Yogi Berra once said, “It's tough to make predictions, especially about the future.”

I don’t normally post articles where I predict things. Nonetheless, I feel the need to comment on what is happening in America and what I suspect happens next.

My political beliefs are not really important here. But for context, I am somewhat fiscally conservative and somewhat socially liberal. It puts me pretty squarely in the middle.

As an entrepreneur and citizen, I feel compelled to find the "signal-in-the-noise" to understand and anticipate the game that’s being played, what the playing field looks like, and the best way forward.

For all the front stage calls for "unity & healing", behind the curtain, the actions of both sides aren't supporting the words they're saying.

When the Democrats first announced the second impeachment, I assumed it was designed to steal news cycles (a nice trick that Trump taught them) and time cycles to minimize potential damage till the inauguration. Meaning that any time they forced the Trump administration to spend discussing what was happening or defending themselves was time taken away from political gamesmanship and last-minute actions that the new administration would have to deal with later.

Meanwhile, perhaps the reason Mitch McConnell has been sending mixed signals about protecting Trump is to avoid angering a meaningful portion of his base – while preparing to create the space to launch his new post-Trump Republican leadership slate (and a powerful Trump hurts those plans).

Ultimately, however, I do not believe that either party really wants to pursue impeachment fully at this point. Consequently, I suspect that the Biden administration will slow down the impeachment (and morph it into other strategies and tactics). I can’t imagine that the new administration will want to give Donald Trump even more of a public forum to broadcast his messages to the whole world (considering what's happening with Big Tech removing his platform). It makes more sense to move on and shift focus.

Strategically, it seems more likely that they’ll go for a censure. With that, I suspect that they will attempt to strip post-presidency benefits and courtesies (including financial, access, and information). Further, it wouldn’t surprise me if they find a way to prohibit him from having any public lands or things (like airports) named after him. This would accomplish three things. First, Democrats would consider it a win and a signal to the world. Second, it would hit Trump where it hurts (in his ego and legacy). Third, it would also support the new Republican leadership's goals by minimizing the chance that Trump could limit McConnell's power or fracture the party further.

Consequently, the real attempts to prevent Trump (or his family) from running for president will be accomplished via felony charges out of places like New York, Georgia, or DC. Even though the motivations may be political, I don’t think it will be a political process. Kind of like what they did to Al Capone. That means that I expect both parties to help various prosecutors keep Trump busy, weaken him, and limit his future impact.

As for the markets, to some extent, what goes up must come down. The pendulum swung pretty far and was propped there for longer than most thought possible. Clearly, we are due for a correction.

Global economic weakness (and falling GDPs), along with the pandemic (and challenges with a vaccine rollout), will all contribute to short term volatility.

However, I think the Democrats will be far less committed than Trump was to propping markets up in the short term. They would prefer any reversion to the mean to happen quickly – so they can blame it on the prior administration.

With that said, the midterm elections are coming up quickly (and control of the Senate likely to be an even hotter topic). Consequently, I expect the Democrats to push hard to help the markets recover coming into the end of their first year.

Of course, all of these thoughts are speculation and may not come true.

I’d love to hear your thoughts.

We certainly live in interesting times.

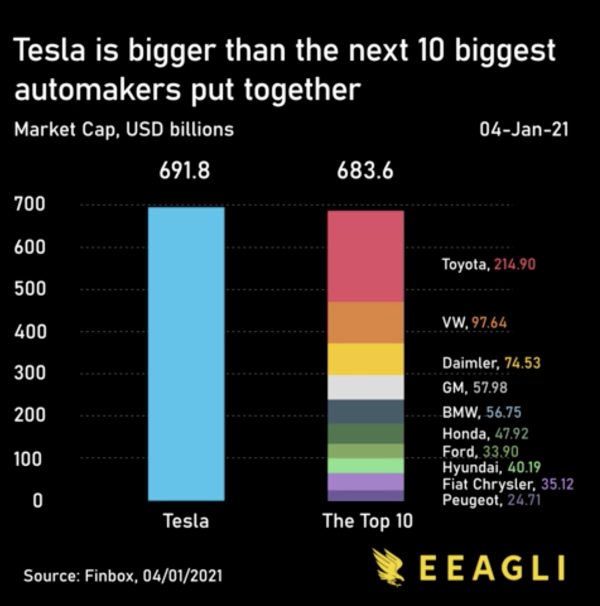

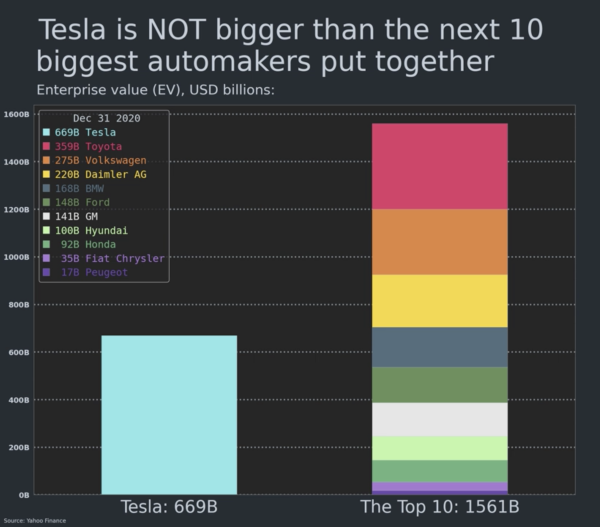

That valuation comes after Tesla's market value passed $700 Billion for the first time. His company is worth more than Toyota, Volkswagen, Hyundai, GM, and Ford combined (despite not having nearly the distribution) based on Market Capitalization.

That valuation comes after Tesla's market value passed $700 Billion for the first time. His company is worth more than Toyota, Volkswagen, Hyundai, GM, and Ford combined (despite not having nearly the distribution) based on Market Capitalization. via

via  via

via

via

via