Wow! That was some week. As I went back through what happened, it is hard to believe it all happened in one week. There was:

- the Nationalization of Fannie Mae, Freddie Mac and AIG;

- the Lehman Brothers bankruptcy;

- Bank of America's purchase of Merrill Lynch;

- historic government actions and regulations to reduce short-selling;

- massive government intervention on a worldwide scale;

- a Fed meeting;

- Government discloses a plan to buy-up the bad assets;

- billions of dollars of liquidity pushed into the market; and

- an incredibly aggressive short squeeze.

Here is what it looked like on a weekly chart of the Dow.

Wall Street experienced several of the best and worst days in its history. Fear spiked early in the week, and there were two days that saw markets lose

about 5%. Individually, each of those down-moves was bigger than

anything we've seen since 9/11. Then after what many will call a Key Reversal Day, there was a breakaway gap higher of more than 4% on Friday.

Somehow, foreign markets were even more

volatile. For example Russia's RTS Index

had a 17% loss in one day, and had trading halted for two days, only to

gain 22% when it opened again on Friday.

It all happened last week.

So, where do we find ourselves? Somehow, pretty much where we were at the beginning of the week. Except you know something important happened. It even trickled down to Saturday Night Live. This week there were several SNL skits related to the market and the market action. People were spooked. More importantly, governments were spooked.

We are witnessing unprecedented market action. I suspect that they will be writing about this period in history books.

Hopefully the actions taken by the government will ultimately have a positive impact. From a trader's perspective, it sure hasn't been easy.

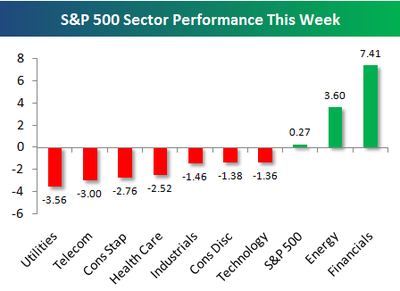

So, how did the interventions affect the markets. One way to see is to

look at how various sectors performed this week. This chart, from

Bespoke, shows that Financials and Energy were the beneficiaries this week.

Here are a few of the posts I found interesting this week:

- Bush Defends Bail-Out (WSJ)

- "The Week That Changed American Capitalism" (Big Picture)

- Chart Showing Big Gains in Global Markets late last week (Bespoke, FT, NYTimes)

- Does Thursday Qualify as a Key Reversal Day? (MarketWatch, Quantifiable Edges)

- VIX Spikes to 42 on Fear last week (VIX and More)

- A Market Indicator that Shows What Panic Looks Like (Trader's Narrative)

- Swenlin Analyzes recent charts looking for perspective on the Bottom (Decision Point)

- How common is a week with multiple daily losses greater than 4% ? (Bespoke)

- Short-Selling Ban Spreads to Foreign Markets (Big Picture)

- Treasury to Guarantee Money Market Funds (Intl. Herald Tribune)

- Treasury Seeks Authority to Buy $700BB of Toxic Assets (Bloomberg)

- Interactive graphic of $1.86 Trillion of Losses in the Financial Sector this year (NYTimes)

- Goldman Sachs and Morgan Stanley to become Bank Holding Companies (WSJ)

And, a little bit extra:

- SEC Bans Frowning (Financial Sense)

- How Wall Street Lied to Its Computers (NYTimes)

- How close did we come to Armageddon in the markets (NY Post)

- Here is the text of the Plan Paulson presented to Congress (Kedrosky)

As I write this, it looks like Lehman is filing for bankruptcy and that Merrill Lynch is getting sold to Bank of America. Futures are down.

As I write this, it looks like Lehman is filing for bankruptcy and that Merrill Lynch is getting sold to Bank of America. Futures are down.