At the core of Capitalogix’s existence is a commitment to systemization and automation.

At first, the goal was to eliminate fear, greed, and discretionary mistakes from trading.

Over time, we’ve worked hard at making countless things easier. Much like math, we found that the best practice is to simplify complex processes before trying to automate them.

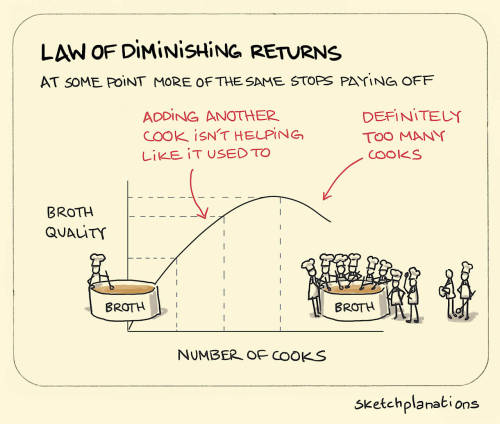

I’m surprised by how many times I have had the same realization … Less is more.

Likewise, I’ve learned the hard way that a great strategy is useless if people don’t get it. That is part of the reason that frameworks are so important.

Ultimately, the process, the system, and the automation should follow this basic recipe if you want it to succeed: Simple, Repeatable, Consistent, and Scalable.

Finding ways to automate sounds great. Increasing efficiency, effectiveness, and certainty sounds great, too … but, routines and habits become ruts and limits when they become un-measured, un-managed, or forgotten.

A practical reality of increasing automation and constant progress is that it becomes increasingly important to have expiration dates on decisions, systems, components, and automations. We need to shine a light on things to make sure they still make sense or to determine whether we have a better option.

Freeing humans to create the most value sounds great, too … but, as the pace of technological progress increases, the importance of freeing people to do more diminishes if they don’t actively rise to the occasion.

My Use of Technology

I got my first computer in 1984. It was the original Macintosh. That means I’ve been searching for and collecting technology tools to make business and life easier and better since the mid-80s.

It has been a long and winding road. These days, it seems like I’m constantly looking for new ways to use AI in my life.

As you might guess, I “play” with a lot of tools. Of course, I think of it as research, discovery, and skill-building … rather than playing. Why? Because it is something I’m good at, it produces value – and it gives me energy … so, I make sure to reserve a place for it in my routine.

While most of what I explore doesn’t make it into my “real work” routine, I now have a toolbox of dozens of tools that I use for everything from research, notetaking, brainstorming, writing, and even relaxing.

It’s a little embarrassing, but my most popular YouTube video is an explainer video on Dragon NaturallySpeaking from 13 years ago. It was (and still is) dictation software, but from a time before your phone gave you that capability.

As I focus on systemization, I also have to focus on optimization.

Using generative AI tools for daily research has fundamentally changed how I approach information gathering. What began as a meditative practice—slowly reading, digesting, and reflecting on material—has evolved into a faster, more expansive process. With AI, I can now scan and synthesize a much broader set of sources in far less time. The quality of the summaries and takeaways is high, enabling me to deliver more value to others. I can write better articles, share timely insights with fellow business owners, and keep my team well-informed. The impact on others has grown — but something subtle has shifted in my own learning.

The tradeoff is that if I’m not as careful as I used to be while doing the research, and I don’t engage with the material in the same way I did before. When I did the research manually, I was “chewing and swallowing” each idea, pausing to make connections, reflecting on implications, and wrestling with the nuance. That process was slower, but it etched ideas more deeply into memory.

As a result, my favorite articles of the week or month would show up in how I spoke on stage, what I wrote about, and how I worked through roadblocks with employees. Now, I notice that although I’m exposed to more information, it doesn’t have the same weight or impact. I’m consuming more at scale … but retaining less, or perhaps less deeply (at least in my head). In contrast, I store much more, both in terms of quantity and depth, in my second brain (meaning, the digital repositories available for search when needed).

This brings up a fundamental distinction between knowledge storage and knowledge retrieval. Storage is about accumulating information, while retrieval is about quickly accessing and using the correct information at the right time. It requires digestion.

It’s kind of like Amazon. Amazon has made buying books and getting them on my shelves easier than ever. I’ve got 1000s of books with answers to many of life’s questions. But, I’d estimate that I’ve really only read around half of the books I currently have on my shelf. The point is that having a book on your shelf with the answer to a problem is not the same as having the answers.

I now have many thousands of articles in my Evernote. There are probably over a hundred of them about better “prompt engineering” or using “prompting techniques better”… but I can’t pretend that each article has made me better at those things. I have gotten better at thin-slicing and knowing what I want to store to improve the quality of the raw material I search for.

So now, I’m exploring how to maintain a balance. I still want to leverage AI’s value, while reintroducing a layer of slowness and reflection into the process. Maybe that means manually summarizing some articles. Maybe it means pausing to journal about what I’ve read, or discussing it with someone. The goal is not to abandon the efficiency — but to ensure that efficiency doesn’t come at the cost of depth.

The priority is making sure I’m optimizing on the right thing. It’s not progress if you’re taking steps in the wrong direction.

Let me know what you think about that … or what you are doing that you think is worth sharing.

Onwards!

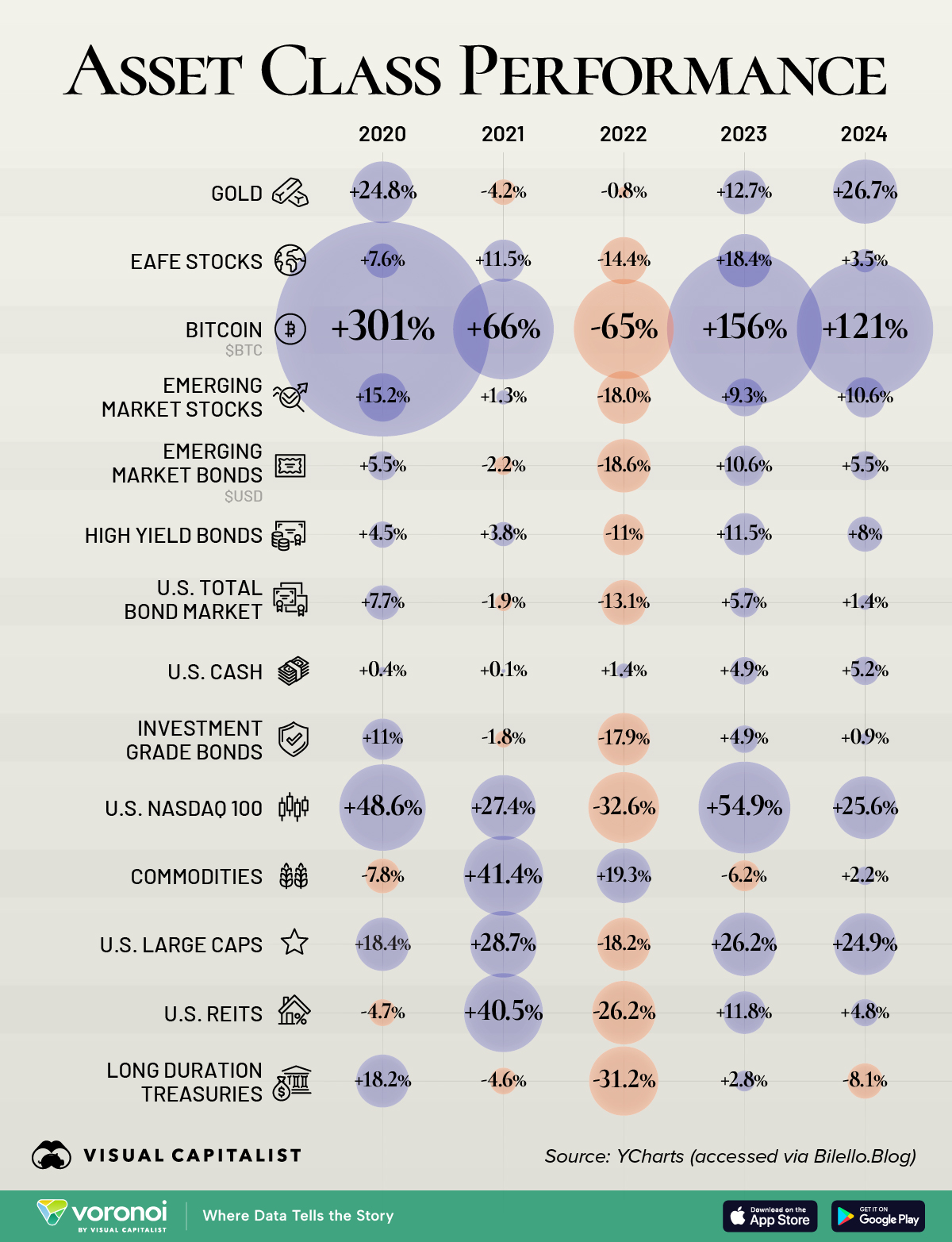

via

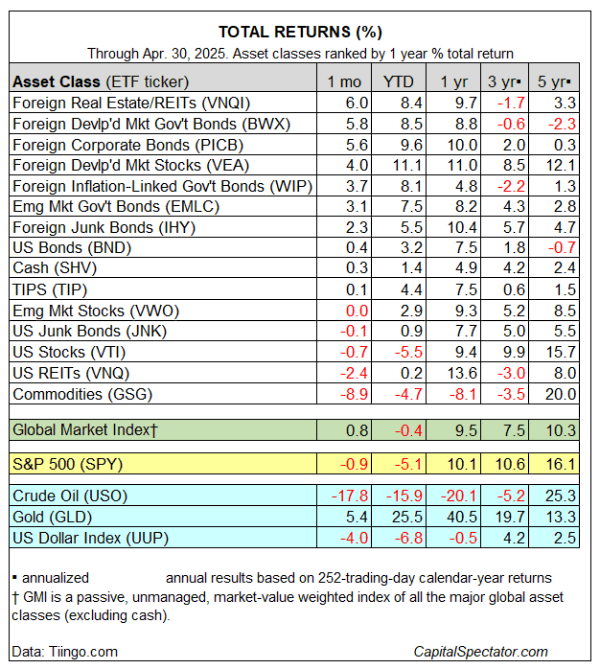

via  via

via

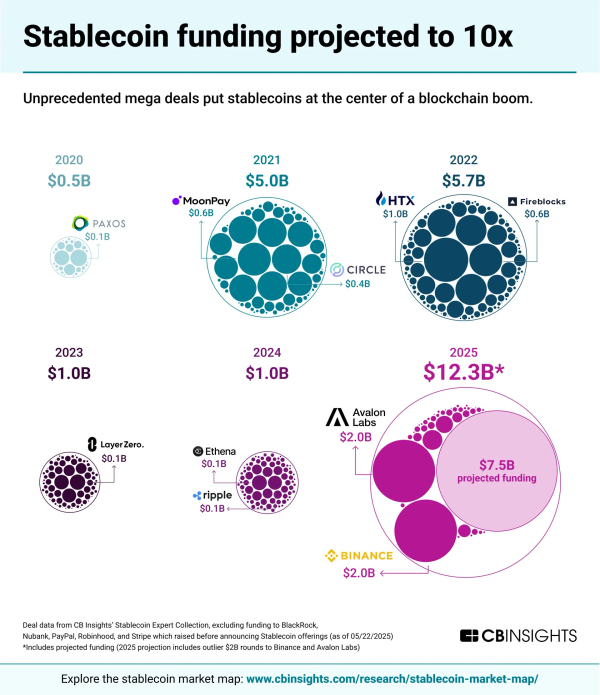

CBInsights via

CBInsights via