How much is a Trillion? If you were paid a dollar per second, it would take you 31,709 years to earn a Trillion dollars.

If you are more graphic,

this link will show you how much it is in more detail.

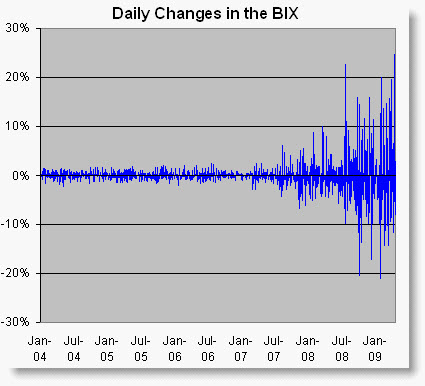

To put things in perspective, now think about Bailout … or that the IMF released its Global Financial Stability Report this week; and it's projecting total losses from the global financial crisis to reach $4.1 Trillion.

This Week's Market Charts.

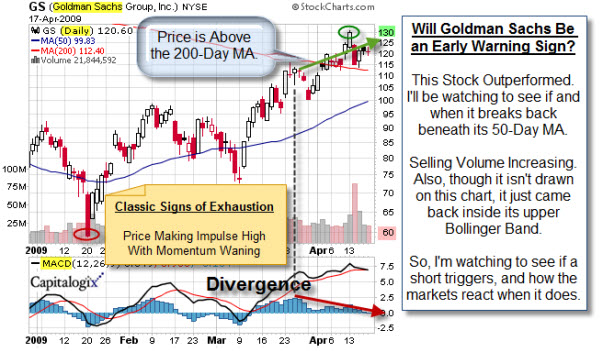

The Markets held up nicely after a sell-off early last week. Technology is still leading and the Dow has been lagging a little. Other things nagging at me about the rally is that momentum is fading and volume hasn't been great. Here is a chart showing how the Dow is positioned at key support and resistance levels.

Trader's Narrative had a chart that caught my eye. It shows that the short term moving average of the CBOE (equity only) Put-Call ratio is still quite low, corresponding to market tops. Adjusting for the upward sloping range of the data we find it at a similar level to October 2007.

Business Posts Moving the Markets that I Found Interesting This Week:

- Microsoft Disappoints A day after Apple Didn't. (BW)

- Amazon Net Jumps 24%, Resisting Recession (WSJ)

- Hope, Greed and Fear: The Psychology Behind the Financial Crisis (Wharton)

- An interactive map of vanishing employment across the country.(Slate)

- Second Market: A New Form of Public Offering Is Emerging (A VC)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- Are You Being Tracked Via Your Cell Phone? (MediaPost)

- Apple Reaches 1 Billion iPhone Apps Downloaded. (TechChuck)

- Who Is Defending Cyberspace, And Are They Doing A Good Job? (USNews)

- How To Spot Technology Trends With Job Postings. (SmallBizTrends)

- Children Surprisingly Willing To Treat Robot Dogs As 'Dog-Like'. (BPS Research)

- More Posts with Lighter Ideas and Fun Links.