Back in June, I participated in a series of webinars for IBM. The focus was on building smart and secure financial services. My talk, specifically, was on advanced computing and the new world of trading. Challenging times drive advancement – and what better time to talk about advancements in technology (and their applications) than in the midst of a global pandemic.

You can watch a replay of the Fintech webinar here. There are several interesting presentations. If you just want to watch my presentation, it starts at the 5:16 mark.

In addition, I've uploaded a different version of just my talk that you can watch directly here.

In the past. trading used to be about people trading with people. Markets represented the collective fear and greed of populations. So price patterns and other technical analysis measures really represented the collective fear and greed of a population. If you could capture that data and figure out certain statistical probabilities, you might have had an edge. The keywords is "might have".

If you had more information than your competitors – an information asymmetry – you had an amazing edge. At one time that was being able to print out reports on stocks from that new-fangled technology called the internet. As time passed, it became harder and harder to gain an asymmetric information advantage.

The rules, the players, and the game have all changed. Today, technological asymmetry is a major factor, and your edges come from things like bigger and faster servers and low latency connections to markets.

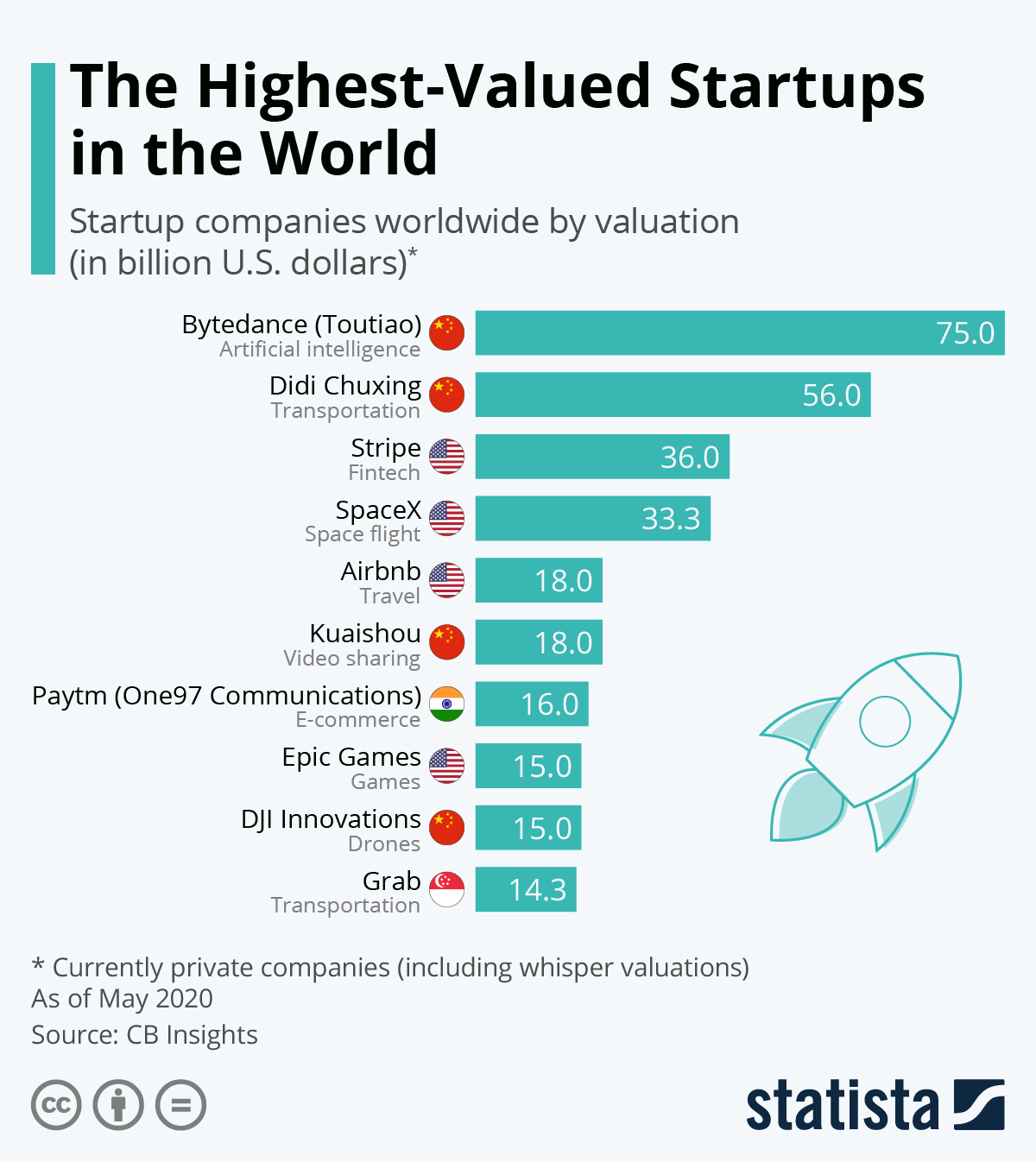

In the future, I see those edges combining as artificial intelligence starts to leverage exponential technologies and new data sources (like alternative data and metadata feedback loops). It is easy to imagine a time when information is the fuel, but your ability to digest and parse that information is the engine.

I talk about much more in the video but boiling down the main points, ask yourself (in business, in trading, in life) are you separating the signal from the noise?

A technological advantage doesn't mean anything if you're plugging in inaccurate or biased data into it.

We've talked about it over the past few weeks with the never-ending news cycle – but it's a lesson that's infinitely applicable.

Onwards!

via

via

Anna Vital via

Anna Vital via  via

via

via

via