Newsweek had a great cover: "Apocalypse Now". Think about it, Tsunamis, Earthquakes, Nuclear Melt-Downs, Revolutions, Governments on the Verge of Shutting-Down …

And, yet, despite a cavalcade of horrors … the markets have held up well.

Is This as Good as it Gets?

Barron's notes:

Having snagged its best first quarter since 1998, the U.S. stock market began April on a hopeful, if hesitant, note, encouraged by evidence that our economy is improving, but a little fearful that this may be as good as it gets.

On Friday, the Dow Jones Industrial Average nudged briefly above its recent February peak to reach its highest level in nearly three years, effectively brushing aside recent concerns such as high oil prices, flailing European banks and disruptions in the wake of Japan's disaster that had so alarmed investors mere weeks earlier.

Are Cracks Starting to Show in the Rally's Foundation?

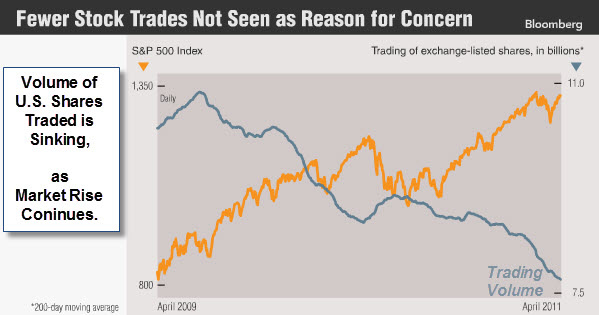

Bloomberg posted a chart showing the bull market move put in by the S&P 500 Index. Note, however, the dwindling volume of shares traded, especially since prices rebounded off lows earlier this year.

Barry Ritholz notes "Fed induced rallies tend to be liquidity, not conviction driven. Thus, the anemic volume".

Breadth is Starting to Show Signs of Fatigue as Well.

The following chart shows the percent of stocks trading above their 50-Day Moving Averages.

In strong markets, this indicator goes up as price rises. However, as the market rally loses momentum, this indicator starts tracing-out lower highs.

So what do you do? With the charts shown above and QE2 is supposedly ending in June … price is still the primary indicator. Until sellers show up with conviction, the liquidity rally is likely to continue.

Some weekend reading.

Some weekend reading.