Visual Thinking, Idea Mapping or Mind-Mapping … whatever you call it, there are some terrific new tools available to help you think, plan and write better.

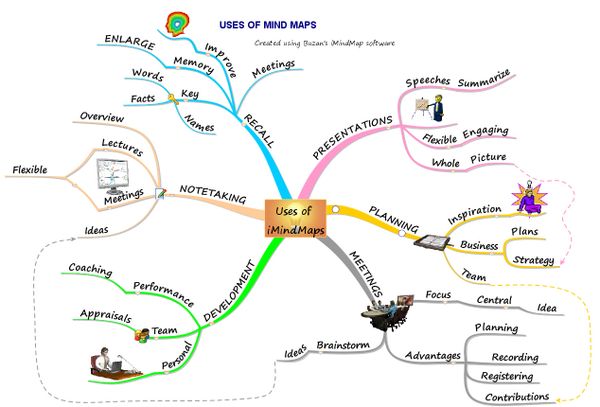

I find I'm using it more often and for more things, like: note-taking, process maps, brainstorming and presentations.

How Does It Work?

Mind-Mapping is related to outlining. So you already know how to do it. It is intuitive, and makes it

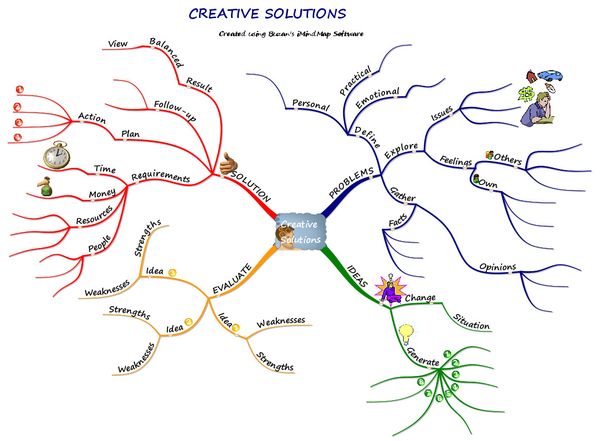

easy to see thought structure and relationships. It also makes it easy to review and re-organize the framework that organizes your data. Here is an example showing what you can do with a tool like this.

How Can You Use Mind-Mapping Software?

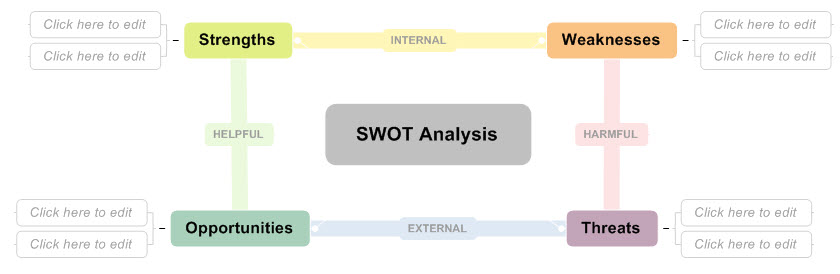

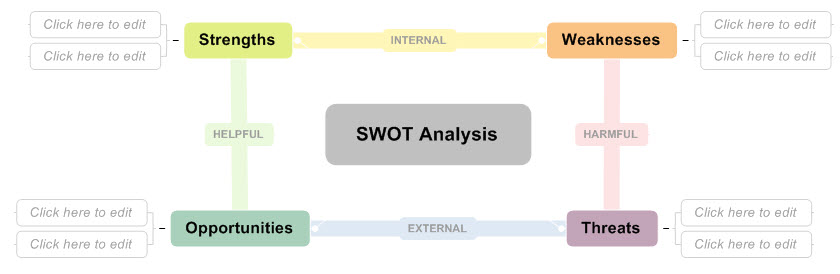

I use this type of software like a virtual whiteboard. It helps me organize a meeting or present a thought process. What used to be a form on a piece of paper, now becomes the dynamic center of collective focus. For example, here is a map template from Mindjet's MindManager; it is used to evaluate an

idea using SWOT analysis (which stands for: strength, weakness,

opportunity, and threat).

The structure of the outline and actually

helps control focus and trigger new ideas. And the software allow me to add detail and new items in any order. The result is better understanding and often, new ideas and possibilities.

Brainstorming.

The computer age has made it a lot easier for me to collect data. Then what? Data is a raw material, but I often want to think better …

rather than to just have more data. So, I use visual thinking tools to help me

make sense of lots of ideas. It often helps me see relationships and

move items around to places where they fit better, or trigger new

thoughts.

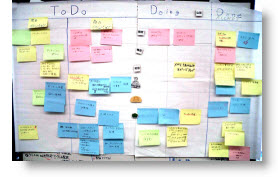

For brainstorming, the software is a lot like writing ideas on Post-It Notes and moving them around on a whiteboard. I like being able to enter information the order

For brainstorming, the software is a lot like writing ideas on Post-It Notes and moving them around on a whiteboard. I like being able to enter information the order

that occurs to me, rather than having to understand the bigger picture.

In fact, it's by placing all the seemingly random bits of information

page and dragging them around into piles, that the bigger picture often

reveals itself to me.

To do that, I try to figure what relates the piles, and I create a label for that category. I then try to figure out how categories fit together, and ultimately come up with a better understanding of the thought framework. From there, it doesn't take much work to fill out weaker areas of the outline, adding an idea here, moving an idea from there.

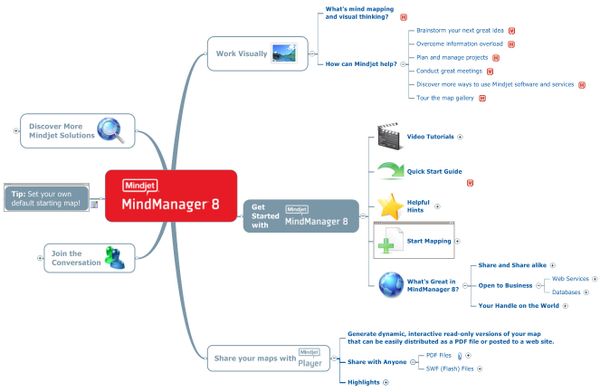

The Software Tools.

Even if you tried a tool like this before, it is time for a fresh look. These tools have evolved and are worth having and using.

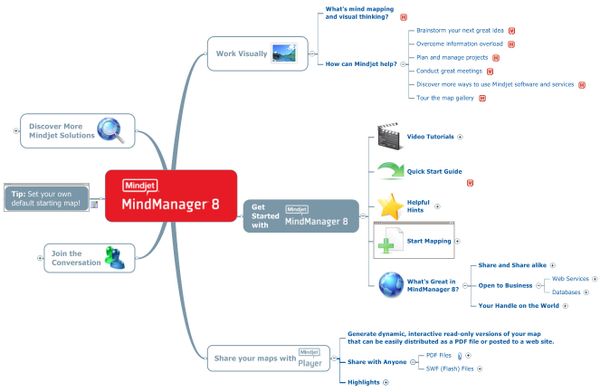

Mindjet's MindManager is the tool I use most often. The current version is stable and mature, with a nice feature set and the ability to export information into a variety of programs and formats. I especially like the new option to export a live branching version of the mind map in PDF format.

Mindjet offers a template gallery for you to download 70+ sample maps to use.

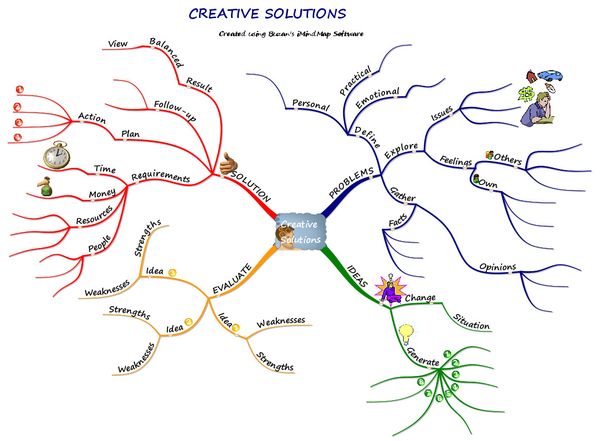

Another tool I've been using more of lately is Tony Buzan's iMindMap. Buzan is a well-known proponent of mind mapping and has created a visually appealing tool.

It's compelling, and I'm trying to use it more. They also have a nice collection of videos explaining the software and concepts behind mind-mapping that is worth exploring.

Personally, though, for real work I find myself going back to Mindjet product.

In addition, there's an open-source version called FreeMind. Here's the link to try that tool as well.

I highly recommend seeing the new Disney – Pixar movie, UP, in 3-D. It was terrific … much better than I hoped or expected.

I highly recommend seeing the new Disney – Pixar movie, UP, in 3-D. It was terrific … much better than I hoped or expected.