstered or thrown-up for grabs. Competitors have to refine or rethink their strategies.

Here is a list compiled by the editors of MIT Technology Review.

They didn’t count patents or PhDs; instead, they asked whether a company had made strides in the past year that will define its field.

“Vision is not enough; it must be combined with venture. It is not enough to stare up the steps; we must step up the stairs.” ~ Vaclav Havel

This list highlights companies where important innovations are happening right now, regardless of reputation. Perhaps that is why familiar names (such as Apple and Facebook) aren’t on this list.

It is kind of fun to read through what is being created now.

There are more millionaires in the United States than ever before.

via Spectrem Group.

The number of households with net worth of $1 million or more, excluding their homes, is at a record 9.63 million, according to a new report.

That eclipses the old mark of 9.2 million in 2007 before the global financial crisis, according to Spectrem Group research. The tally of millionaires slipped to 6.7 million in 2008 as the financial crisis struck.

This study reinforces other data showing that the wealthy in the U.S. are doing well.

First they will laugh … Then they will copy.

Don't give up.

"Many of life's failures are people who did not realize how close they were to success when they gave up." ~ Thomas A. Edison

Here are some of the posts that caught my eye. Hope you find something interesting.

Here is jigsaw graphic that shows the size of Africa relative to other countries.

via Kai Krause.

This video from the second season of "West Wing" presents other misleading map distortions.

Interesting stuff … Click here for more.

We just passed the five-year anniversary of economic stimulus.

Here are some of the posts that caught my eye. Hope you find something interesting.

Were you surprised how quickly Markets digested the risk of Russia and the Ukraine?

It’s not the news … it’s what markets do after the news hits. In Bear Markets, markets are looking for excuses to pull-back and take risk off the table. In Bull Markets, things can advance, even with uncertainty.

The New York Stock Exchange publishes end-of-month data for margin debt. Historically, surging peaks of margin debt often happen before big market pull-backs.

The chart, below, shows the relationship between margin debt and the market (using the S&P 500 as the proxy for the market). Even adjusted for inflation, the latest data puts margin debt as at an all-time high.

via Doug Short.

Victor Sperandeo advised speculators to ride the false train of hope as far as possible and jump off just before it falls into the abyss.

Good luck.