This was a big week for questions (and not so much for answers). The Market is good at that.

For example, did we just witness another successful retest of recent market lows, or are we just at the bottom again?

Are you surprised that GM's share price is at lows not seen since 1943? If not, were you surprised they wanted in on the Bail-out too? How surprised were you that the Bail-out isn't proceeding as planned? Do you wonder whether Depression Economics is returning?

Many people believe that the finance sector is an early indicator for the market in general. This was a tough week for finance sector stocks. Yet, many stocks in that sector made spike bottoms. This is something I am watching.

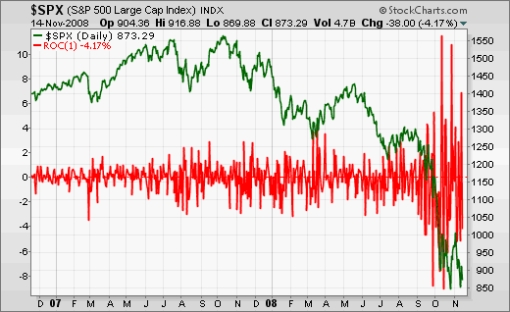

Still, volatility remains high, and I take that as a sign of bear markets. In the chart below, which shows the S&P 500 Index, the green line represents the index itself; and the red line shows the daily percent change in that Index, illustrating how volatility has increased recently.

(via Investment Postcards)

The Cloud Hanging Over the Markets:

People look for scapegoats During market troughs. One of the first places they are looking now is the hedge fund industry. What follows is a Wordle "word cloud" created from the text of the Congressional hearings held last week.

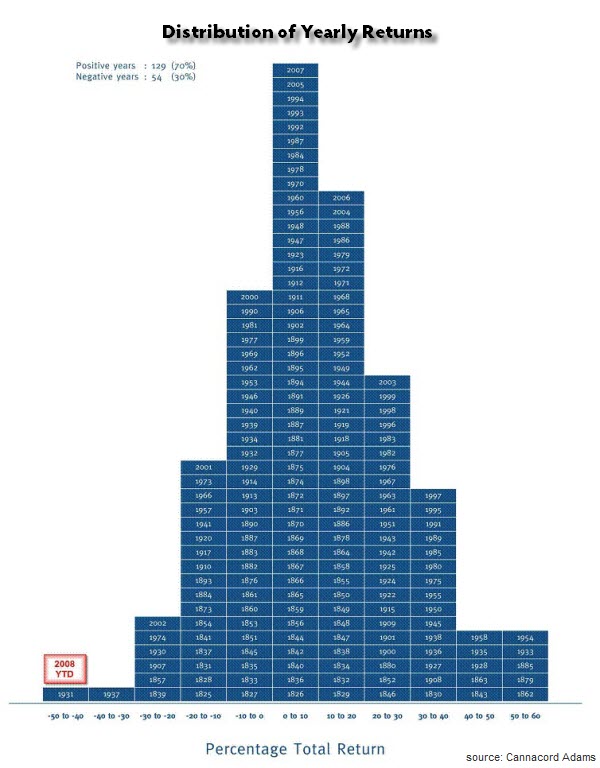

Ultimately, the markets are having a tough time world-wide. If you are standing in the rain, you are going to get wet. Well, it rained a lot this year. Take a look at this chart that shows the distribution of yearly returns in the US. Hint: look at the bottom left of the graphic to find this year.

(hat-tip to Howard Lindzon)

With markets performing so poorly here, and world-wide, It is not surprising that the demand for gold is rising in China or Saudi Arabia.