We live in exciting times!

No, I'm not talking about how fast the DOGE team is terraforming government.

I'm talking about how fast the insights of exponential technologies are compounding the real-world implications of where we are and where we are going.

In past issues, we've talked about how quickly the world is changing, how fast innovations happen, and why it's not about today's tools but rather the value and capabilities of the foundational assets we build upon … and, ultimately, the things that makes possible.

Today's commentary is different from our usual posts. Yes, the inspiration came from my weekly curation of links selected based on what captured my attention or imagination. However, today's post is about the sheer volume and density of groundbreaking innovations competing for mindshare and investment dollars. And while commercial success is a great way to keep score, we'll explore what this accelerating pace of innovation means for our future and the world.

So, here is a list of some of the things that made headlines this week.

- After 17 years of research, Microsoft has announced a massive breakthrough in quantum computing, resulting in a new state of matter and their new Majorana 1 chip.

- Google announced its new AI co-scientist to help accelerate research for scientists … and it's already finding novel breakthroughs on decade-long problems.

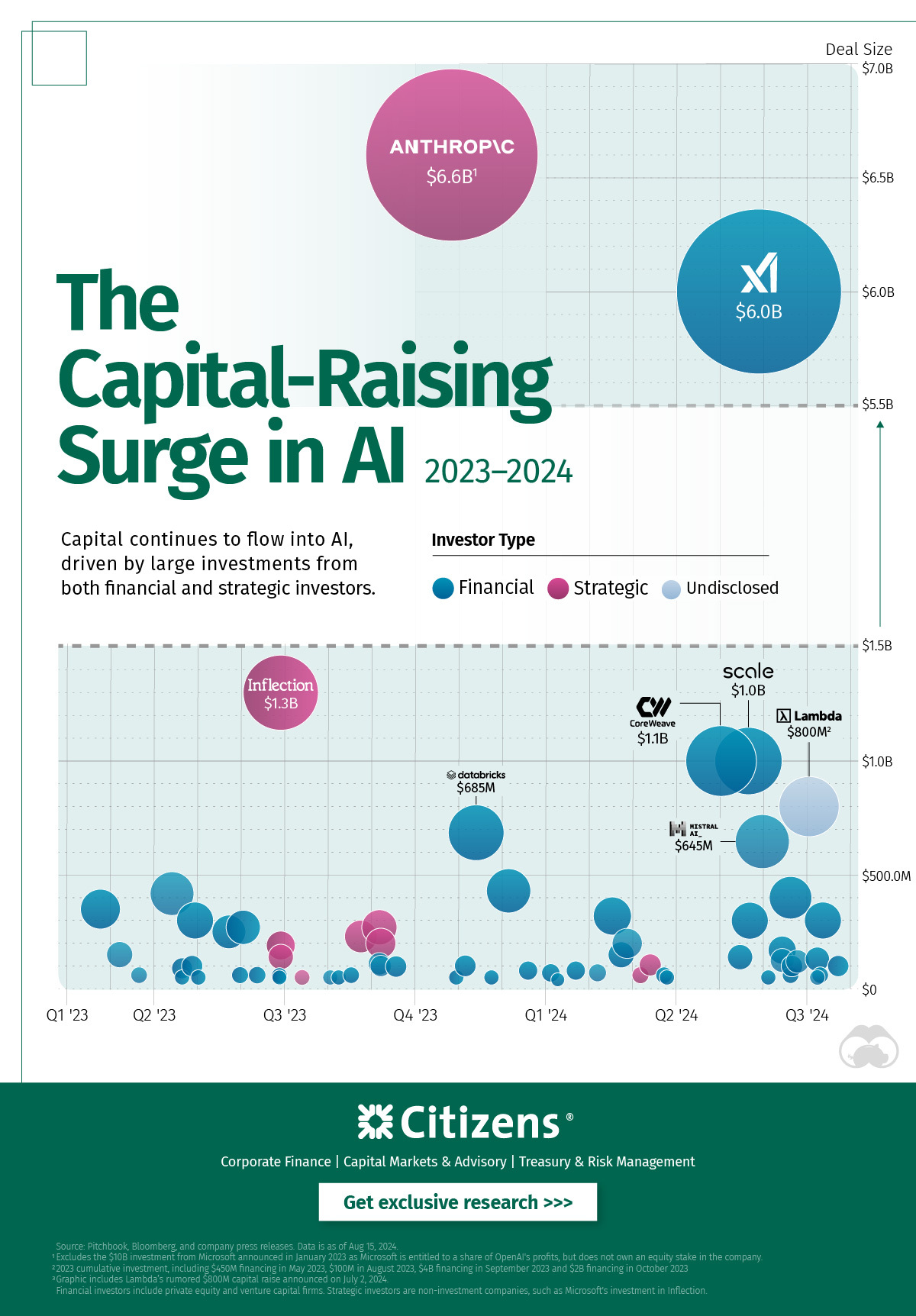

- xAI released Grok 3, a significant advancement in the reasoning and performance of their LLM and a competitor to other top models like DeepSeek-R1.

- Clone Robotics unveiled a video of "ProtoClone," a faceless musculoskeletal android robot with 1000 muscles and over 200 degrees of freedom.

- Nvidia and Arc Institute launched a new AI Bio model – Evo 2 – trained on over 100k species. This doesn't just analyze genomes … it creates them.

- Sakana.AI introduced the AI CUDA Engineer, an agentic AI system that automates the production of CUDA kernels 10-100x faster than with common machine learning,

- Claude announced their intention to include reasoning and web search in Claude 4.

- France sustained a Nuclear Fusion plasma reaction for 1,337 seconds – a 25% improvement over the previous record.

Some may not matter to you now. Try re-reading the list while letting yourself be amazed at what is happening!

Any one of these is a momentous achievement that would have sounded like science fiction even 10 years ago. Now, that's one week of achievement.

As someone whose company invents things for a living, I understand that none of these breakthroughs were actually invented last week. Obviously, a long and winding road leads to each of those announcements. However, it's remarkable to see so many significant innovations reaching the stage of public announcement simultaneously.

It's hard to quantify the impact of these innovations on not only the tech industry – but the world.

Think about the implications. Google's co-scientist is already solving problems that humans haven't been able to solve for decades. Clone is building robots that will use the next generations of AI to transform how we think about what artificial intelligence looks like.

Not to mention the improvement in quantum computing and nuclear fusion, industries that I've been paying attention to since the 90s.

While any of these topics would have made a good article, in my opinion, the whole is more impressive than the sum of its parts.

If I had to pick one of those topics to highlight, I think it's now time to start focusing more on quantum computing.

To start, here's an hour-long interview with Satya Nadella about Microsoft's new quantum chip – and what it means for AI & business.

via Dwarkesh Patel

Most of you probably aren't interested in watching the whole thing, but here are some of the highlights.

- They've created a new state of matter called a topological superconductor.

- The qubits created with topological superconductors are fast, reliable, and small … very small.

- These new qubits are 1/100th of a millimeter, meaning we now have a clear path to a million-qubit processor.

- To put that in perspective, imagine a chip that can fit in the palm of your hand yet can solve problems that even all the computers on Earth today combined can't!

- Satya doesn't believe in making claims about how quickly AGI is coming.

- However, he believes it is useful and productive to set a benchmark of making the world 10% better.

- He also believes the topological superconductor breakthrough makes quantum computing a practical reality that can happen in a few years – not decades +.

Prepare for things to get more interesting.

We do live in exciting times!

via

via

Image via

Image via