Michael Masterson wrote a book called Ready Fire Aim: Zero to $100 Million In No Time Flat. It is a practical guide for entrepreneurs and business leaders, focusing on the different stages of business growth and the key challenges and priorities at each stage.

A core message of the book is to start taking action quickly (instead of getting bogged down in over-planning) and use rapid iteration and real-world feedback to refine strategies.

The concept is presented in the context of growing a business – yet the lessons apply broadly.

Swift action should be your focus … not over-planning or perfect timing.

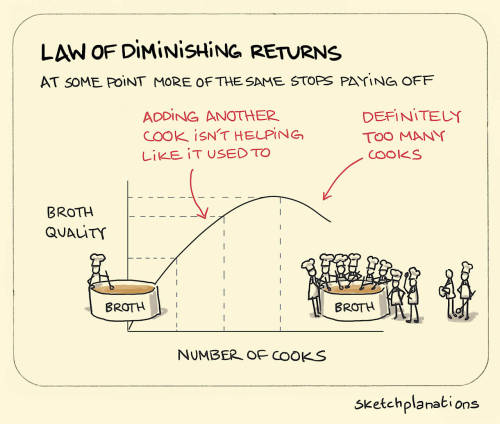

Too many companies get stuck in a cycle of brainstorming, getting internal feedback, making changes, and failing to release the product.

Even for released products, too many fail because they took too long to launch or ignored market feedback.

Masterson stresses that the value of live performance is that it helps you course-correct. He also cautions that there is no such thing as perfect timing. The best timing is almost always ‘Now!’

Now, let’s extrapolate.

Let’s say you’re pondering a tricky work problem. You know you need to figure it out before the end of the week … but your brain keeps going in circles.

You don’t believe you can take decisive action and course-correct because you feel you have to get it right.

So, what can you do? Write it out. Write out the potential paths, ramifications, and worst-case scenarios as holistically as possible.

You’ll find that simply by writing it out instead of just ‘thinking,’ you end up more creative with more insight.

Writing aids in organizing and clarifying your thoughts.

AI As Your ‘Action’ Partner

AI can make this process easier, faster, and more manageable. Tools like ChatGPT can help you explore complex topics, run scenarios for you, and provide external feedback.

It’s not the same as real-world feedback, but it can shorten the ‘Aim’ part of the process.

As you externalize your thoughts in writing them to whatever AI you choose, you also get the same benefit you did writing your thoughts out in our previous example.

The business environment is changing faster than ever. Technology is advancing faster, adoption is getting easier, and the average Joe is becoming bullish on AI. Because of that, Masterson’s book is even more relevant now than it was in 2007. Here are a few of the other key takeaways from Ready, Fire, Aim.

- Adapt Your Role: As a company scales, leaders must shift from “doing” to guiding and from tactics to strategy.

- Be Sales-Focused: Keep revenue generation as a core priority, especially in the early stages.

- Build Scalable Systems: Invest in operations and leadership at the right time to support sustainable growth.

- Innovate Continuously: Avoid complacency by fostering an organizational culture that balances efficiency with creativity.

AI and exponential technologies are going to compress cycle types. What used to be long-term planning will just be planning. You have to act fast, not only to capitalize on these trends but also to avoid being wiped out by them.

Are you keeping up?

Reddit via

Reddit via

via

via

via

via

via

via