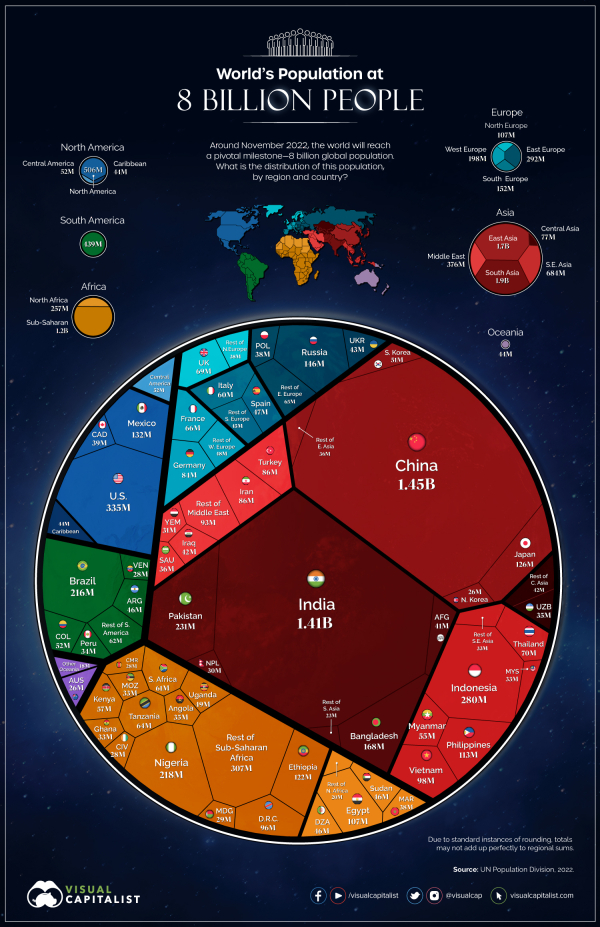

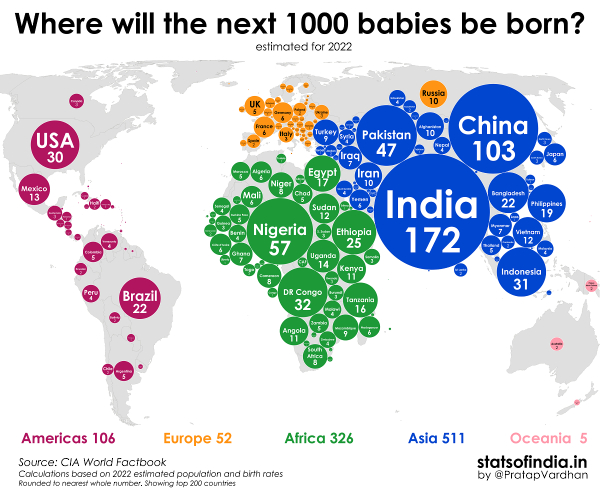

The world will reach 8 billion people at some point this year. That is a new (and potentially scary) milestone.

Part of the concern stems from how fast population is growing. Consider that the world’s population has doubled during the last 50 years … and the geographic distribution of the population has changed as well. Here is an infographic that highlights some interesting trends.

via visualcapitalist

via visualcapitalist

If you want to look at where the economy is going over time, you don't have to guess to wildly. Population growth is a primary clue. Consequently, focus on where the most children are being born – or where relatively more children are being born recently. For example, economists don’t have to work too hard to figure out how many 18-year-olds will exist somewhere in the next 15 years – they start by counting the 3-year-olds.

While China, India, and the U.S. top the world's population lists (with the U.S. dramatically behind China and India), many countries are creeping up the list. In fact, Lagos, Nigeria's largest city, is expected to the world's biggest megacity by the end of the century. Many of the world's highest growth rates are found in Africa.

As another "surprise," India is set to pass China as the world's most populous country. Meanwhile, much of Europe's populations are contracting.

The U.S. is still growing – but is not matching the rates of emerging countries in Asia and Africa.

The world is expected to reach a population of around 10 Billion before 2100. With that said, many expect the number to decrease from there.

Interesting?

How do you think this will affect the next 20 years?

View the full infographic at

View the full infographic at  View the full infographic at

View the full infographic at

via

via

via

via

via

via

via

via  via

via