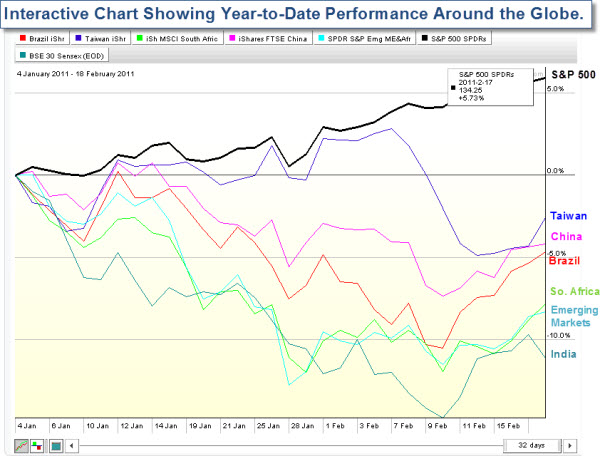

The rally continues, and the S&P 500 is up about 5% so far this year. Pretty impressive on many fronts.

How does it compare to other markets around the world? Well, France's CAC and Germany's DAX are up a little more, and London's FTSE a little less … Yet, this chart shows how several of last year's hot world markets have done so far in 2011.

Clearly, the European and U.S. Markets have done better than the BRIC markets and other emerging markets so far this year.

After the crisis, world markets seemed to move in lock-step with each other. It is interesting to see how Central Bank Policy is de-coupling. Something to watch.

Business Posts Moving the Markets that I Found Interesting This Week:

- Germans Buying the "Cradle of Capitalism" – NY Stock Exchange. (Newser)

- SEC Outgunned by Wall Street on Tech Spending. (SecuritiesTech)

- Should Regulators Review Trading Algorithms Before They Are Used In Markets? (Bloomberg)

- Is Mubarak the World's Richest Man with $70 Billion Fortune? (Newser & TheWeek)

- Big Surprise: Investors Piling into Egypt ETF. (InvestmentNews)

- More Posts Moving the Markets.

Lighter Ideas and Fun Links that I Found Interesting This Week

- How Discontent Can Bring Out the Hosni Mubarak in Each of Us. (BusinessWeek)

- Political Islam is Here to Stay: Is It Time to Accept & Adjust? (CSMonitor)

- Scientists Say Dolphins Should Be Treated As 'Non-Human Persons'. (TimesOnline)

- Can You Build a Better Brain – What Really Works? (Newsweek)

- 20 Things That Became Obsolete This Decade. (HuffingtonPost)

- More Posts with Lighter Ideas and Fun Links.