Image Wikipedia

Image Wikipedia

German Chancellor Angela Merkel sent a pretty clear message to the Markets this weekend – that Europe's leaders will not be bullied into action just because the markets are throwing a fit about the speed of their actions.

Other highlights of her recent comments include:

- “At this time — we’re in a dramatic crisis — euro bonds are precisely the wrong answer.”

- “They lead us into a debt union, not a stability union. Each country has to take its own steps to reduce its debt.”

- “Politicians can’t and won’t simply run after the markets.”

- “The markets want to force us to do certain things. That we won’t do."

Cullen Roche, from Pragmatic Capitalism, says: if you’re a market speculator you can basically read her comments as such: “We are in no rush whatsoever to solve the crisis in Europe. We will not be swayed by market crashes or panics.” Interesting, because the markets are sending them a very clear message. There is a very serious risk of a banking crisis in Europe.

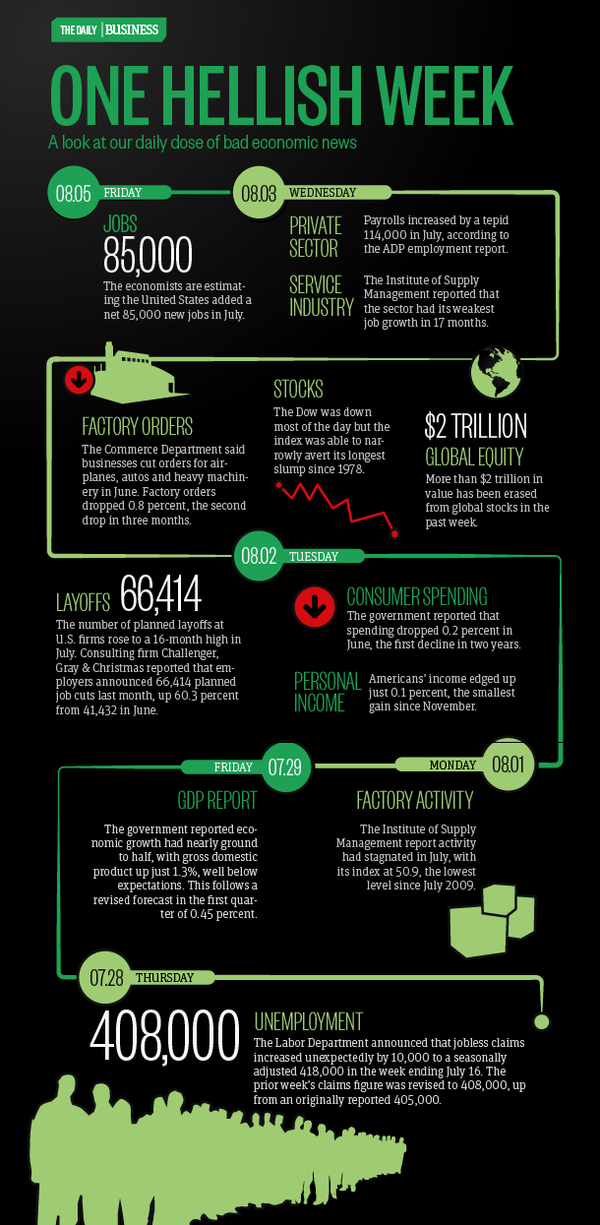

It's Not Just Europe.

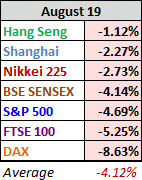

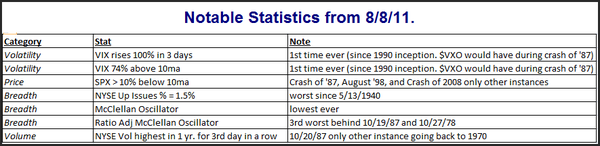

The world continued its sell-off last week. The table on the right shows the damage done to seven major markets.

The world continued its sell-off last week. The table on the right shows the damage done to seven major markets.

The DAX was the biggest loser, down 8.63%. It's also the index that has slipped the furthest into bear territory, down 27.20% from its interim high set on May 2nd.

In fact, five of the seven are now in cyclical bear territory, down 20% or more from their interim highs: The DAX, Nikkei, Hang Seng, Shanghai, and the BSE Sensex.

The FTSE and S&P 500 remain above the traditional bear boundary, vying for the dubious designation as top performer during this world-wide correction.

How Do The Moves in Once Country Compare to Others?

Here is a chart, from Doug Short, showing the comparative performance of World Markets since March 9, 2009.

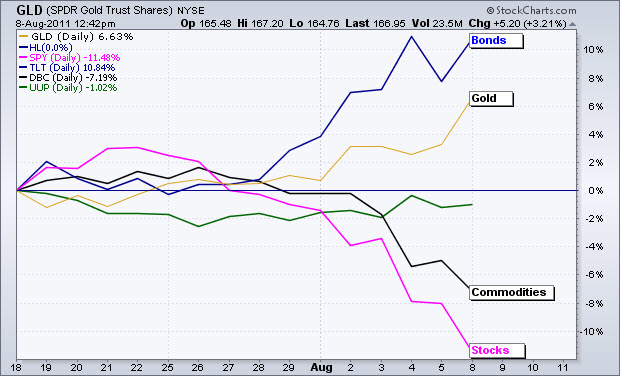

It has been a tough few weeks for just about everyone.

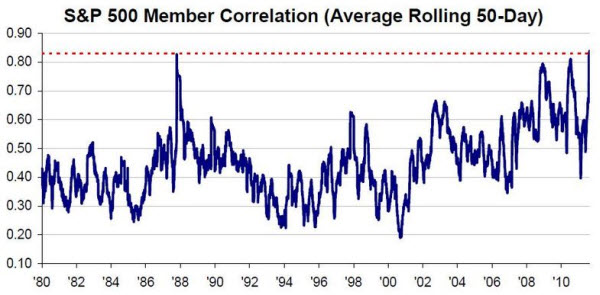

Laszlo Birinyi adds that stock correlation is also soaring. The average 50-day correlation of S&P 500 members to the index has risen to the highest levels since the market bottomed in 1987.

Are 'fat tails' are more likely to happen at the end of a crisis? If so, we might see a bottom soon. It bears watching to notice which sectors will break out as new leaders.

via

via