via Bespoke.

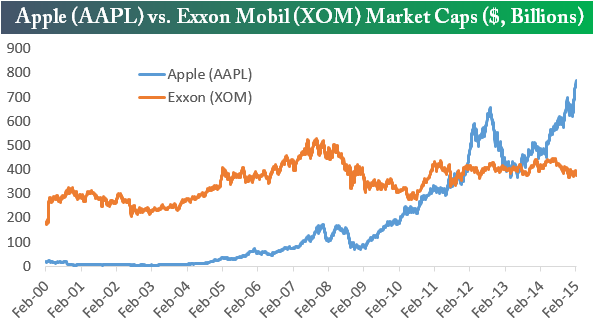

Just 15 years ago, Apple was struggling as a public company — in December 2000 its market cap had dipped to just $4.65 billion. 15 years later, and Apple now has a market cap of $770 billion!

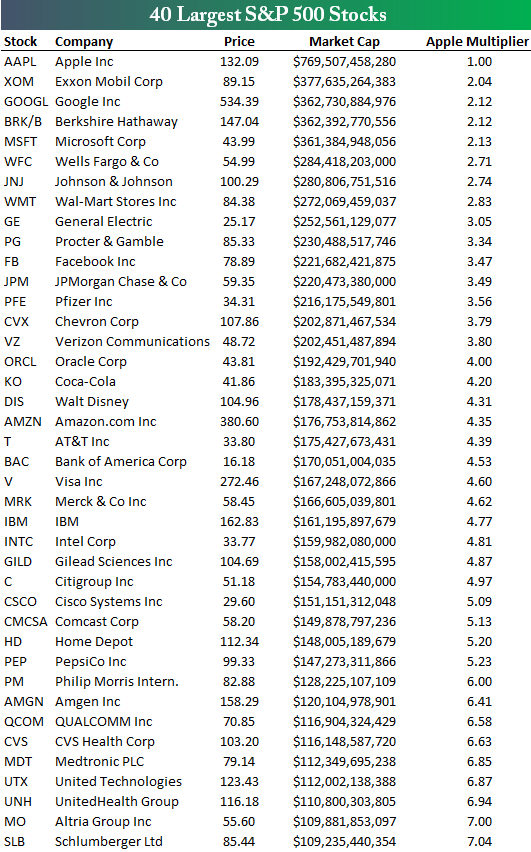

Below is a list of the 40 largest stocks in the S&P 500. For each stock, Bespoke highlights its "Apple Multiplier", or the amount that each company would have to multiply by to reach the size of Apple.

As shown, Apple is currently 2.04x as big as Exxon Mobil — the second largest company in the S&P. Apple is more than 3x the size of companies like General Electric, Procter & Gamble, Facebook, and JP Morgan.

Pretty staggering numbers.