Auto-Mate is a Microsoft Outlook add-in that automatically organizes your inbox and other mail folders. It makes it easy for you to focus on the items that are important or related to a topic you choose.

Auto-Mate is a Microsoft Outlook add-in that automatically organizes your inbox and other mail folders. It makes it easy for you to focus on the items that are important or related to a topic you choose.

Do you get too much e-mail?

I'm amazed at the volume of information that passes through my inbox. It's a challenge to figure out what's important, what's relevant, and what deserves time and attention.

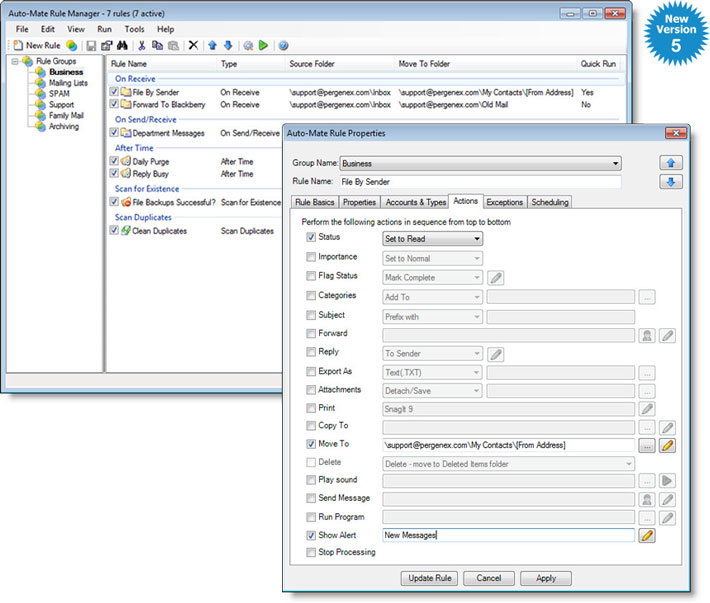

That's where Auto-Mate shines. It watches your message traffic and takes action based on the rules and filters you've enabled. Pergenex ships Auto-Mate with many pre-built tools and templates. In addition, it's easy to customize based on the way that you work and use mail. For example, it will automatically create folders for any contact that you have corresponded with, or it can put your mail into folders based on years and months.

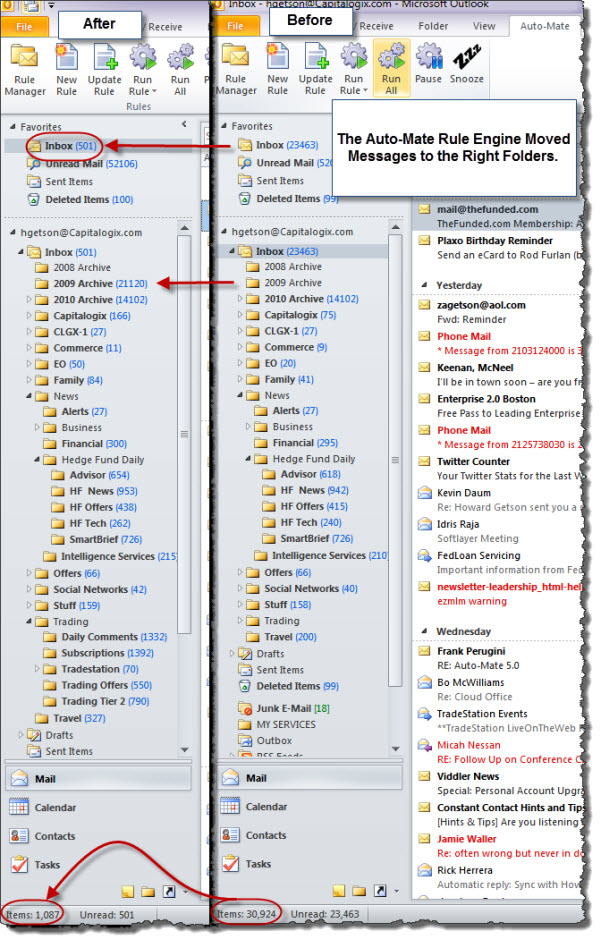

Personally, I use a different organization structure than that. I prefer to sort items based on topics. So, I have a categories for business, hedge funds, family, internal company matters, etc.

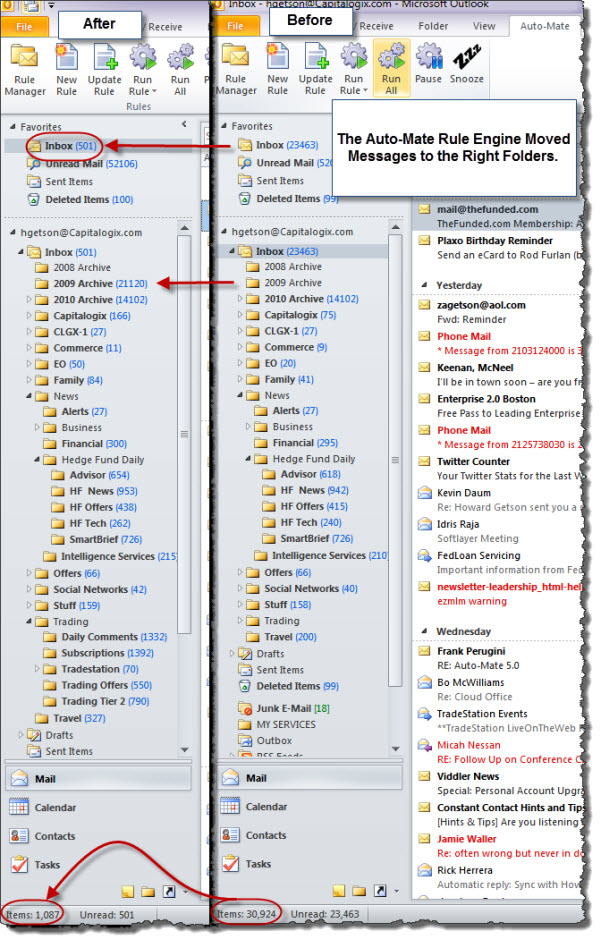

Here's an example of a screenshot of my folder structure. I've taken a before and after snapshot. Notice how many items are in my inbox versus the topic folders. The Auto-Mate rule engine puts things where they should be, so you can spend your time more efficiently and effectively.

Why You Should Use Auto-Mate.

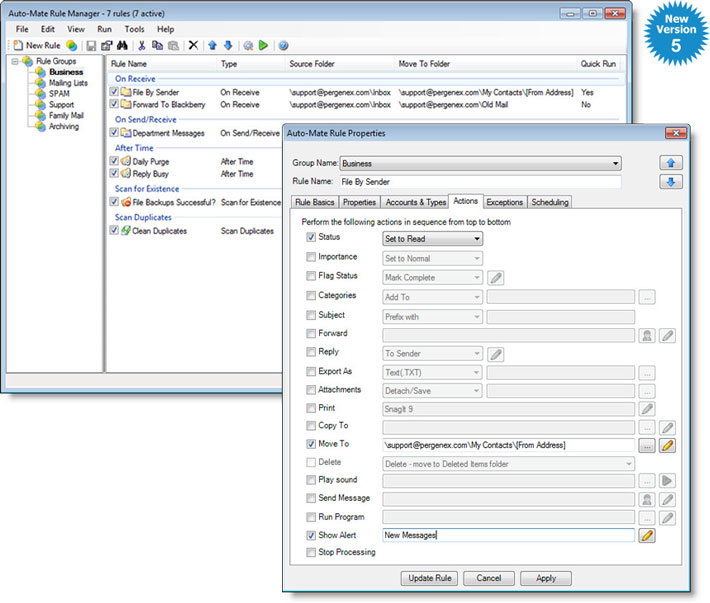

Outlook comes with a pretty powerful rule engine itself. Auto-Mate extends these capabilities significantly. Some of the ways that Auto-Mate is better include the number of rules you can store and manage, the types of activities, actions, and exceptions you can use to customize your workflow.

Another key benefit is that Pergenex lets you take different action based on time. That means Auto-Mate lets you run a rule on a particular message that has been in a certain folder for a certain period of time.

For example, I use my inbox as a point of focus … when I get an e-mail from someone important (like a direct report, key stakeholder, family member, accountant, or advisor), I want it to stay in the inbox for a period of time (so that I notice it, pay attention to it, and deal with it). However, if it's there for over a week, then it makes sense for this program to automatically file it in the appropriate folder. That's just one example of how these rules keep your inbox as a productivity tool rather than a distraction.

Here are some examples of what you can do with Auto-Mate.

- You can create an unlimited number of rules and organize them how you want.

- You can also easily to update your rules when it makes sense to do so.

- Not only can you run rules when new mail arrives or when new mail is sent, but you can also run rules "on demand" or in the background to perform general cleanup and archiving.

- Speaking of archiving, Auto-mate can easily reduce your mailbox storage size by extracting attachments and saving them to your hard disk or a network folder. It even leaves a link in your email messages so you can easily re-open the attachment.

In addition, there are many features for advanced users, from auto-responders, auto-printing of certain messages, auto-compressing attachments in messages, and even executing other programs.

Best of all, it works reliably and does great job. All in all, this is a well-designed tool and worth a try.

Here's a link to download a copy for yourself.