-

Wintergatan – Marble Music Machine [Video]

This video shows Swedish band, Wintergatan, playing a music instrument using 2000 marbles.I love how order emerges from chaos.Their system is simple, consistent, and adaptive … and cooler than it sounds.via YouTube.Wintergatan will play live concerts starting this summer.For more, here is a link to their YouTube Channel. -

Here Are Some Links for Your Weekend Reading

The best way to make dreams come true is to wake up.

Here are some of the posts that caught my eye. Hope you find something interesting.

- How Elon Musk Taught Himself Rocket Science. (Time)

- How (and Why) SpaceX Will Colonize Mars. (Wait But Why)

- The 13 Principles of Disagreement. (LeadershipFreak)

- 16 Startup Metrics | Andreessen Horowitz. (A16z)

- 16 More Startup Metrics | Andreessen Horowitz. (A16z)

- Immigrants Founded 51% of U.S. Billion-Dollar Startups. (WSJ)

- A New Stop Loss: Slot Machines That Tell Gamblers When to Give Up. (AP)

- The Problem with Average. (The Irrelevant Investor)

- Hedge Fund Closures Return to Crisis Highs. (FT)

- This is 'No Longer an Investment Market but a Battlefield'. (Hedge Fund Manager)

-

Here Are Some Links for Your Weekend Reading

The best way to make dreams come true is to wake up.

Here are some of the posts that caught my eye. Hope you find something interesting.

- How Elon Musk Taught Himself Rocket Science. (Time)

- How (and Why) SpaceX Will Colonize Mars. (Wait But Why)

- The 13 Principles of Disagreement. (LeadershipFreak)

- 16 Startup Metrics | Andreessen Horowitz. (A16z)

- 16 More Startup Metrics | Andreessen Horowitz. (A16z)

- Immigrants Founded 51% of U.S. Billion-Dollar Startups. (WSJ)

- A New Stop Loss: Slot Machines That Tell Gamblers When to Give Up. (AP)

- The Problem with Average. (The Irrelevant Investor)

- Hedge Fund Closures Return to Crisis Highs. (FT)

- This is 'No Longer an Investment Market but a Battlefield'. (Hedge Fund Manager)

-

Danger or Opportunity? Close to New Highs

This week, Lance Roberts posted "Only 4% From Record Highs" on RealInvestmentAdvice.com.

“While my “emotions” are currently screaming to start increasing equity allocations at this juncture, there are several reasons why my discipline is keeping me from doing so currently:

- The market is GROSSLY overbought in the short-term and will have either a mild corrective process or consolidation to allow for an increase in equity exposure.

- Negative trends are still in place which suggests the current rally, while significant, remains within the context of a reflexive rally.

- Volume is declining on the rally suggesting a lack of conviction.

- This rally looks very similar to the rally last October except the fundamentals are substantially weaker.”

Here is the chart (with his notations) that caught my eye.

The question it poses is whether enough “technical repair” has been completed to warrant an increase in equity exposure in portfolios? Does the “risk” that the current “bear market” rally is nearer completion outweigh the possibility currently the markets are changing back to a “bull market”?

In other words, does the “risk” that the current “bear market” rally is nearer completion outweigh the possibility currently the markets are changing back to a “bull market”?

As we approach summer, the seasonal weakness of the markets will likely resurface as the reality of Central Bank interventions are digested and focus once again returns to the real driver of asset prices longer term – profits.

“There have been three great inventions since the beginning of time: fire, the wheel, and Central Banking.” – Will Rogers

Happy Spring!

-

Danger or Opportunity? Close to New Highs

This week, Lance Roberts posted "Only 4% From Record Highs" on RealInvestmentAdvice.com.

“While my “emotions” are currently screaming to start increasing equity allocations at this juncture, there are several reasons why my discipline is keeping me from doing so currently:

- The market is GROSSLY overbought in the short-term and will have either a mild corrective process or consolidation to allow for an increase in equity exposure.

- Negative trends are still in place which suggests the current rally, while significant, remains within the context of a reflexive rally.

- Volume is declining on the rally suggesting a lack of conviction.

- This rally looks very similar to the rally last October except the fundamentals are substantially weaker.”

Here is the chart (with his notations) that caught my eye.

The question it poses is whether enough “technical repair” has been completed to warrant an increase in equity exposure in portfolios? Does the “risk” that the current “bear market” rally is nearer completion outweigh the possibility currently the markets are changing back to a “bull market”?

In other words, does the “risk” that the current “bear market” rally is nearer completion outweigh the possibility currently the markets are changing back to a “bull market”?

As we approach summer, the seasonal weakness of the markets will likely resurface as the reality of Central Bank interventions are digested and focus once again returns to the real driver of asset prices longer term – profits.

“There have been three great inventions since the beginning of time: fire, the wheel, and Central Banking.” – Will Rogers

Happy Spring!

-

Here Are Some Weekend Reading Links

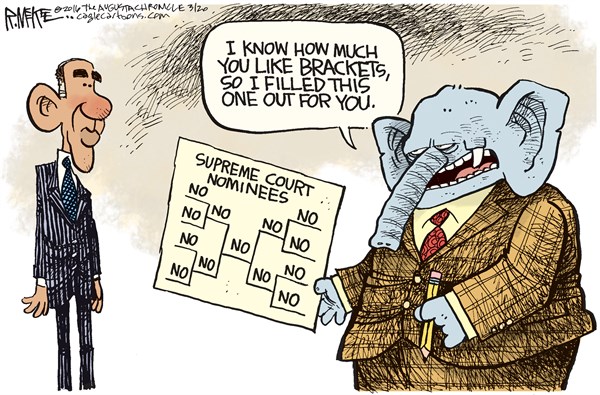

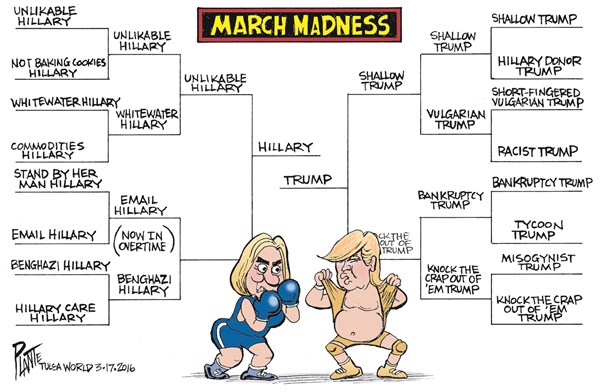

It's March Madness – so bracket-themed comics are out in full-force. Here are two that made me smile.

Here are some of the posts that caught my eye. Hope you find something interesting.

- Wharton Professor Adam Grant On Creativity and the First Mover Myth. (TechCrunch)

- 15 Documentaries On Netflix That Will Make You Smarter About Business. (BizInsider)

- Not Even the People Who Write Algorithms Really Know How They Work. (Atlantic)

- Industrial Designers Predict the Future of Transportation in 50 Years. (Guardian)

- Anne Frank's Diary Is Now Free to Download. (The Verge)

- Why Robots Mean Interest Rates Could Go Even Lower in the Future. (Bloomberg)

- You’re Not Supposed to Understand the Federal Reserve. (NYTimes)

- What Robo-Advisors Truly Threaten To Disrupt. (Kitces)

- EY Statistics On FinTech Usage. (Business Insider)

- Here's an Economist's Reasonably Rosy Countdown to the Next Depression. (BizJournals)

-

Here Are Some Weekend Reading Links

It's March Madness – so bracket-themed comics are out in full-force. Here are two that made me smile.

Here are some of the posts that caught my eye. Hope you find something interesting.

- Wharton Professor Adam Grant On Creativity and the First Mover Myth. (TechCrunch)

- 15 Documentaries On Netflix That Will Make You Smarter About Business. (BizInsider)

- Not Even the People Who Write Algorithms Really Know How They Work. (Atlantic)

- Industrial Designers Predict the Future of Transportation in 50 Years. (Guardian)

- Anne Frank's Diary Is Now Free to Download. (The Verge)

- Why Robots Mean Interest Rates Could Go Even Lower in the Future. (Bloomberg)

- You’re Not Supposed to Understand the Federal Reserve. (NYTimes)

- What Robo-Advisors Truly Threaten To Disrupt. (Kitces)

- EY Statistics On FinTech Usage. (Business Insider)

- Here's an Economist's Reasonably Rosy Countdown to the Next Depression. (BizJournals)

-

Meet the Queen of Sh*tty Robots

I love innovation … And I know that things often suck before they suck less.

Here is a quick and fun interview about someone who loves building hilariously terrible robots (from a terrifying knife-wielding chopping bot to a life-affirming applause bot).via YouTube.For more, check out Simone's YouTube Channel.

-

Meet the Queen of Sh*tty Robots

I love innovation … And I know that things often suck before they suck less.

Here is a quick and fun interview about someone who loves building hilariously terrible robots (from a terrifying knife-wielding chopping bot to a life-affirming applause bot).via YouTube.For more, check out Simone's YouTube Channel.

-

World Happiness Report 2016 Update Ranks Happiest Countries

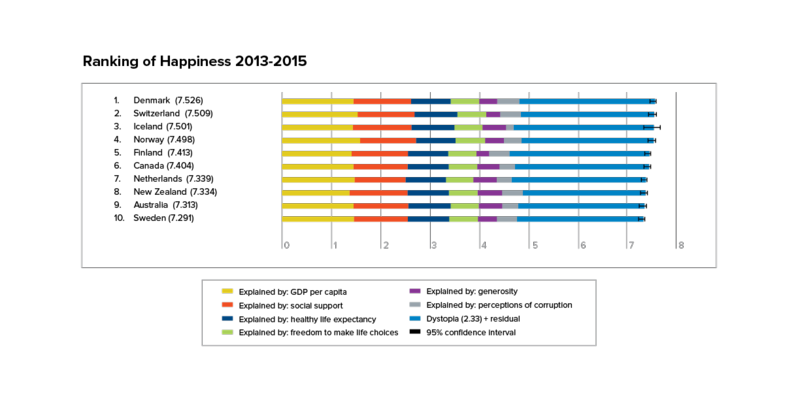

The World Happiness Report 2016 Update, which ranks 156 countries by their happiness levels, was released last week.

Denmark, Iceland, Norway and Finland may get little sunlight and daylight for months on end, but people living there continue to be happier than most. These countries once again top a poll of the happiest people on Earth, with only Switzerland (second place) breaking up a Nordic clean sweep of the top-five places. Happiness clearly has less to do with the weather, and more to do with factors like social cohesiveness and a strong safety net.

Here is a chart showing the top-ten.

Thoughts about the markets, automated trading algorithms, artificial intelligence, and lots of other stuff