I've recently posted about the rise in global & national debt and the increasing dissonance between markets and the economy. This post is about inflation and the long-term economic effects of 2020.

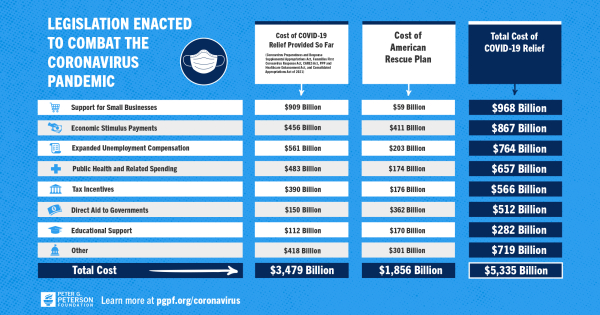

We're currently operating on $6 trillion of stimulus. The Trump administration approved the first 4 trillion dollars, and Biden's administration added another $1.9 trillion. Around $3.5 trillion of that went to purchasing government securities. Meanwhile, the U.S. Treasury also printed another $2B in dollars (more than they produce in a normal year).

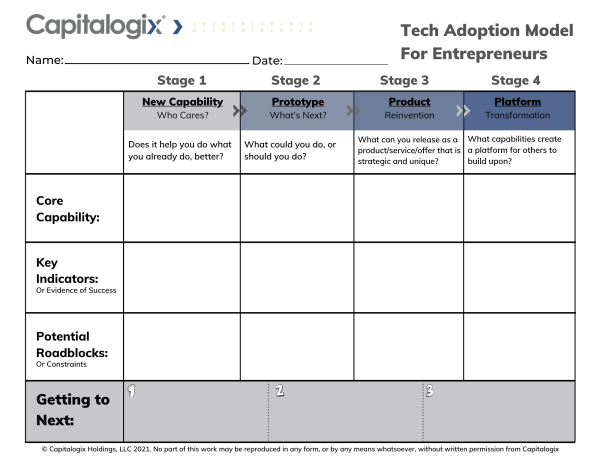

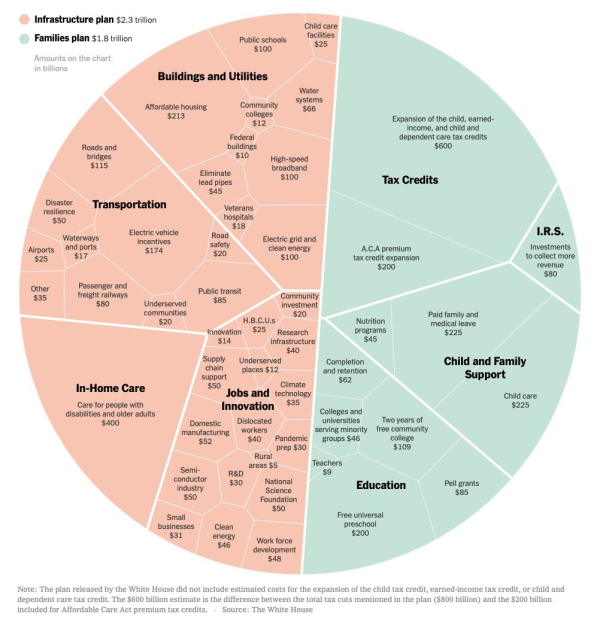

Here is an infographic showing the programs enacted to counteract the pandemic's economic impact.

via PGPF (3/15/21)

via PGPF (3/15/21)

These strategies make credit easier to get by growing the money supply and lowering interest rates with banks having more reserves. Without these and the Fed's other emergency measures, the economy likely would have crashed … but was it a "fix" … or did it just delay the inevitable?

In the short term, the stimuli did a pretty good job of creating liquidity, preventing a substantial market crash, and increasing faith in the system.

Markets became more erratic and harder to predict. And other ripples are starting to show in the economy.

Inflation: Temporary?

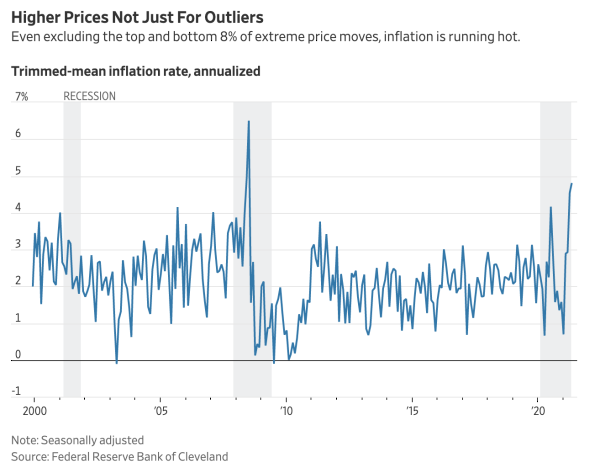

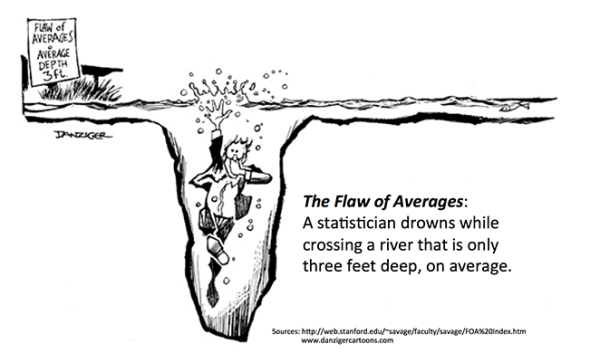

It's not hard to tell that prices have risen recently. But, while consumer prices have risen 2%, on average, investors continue to invest in treasuries and push the price of 10-year yields down to where they were in February of last year. That seems to imply that despite inflation and stimulus, investors still have faith in the Fed.

The hope would then be that the inflation is transitory and not a long-term effect of the stimulus.

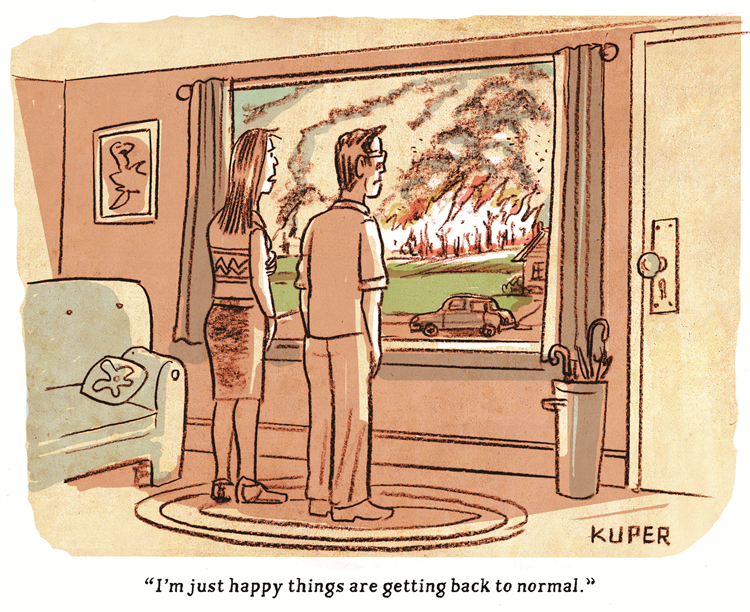

It's possible that this inflation is the result of a post-Covid demand surge (and not the beginning of a larger trend). You can also assume that the surge in prices of airfares, hotels, and sports games will drop once they become "normal" again. And, even if they don't, if wages don't rise with that new demand, it's easy to picture demand returning to normal.

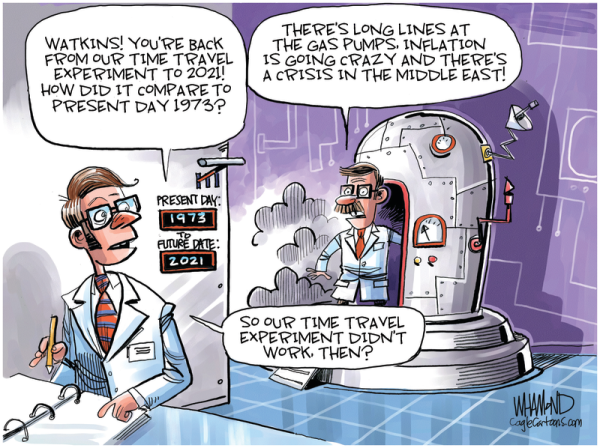

The last time the Fed created money on a similar scale (the Great Recession), high long-term inflation didn't materialize, so it might not happen again.

Conclusion

I think it's unlikely that we see another 1970s style surge – and I think it's equally unlikely we see major deflation. With that said, I still don't think we've seen the end of the effects of the pandemic and the pandemic stimulus either.

One of the practical results of the Fed's bond purchases is that it creates money to finance the gigantic debt run up by Congress. With the national debt at almost $25 Trillion, it gets harder to pick a measuring rod of financial health that isn't woefully inefficient. The idea of "sound money" or a sustainable fiscal path seems increasingly questionable. But, if you believe in Modern Monetary Theory and in the United States' amazing ability to borrow, it's possible that there truly is no worry. Japan is a potential example of that – with a debt-to-GDP ratio of double the U.S.

So, even if inflation continues, it's hard to judge how bad a sign it is.

Whether or not there's a crash tomorrow (or 7 years from now), at some point, we know there will be a "correction."

Predicting the future is hard!

Curious to hear what you think.

via

via

via

via  via

via