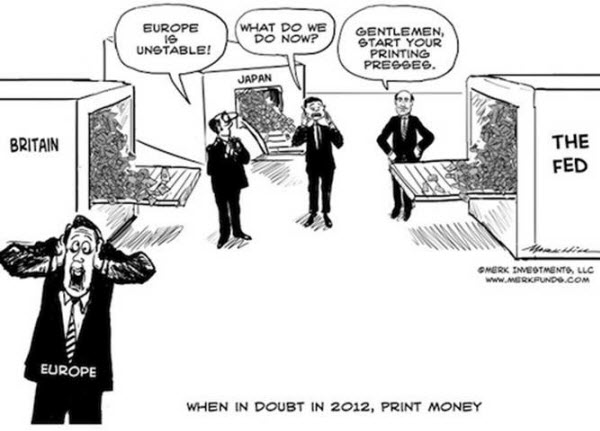

S&P Downgraded France and several other Euro-Zone countries this weekend. Now what?

Here are some of the posts that caught my eye. Hope you find something interesting.

- Brave Thinkers. Annual list of Big Ideas & the people who pursue them. (Atlantic)

- Why Competing Through Culture Matters More Than Ever. (ChiefExecutive)

- 50 Most Stunning Examples of Data Visualization and Infographics. (RichWorks)

- AllMyApps Makes Re-Installing Software on a New Machine Easy. (RedFerret)

- Top 10 Simple Privacy Tricks Everyone Should Use. (Lifehacker)

- Unlike Trading, Economics Is Not a Zero Sum Game. (WallStreetPit)

- Why Bad Economies Recover Fast When Governments Get Out Of The Way. (Forbes)

- Is the Crisis Over? 10 Reasons It May Flare-Up Again. (MarketWatch)

- The Real Point of Visualizations Is to Manage Data Overload w/o Algorithms. (Atlantic)

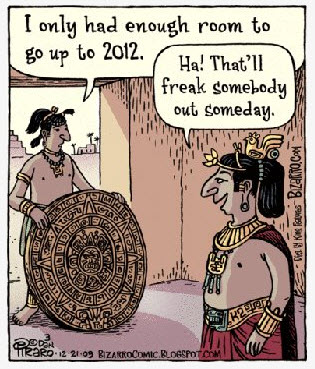

- Doug Kass – 15 Surprises for 2012. (TheStreet)