via ShoeBox

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- The Truth about Intelligence: What Makes Someone Smarter Than Others? (NewScientist)

- Yuval Noah Harari Extract: Humans are a Post-truth Species'. (TheGuardian)

- Pentagon Restricts Use of Fitness Trackers, Other Devices. (AP News)

- China is Quietly Relaxing Its Sanctions against North Korea, Complicating Matters for Trump. (LATimes)

- Democrats Warn Candidates Not to Use Chinese Devices 'Even If the Price is Low or Free'. (BusinessInsider)

Trading Links

- Here's What Tesla Would Have to Do to Go Private. (Money)

- A New Cold War? Why the U.S. and China Would Both Lose. (Knowledge)

- Malls are Turning Empty Storefronts into Startup Incubators. (Footwearnews)

- NYC is Set to Impose a Cap on Uber. (Bloomberg)

- July Sets a Record for Number of $100M+ Venture Capital Rounds. (TechCrunch)

-

Here Are Some Links For Your Weekly Reading – August 12th, 2018

-

Exploring Nasdaq’s Prediction for 2018 FinTech Trends

We’re past the midway mark for 2018. It has been an interesting year for America and for technology. At the beginning of the year, Nasdaq released its predictions for this year’s FinTech trends. I think it’s worth seeing how they've held up.

Nasdaq has been around since 1971 when they launched the world’s first electronic stock exchange, and they’re doing their best to hold innovation as one of their core tenets. According to them “recent advances in technologies such as blockchain, cloud computing, machine intelligence, behavioral science, and other areas provide us with the opportunity to literally rewrite tomorrow and drive our industry forward in entirely new ways.”

They identify four key trends and seven advanced technologies that will start to converge.

Four Key Trends

When evaluating a new product or market, trends are an important factor. The four key trends Nasdaq foresees are as follows.

- First, is the development of the marketplace economy, an evolution in the purchase and sale of non-financial assets using market mechanisms that allow for real-time negotiation on price.

- Second, is investment banks demonstrating an interest in partnering with firms to develop new technologies that can drive their businesses into the future.

- Third, is the big data explosion which combined with advances in machine learning creates a myriad of opportunities in market surveillance, data analytics and in the capital markets themselves.

- Finally, the investment management is becoming increasingly competitive, specifically in regard to technology-powered pursuits.

If one thing is apparent, innovation is the golden thread between it all. Finance is quickly becoming synonymous with FinTech as finance and technology becomes inextricable.

Seven Key Technologies

- Cloud technology is maturing and adoption is accelerating. People are recognizing that several types of workload work more efficiently in the cloud. It’s not right for everyone, and the scale and speed of adoption will differ for different industries, but hybrid cloud experiences will be widely adopted by organizations.

- Machine intelligence is helping firms find an edge in an increasingly tough landscape. Machines are getting better at interpreting data and creating structure from unstructured data (80% of the world’s data is unstructured, according to Gartner Group). Machine intelligence is also enabling real-time broad-spectrum surveillance.

- Behavioral Science is increasing sophistication by increasing insights from human factors and cognitive analysis. This can bolster machine learning as well as improve workflow and user interfaces.

- Blockchain is rapidly moving towards commercial applications, with proof of concepts becoming pilots and soon live products. Lots of activity as well in the crypto space.

- Pari-mutuel technology can be applied to create new products. Bilateral trading works when you have a liquid market, but it's not always possible to find a counterparty. Pari-mutuel (pool-based) models enable more products – as long as there is still differing sentiment. This also allows more customized positions.

- Cybersecurity is becoming more and more necessary as cyberattacks increase. Cybersecurity is evolving and becoming an issue and focus for not just firms but individuals. Reminder: Here are some cybersecurity tips I put together last year.

- Quantum Computing – while exciting – has no clear timeframe of adoption. It's an emerging technology but has the potential to radically transform the trading landscape by increasing the rate at which we perform optimizations and calculations.

If you’re interested in seeing the whole report you can download it here.

-

Here Are Some Links For Your Weekly Reading – August 5th, 2018

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- The 5 Levels of Leadership. (Quartz)

- Your Obsession with Cognitive Biases is Probably Making You Dumber. (Inc)

- Apple Watch Keeps Spotting Cardiac Issues and Saving Lives, this Time in Australia. (AppleInsider)

- What is Intermittent Fasting and is It Actually Good for You? (Time)

- New Radio Telescope Picks up Mysterious Signal from Space. (CNet)

Trading Links- Jeff Bezos' Parents Invested $245,573 in Amazon in 1995 Now They Could Be Worth $30 Billion. (Insider)

- The Biggest Thing to Happen in Blockchain since Bitcoin. (Forbes)

- Russia Dumped 84% of Its American Debt. What that Means. (Money)

- Big Pharma Would like Your DNA. (The Atlantic)

- AAPL Gets Even Closer to $1Tn Market Cap, Hits New All-time High in After-hours Trading. (9to5Mac)

-

Camp Kotok: Cautiously Optimisitc

I'm in Maine at Camp Kotok, a private gathering of economists, fund managers, and other financial industry professionals.

The mood is cautiously optimistic to bullish.

The financial industry is changing quickly and I'm confident that advanced technology will become an even bigger driver.

Lots of cool discussions here. Call me if you want to talk about it.

-

Some Down Time – Replacing Head With Heart

I was at the Jersey Shore for my birthday this weekend. Over 30 people showed up to surprise me. It was heartwarming, fun, and genuinely surprising.

My wife, Jennifer, arranged it all without me knowing (or even suspecting).

Here's one picture from the festivities.

We didn't go to the casinos, amusement parks, or to see shows. We did, however, eat good food, go to the beach and spend time together. I wasn't focused on my business or deadlines.

It was a heart-focused (rather than head-focused) time for us.

We are often so good at what we're good at that we forget to focus on the other stuff.

Thanks for the reminder. I'm passing it on!

-

Here Are Some Links For Your Weekly Reading – July 29th, 2018

We often focus on the big changes in technology's evolution … but, sometimes, the smaller details can be as (if not more) interesting.

Phone companies used to use approximately 1200 cables to handle the traffic of around 600 buildings.

Below is an image of one of those bundles being cut – and replaced – with 48 fiber optic cables.

Sometimes, less is more.

Pretty cool.

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- Scientists Discover the First Large Body of Liquid Water on Mars. (Wired)

- Barack Obama Says He's "Surprised by How Much Money" He Has. (CNW)

- Richard Branson Shares a Letter with His Teenage Self.(CelebrityNetWorth)

- Introverts: Use this Flowchart to See If You *Actually* Have to Hug Someone. (Well&Good)

- Apple's Self-driving Car System Could Change How It Drives by Detecting Passenger Stress Levels. (AppleInsider)

- Amazon Will Likely Pass Apple to Be the First $1 Trillion Company, Investors Say. (CNBC)

- CEOs are Starting to Bank Billion-Dollar Bonuses with IPOs. (Bloomberg)

- Venezuela's Inflation Rate May Hit 1,000,000 Percent. Yes, 1 Million. (WashPost)

- Iran is Planning to Launch Its Own Cryptocurrency in Order to Bust U.S. Sanctions. (Fortune)

- Which State Has the Highest Percentage of Millionaires? Bet You Can't Guess. (Hint: Not New York or California). (Inc)

-

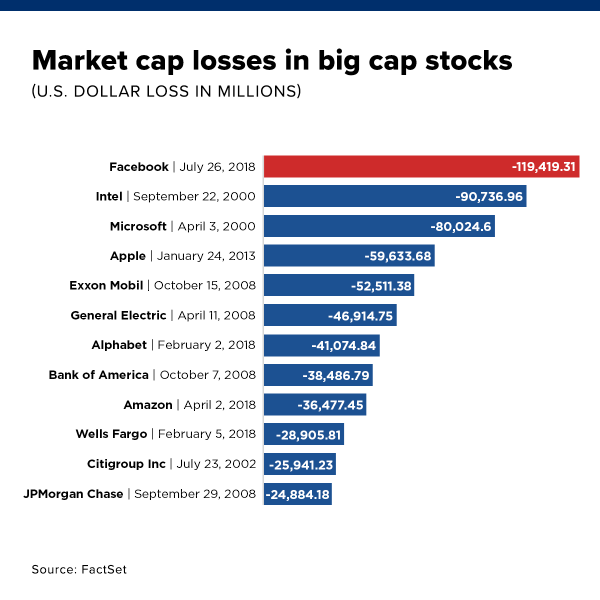

Largest Single-Day Market Cap Loss in History

Facebook has been under fire for a while now – misuse of data, privacy issues and more.

This Thursday, following a horrible quarterly report with lower-than-expected revenue and low daily active users, Facebook posted the largest single-day loss in market value by any company in U.S. history. They had peaked at about $630 billion.

Mark Zuckerberg himself lost approximately 17 billion.

via CNBC

via CNBCLooking at the list of the largest "losers" there are plenty of winning companies in their ranks, but, Facebook expects their revenue growth rate to continue to slow.

Do you think Facebook will still be a major player in the next 5 years?

-

Is Biohacking the New Key to Trading?

Last week, I was in Alaska at Steamboat Bay for a CEO retreat.

One of the other attendees was Dave Asprey – CEO of Bulletproof, author of Headstrong, and a biohacking thought-leader.

Very few people understand what we do at Capitalogix; even fewer understand it well enough to paint a vivid picture … yet, that's exactly what Dave did … almost instantly.

I asked him to retell it on video – to try and capture his take. To set your expectations, his take is different than you might imagine … It's got ancient bacteria, futuristic algorithms, and a little genius.

Kind of cool … Check it out.

"It takes a lot of computer power, and it takes a lot of algorithms, and it takes a lot of environmental sensors … that's why we can walk around, breathe, and think."

~ Dave AspreyMarkets are an environment just like the environment we live in. Our algorithms can learn and evolve based on markets in a similar way to how humans evolved and adapted to their environments.

To summarize: In the beginning, there was an algorithm … and it was good.

And, it's just the beginning.

Onwards!

-

Here Are Some Links For Your Weekly Reading – July 22nd, 2018

Here are some of the posts that caught my eye recently. Hope you find something interesting.

- The Boston Dynamics Robots Can Now Hunt You in the Woods. (DailyDot)

- What Cyber-War Will Look Like. (Scholars-Stage)

- The Mistakes You Make in a Meeting's First Milliseconds. (Wall Street Journal)

- Does Intermittent Fasting Work? Here's What It Can (And Can't) Do for You. (Cheatsheet)

- 'Never Underestimate Human Stupidity,' Says Historian Whose Fans Include Bill Gates and Barack Obama. (CNBC)

- Coinbase Says It Has Green Light to List Coins Deemed Securities. (Bloomberg)

- CRISPR Stocks Plummet over Study Pointing to Potential Adverse Effects. (FastCompany)

- Warren Buffett Donates $3.4-Billion to Gates Foundation and His Family's Charities. (Globe&Mail)

- The 24 Rules for Success Left behind by a Legendary Wall Street Banker. (Time)

- Scientists Discovered a Quadrillion Diamonds Hidden Deep within the Earth. (Inverse)