This was a tough week for the markets. Strangely, it might soon prove to have been a good week for the markets as well.

So what is it going to take for the markets to finally bounce? History shows

that most intermediate or long-term bottoms are characterized by panic

selling, hopelessness, and people simply giving-up. If that is the standard, then we may be close.

Here is some of the evidence of the fear, uncertainty, doubt that often accompanies bottoms:

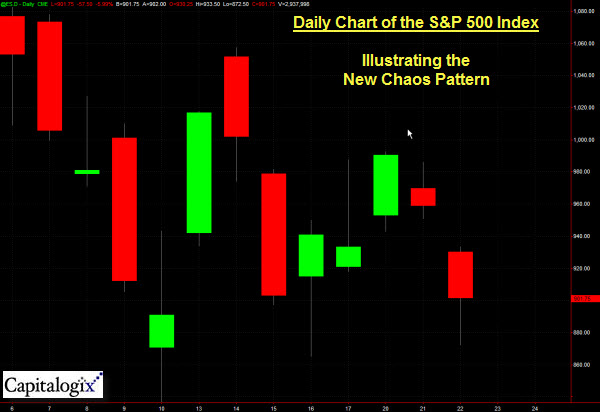

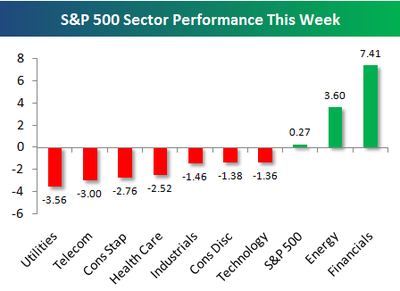

- This week reversed most gains from the prior week's rally and short-squeeze.

- The markets continue to flirt with lows for the year.

- Because of the volatility and gaps, trading simply hasn't been normal recently.

- The economy and the markets dominate news and popular culture.

- This week, the President of the United States basically said that

if a radical bail-out wasn't done, right now, it would damage our

economy – and many others across the globe.

However, as bad as the markets did last week, they held up

reasonably well considering how much bad news there has been and how

close to the edge things really were (or are). Also, while markets went

down, it was on lower volume than last week, and we didn't break last

week's low.

The Calm After the Storm. It's

also probably worth noting that, historically, periods of great

volatility are often followed by periods of much less volatility.

With that in mind, I do believe that the government will reach a

reasonable compromise to end the "Deal – or No Deal" situation very

quickly. It's also likely that this agreement and the liquidity that it

brings will give the markets some room to breathe and some fuel for a

meaningful rally.

On the other hand, there is a long way to go

from here to recovery. Some people see this as the end of the crisis.

At best, I see this as the end of the first step on the road to

recovery.

You Can't Bounce Until you Hit Bottom.

There are many corollaries in nature. This troubling time created a

clearing. Much of the fear, uncertainty, doubt, and baggage from past

mistakes are being wiped away. Firms are closing, the landscape is

changing, Wall Street and our economy will literally never be the same

again. And, yet, this kind of clearing is often the catalyst to new

beginnings and fast growth.

Noise Reduction.

When creating automated trading systems, one of the things that becomes

increasingly important is to recognize the difference between signal

and noise. Right now, there's a lot of noise. The markets, market

players, and even governments are spooked. Under those circumstances,

it doesn't take much to stir things up.

The bailout and worldwide

cooperation can be looked at as noise reduction. Temporarily, there

will be a forced and tenuous peace. The hope is that as things calm

down, people will make decisions from a stronger position (or at least

from a position that's less fearful than where they are now).

Remember, a journey of a thousand miles begins with one step. Here's to progress.