This week, Microsoft CEO Steve Ballmer said goodbye to his company’s employees.

Here is a video of his farewell speech at Microsoft's 2013 Company Meeting.

Here is a link to the Verge's article covering this event.

The Ballmer Era Ends. What To Make Of It?

While he will stay on until a new CEO has been selected, we can now assess his legacy at Microsoft based on the 13 years during which he was at the helm of the company.

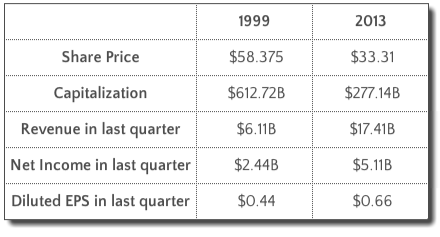

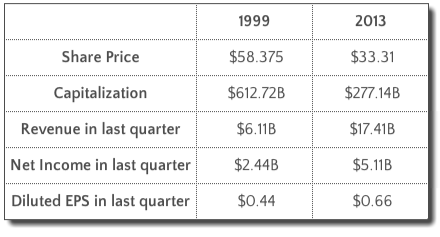

According to Forbes, when Ballmer took over the company from Bill Gates on January 1, 2000, Microsoft shares had already begun falling from its record high reached on December 23, 1999 … and as of this week’s close of market, Microsoft shares had dropped 55% since Ballmer took over.

Without any other historical references, this may look like an utter disaster – but consider the timing of the transition and subsequent events. When Ballmer took over, the company was riding the dotcom bubble and had achieved this valuation with $6.11 billion in quarterly revenue and a net income of $2.44 billion. This gave them $0.44 in diluted earnings per share.

By the end of Ballmer’s first year at the helm, the dotcom crash had wiped out the technology sector, driving Microsoft’s share price to $21.688 by the end of 2000, a low it would not break until its ill-fated effort to purchase Yahoo in March 2009.

The company survived the 2008 financial crisis relatively well, buoyed by strong revenue and a diversified set of products that allowed it to generate cash in an era when credit became very tight.

On an annualized basis, Microsoft saw its yearly profits grow from roughly $25 billion to around $70 billion, or an average of 16.4% in annualized growth, a record that beats the performance of well known CEOs like Jack Welch at GE (11.2%), Lou Gerstner at IBM (2%) but eclipsed by Steve Jobs’ record of 33x growth (from $786 million to $25.922 billion) during his tenure as CEO.