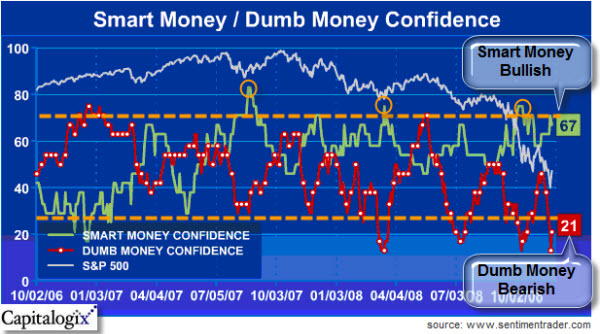

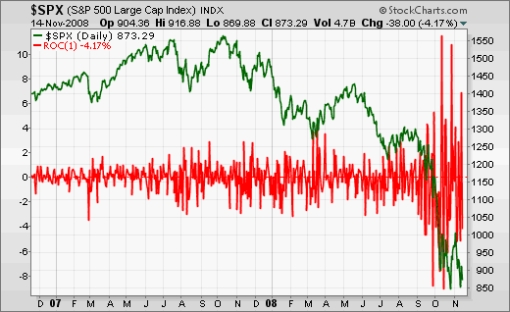

There was good and bad news in the market this week. The bad news was that the economy continued to suffer (for example, the worst job loss numbers in decades), and the good news was that the market went up anyway. In contrast to recent reactions, that's very good news.

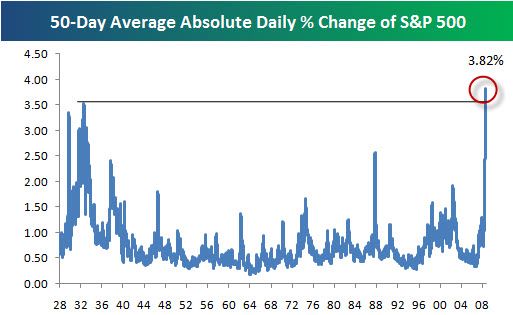

Something about the tempo of the market may have changed this week too. There were still a few big fast moves, however there were also longer periods of more natural trading.

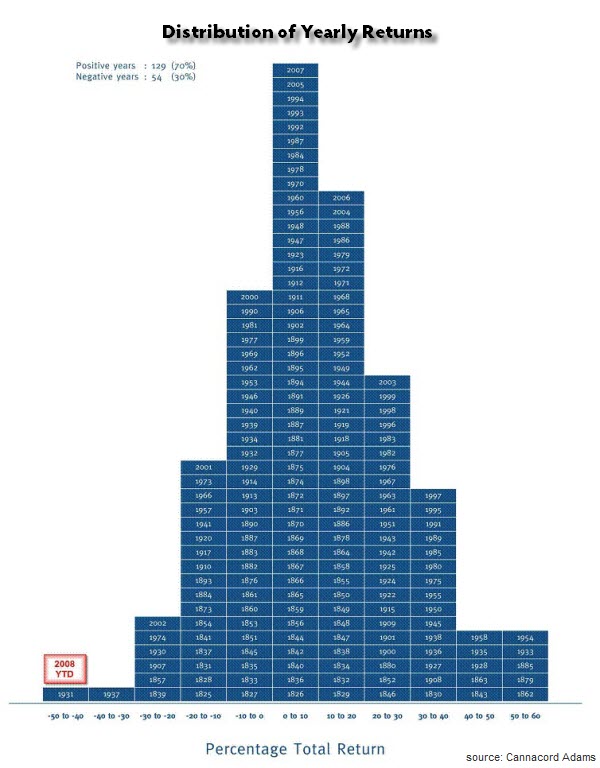

I'm not saying that the bear market is over. It will probably take a lot more than this to have a meaningful long-term bottom. Nonetheless, we may have a nice intermediate term support area in place, and the possibility for a decent rally from here.

The Migration to Automated Trading:

For many years I was a discretionary trader. That means I decided what

to buy and what to sell using the tools I thought gave me the best edge

for that trade. Over time I relied more on technical analysis. And,

now, my trading is done by automated systems.

The use of so many

different algorithms provides an interesting perspective on the rhythm

of market.

For years, market charts reflected the collective fear and greed of market participants. Likewise, the patterns from one generation are not much different than the patterns from a different generation of traders; not because the world hadn't changed, but because human nature hadn't changed.

People still traded with people. When prices got too high, a certain percentage of people decided to sell. When prices started to go down, some people got fearful – and as prices continued to go down, other people got greedy and decide to buy. In other words, human nature is human nature; and while the magnitude of the moves may change a little, the basic pattern, the shapes and the slopes probably have remained relatively consistent for millennia.

The Markets Are Changing:

Now, however, something different is beginning to happen. A greater percentage of the daily trading volume results from computer trading and automated models. Consequently, more trades are happening outside the influence of fear and greed. This means that the shapes and the basic nature of trading patterns are bound to change.

It is early in this cycle. Think about the Internet in the early 1990s. Looking back, it all makes sense. Yet in 1995, did you imagine this (how radically research, media, information delivery, media, and commerce would change)? The game is changing. Investing will never be the same again.