As Markets continue higher, more people wonder how that reflects the real economy?

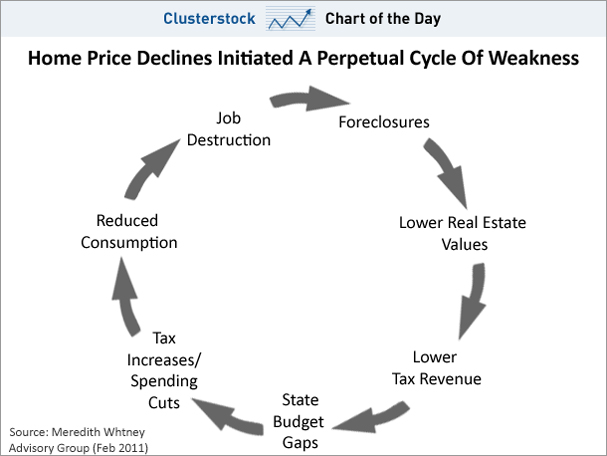

Meredith Whitney’s Perpetual Cycle of Weakness.

Why is Meredith Whitney so bearish on things? Business Insider has some insights on the subject. Perhaps it is because she sees the economy as a perpetual cycle of weakness.

Basically, as she sees it, job destruction leads to increased foreclosures, which in turn leads to lower real estate values, which then leads to lower tax revenues, which causes state budget gaps, etc.

For more, see “The Meredith Whitney Muni Bond Report That Insiders Have Been Passing Around“.

So, What’s Keeping the Market Moving Higher?

In short, the answer is that the Fed is printing money.

Officially the Federal Reserve System has a dual mandate, promote price stability and maximum employment. Now it has admitted to a third one, pushing stock prices higher via its quantitative easing policy.

During a recent CNBC interview, Steve Liesman asked Bernanke how he could claim QE2 was a success even though both interest rates and commodity prices have risen considerably since he first announced it. Bernanke’s response:

“Policies have contributed to a stronger stock market just as they did in March 2009, when we did the last iteration of this. The S&P 500 is up 20% plus and the Russell 2000, which is about small cap stocks, is up 30% plus.”

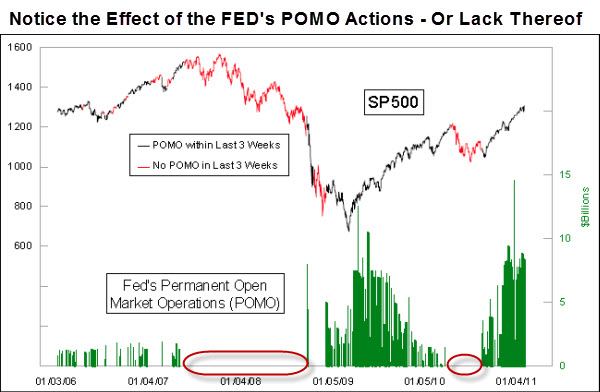

Permanent Open Market Operations.

According to the NY FED, Permanent Open Market Operations, or “POMO”, are purchases or sales of securities on an outright basis that add or drain reserves and change the size of the System Open Market Account (“SOMA”). As you know, on November 3, 2010, the FOMC decided to expand the Federal Reserve’s holdings of securities in the SOMA to promote a stronger pace of economic recovery.

The chart below, from the McClellan Report, shows how well that technique has worked.

The Fed’s POMO actions are keeping the financial markets flush with cash, and the Markets are responding. However, Bernanke says he’ll quit QE2 in June. What happens then?

In the meantime, be vigilant and enjoy the ride.

Business Posts Moving the Markets that I Found Interesting This Week:

- Smoke and Mirrors, or a Solid Market? Is the Economy About to Stall? (NYTimes)

- Deal-Making Returned in 2010. (McKinseyQuarterly)

- Chinese Banks Follow Their Customers to Europe (FT)

- Krugman Says the Road to Economic Crisis Is Paved With Euros. (NYTimes)

- Illinois Passes a Huge 66% Tax Hike. (BusinessInsider)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Visualization: Run Your Business the Way Aaron Rodgers Runs His Offense. (TES)

- Interesting Article: The A.I. Revolution Is On. (Wired)

- The Head of Content for Amazon’s Kindle business Talks about the Future. (LATimes)

- Why Old Dogs Are the Best Dogs. (TheWeek)

- Gallup Poll: Top 5 Men and Women Admired By Americans. (CSMonitor)

- More Posts with Lighter Ideas and Fun Links.

Leave a Reply